The Poles have limited power imports from Germany in order to reduce “loop flows” through the country. Now, grid experts at the European Network of Transmission System Operators (Entso-e) warn that the country may no longer have generation and power import capacity to meet demand. By Craig Morris.

Poland has set up phase shifters to limit the amount of electricity coming from Germany. (Photo by the_riel_thing, modified, CC BY-NC-ND 2.0)

We first reported on the loop flow situation back in 2013; loop flows occur when electricity takes a different path than the one scheduled because power lines are full. In the case of Germany, they occur when electricity from the north cannot reach the south. It then flows through neighboring countries to the east and west. Generally, the problem is reported as pertaining to excess wind power production, as was recently stated in an article at Politico entitled “German winds make central Europe shiver.”

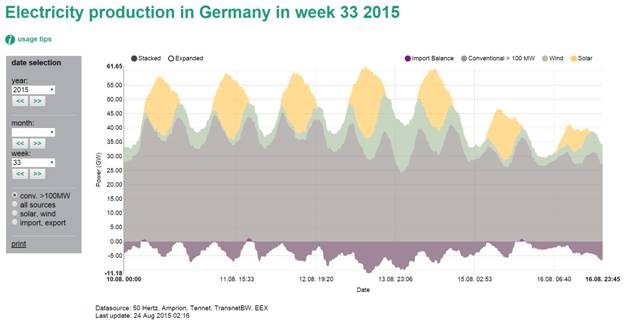

Germany’s neighbor Poland has set up phase shifters to limit the amount of electricity coming from Germany. Now, it seems that this policy might come back to haunt them. In its Winter Supply Outlook, Entso-e finds that “adequacy in Poland was identified as potentially at risk.” The potential shortfall already started in the summer, when Poland had to tell its industry to reduce consumption from August 10-12. At the time, the power line from Sweden was already maxed out, and the lines from Germany were also congested with “high unscheduled flows.” Strangely, during those days, the amount of wind power was minimal, and the amount of solar was unremarkable at no more than around 20 GW.

Source: Energy-Charts.de (Fraunhofer ISE)

Nonetheless, Entso-e says that “the amount of energy required to limit these flows was seven times higher” from June to September 2015 than during those months in 2014 – and 78 times higher than in 2013. The grid experts say that the result could eventually be a major blackout.

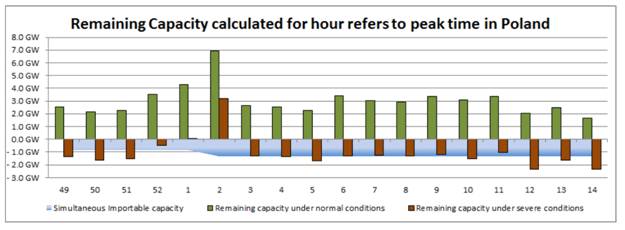

The situation will be relatively tense if Poland runs out of cooling water for thermal power plants (coal), for instance when rivers freeze over during a severe cold spell. The power shortfall this summer occurred for similar reasons, when rivers dried up during a heat wave. The potential shortfall is shown in the following graphic; where the red bars reach below the blue area, there is a theoretical possibility of a power shortfall in this scenario (the numbers at the bottom refer to weeks).

Source: Entso-e Winter Outlook 2015

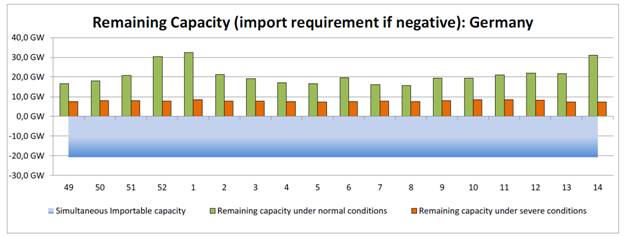

In contrast, for Germany the grid experts speak of “massive oversupply” potential around Christmas. The following chart shows how different the situation is in Germany (for which Entso-e does not provide the same visualization of “peak time” as in Poland).

Source: Entso-e Winter Outlook 2015

The bars indicate that Germany will have positive remaining generation capacity along with just over 20 GW of import capacity. What the chart obliquely indicates is that Germany is highly likely to be a major power exporter during these weeks; a large share of remaining capacity translates into low generation prices relative to other countries.

Tucked away in the report is a piece of interesting good news for wind power: “In week 36, we experienced for the first time that the transmission system was driven without a single central power plant” in eastern Denmark. Strangely, that was a week of very high wind power production in Denmark and in northern Germany, but there seem to be no reports of unusually high loop flows through Poland.

In the end, I’m left with more questions than answers. If wind power is really the problem, why are the specific times indicated by Entso-e not of high wind power production? Are they trying to suggest diplomatically that the reasons Poland gives for the loop flows (which certainly are happening) are not the true causes? And in light of Poland’s ongoing power shortfall, why is the country limiting power flows rather than expanding them to a country that obviously has excess capacity at times of peak demand?

Craig Morris (@PPchef) is the lead author of German Energy Transition. He directs Petite Planète and writes every workday for Renewables International.

The phase shifters are installed to make the interconnectors safe, not to limit imports or exports.

It might have been a concerted propaganda act to supply the public with this misleading ‘news’, the public has to pay for this supposed be heroic installation after all.

A new interconnector between Poland and the Baltic states has been opened:

http://www.bloomberg.com/news/articles/2015-12-08/russia-s-power-grip-over-baltics-ending-with-billion-euro-cables

This allows German lignite power from Eastern Germany to transported through Poland and being sold further ahead.

Two gas power plants have to close (remaining on stand by?) for this reason, despite that there is plenty of gas available.

Polish coal is available for free it seems, more and more is heaped up, the state plans to either throw it back into the holes or export it – subsidising the coal market:

http://www.reuters.com/article/poland-coal-idUSL8N13T2YO20151204

http://www.platts.com/latest-news/coal/warsaw/poland-planning-to-export-coal-from-stockpiles-26310189

This new interconnector from Poland to the Baltics effectively kills the new atom power plant in Kaliningrad

( http://www.nuclear-heritage.net/index.php/Nuclear_plant_near_Kaliningrad_%E2%80%93_bad_story_that_must_be_ended_immediately )

as a reporter claims:

http://kaliningrad-domizil.ru/portal/information/wirtschaft-and-finanzen/kaliningrad-erhlt-kein-atomkraftwerk/

( if anyone has any official news on this atom power plant please let us know)

When checking power imports by Poland then check as well the power exports of Poland going parallel.

The frequently reported looping Germany-Poland-Germany does not seem to exist in reality. Entsoe shows only very small power exports from Southern Poland, these are usually going to Czech.

Czech (the Southern neighbor of Poland neighboring Germany as well)is net client on the international power market since a few moth,being in a similar situation as Poland: expensive non-delivering state owned capacities exposed to the international market.

http://www.praguepost.com/czech-news/51143-license-expiring-for-dukovany-unit-1

The power prices in Czech rose by about 10-15% in the last weeks, the power prices in Germany fell by about the same level.

Germany offers the cheapest power ex power plant and so does Austria, there is no need to loop power from Northern Germany to Southern Germany. The Austrian power being exported to Southern Germany would be cheaper than the looping from Northern Germany to Southern Germany.

Austria has the capacity to replace all of Southern Germany’s atom power plants, there is about 50% atom power in Southern Germany’s mix.

The power prices at the EEX have hit new record lows last Friday and again today.

http://www.epexspot.com/de/

The countries Poland and Czech are both net importers eager to get any Watt they can hold on.

To allow for these imports the phase shifters are being installed.

A question concerning the inport-export balances shown at the Fraunhofer data charts :

When looking at the German Fraunhofer page

https://www.energy-charts.de/energy.htm

(click in the left column on “import,export” and “monthly”)

we see Poland and Czech being continuously net importers from Germany.Well, in the case of Czech since June 2015.

But when looking at the chart for the French numbers Germany seems be a net importer.

This Fraunhofer picture is contrary to what the press and RTE (the French grid agency) tell us:

http://www.platts.com/latest-news/electric-power/london/german-november-flow-based-market-coupling-power-26282751

(last sentence)

https://clients.rte-france.com/lang/an/visiteurs/vie/interconnexions/all_histo/capa_bilan.jsp

(look for “table of values” at the bottom of the page and click yourself from day to day)

How can the discrepancy between the Fraunhofer chart and RTE be explained, Platts reports as well that France is net importer from Germany ?

Is this due to looping via Switzerland and a mix-up of data?

I’m confused ….

Maybe there are similar issues with Czech and Poland?

PS

The more I check through the Entsoe data the more useless they appear, some or even most(!)of the data shown there at Entsoe simply doesn’t match the national data charts of the different grid authorities.

Maybe Fraunhofer ISE should think about using the Entsoe data.

Heinblöd wrote: “How can the discrepancy between the Fraunhofer chart and RTE be explained, Platts reports as well that France is net importer from Germany ?

Is this due to looping via Switzerland and a mix-up of data?

I’m confused ….”

You mix electricity purchases, which are used to calculate whether a country is a net exporter or importer, with physical flows. As long as you do this your conclusions are in many cases fawlty.

Thanks, Ulenspiegel.

So import and export shown at Fraunhofer ISE ( https://www.energy-charts.de/exchange.htm ) show “transfers ” as explained when clicking on the Information symbol there

Or “physical flow” as the term is called by Entsoe.

But not “purchases” .

I see where my confusion is based on, the two organisations Fraunhofer and Entsoe use two different terms for one and the same thing.

Where do we get data about “purchases” ?

http://www.derbund.ch/schweiz/standard/Wieso-Experten-einen-Stromblackout-ausschliessen/story/22851953

A black-out in Switzerland is not likely for this winter to occur but the situation is tight.

The ‘free market management’ of hydro power (buying when cheap in the case of pumped hydro storage and selling when expensive) must be limited, the hydro power stations being used and payed for to act as an emergency reserve at the flick of a button.

If one more atomic power reactor fails then situation might demand for brown-outs, the plans are being prepared now.

The reason given is the lack of transformer stations in Switzerland which can take high voltage power from Germany and transform this into the national grid …

Power exchange prices in Switzerland have doubled within the last year and are about as expensive as UK power prices now. But Wylfa will close down before the year ends and everything is ok again ….:)

The price for emergency power (tertiary reserves) just went up from SFr. 3000.-/MWh to SFr. 9999.-/MWh. There might not have been more room for more digits …;)

Isn’t this a nice gesture to the atom industry? Taking 2 old reactors in Beznau out of production and then selling Diesel power for 9999.-/MWh ?

The dry summer is blamed for this, no joke.

The LOOPING MYTH visualized with the aid of Fraunhofer ISE:

Go to

https://www.energy-charts.de/power.htm

click in the left column on year 2015, week 51 and “import,export”

Then click away in the header all nations except for Poland (blue) and Czech (yellow) and see: no looping in week 51/2015

Do the same with a monthly choice – for a quicker overview – going back to 2014: the first sign of non-looping (which existed in the past to some extend) came up in the last week of November 2014.

Again then from the 10.-26. of December.

January-March 2015 there was normal looping to be observed.

Since April 2015 the absence of looping manifests, half of Mai and June 2015 there was no looping.

Since July 2015 the absence of looping situations became very clear, both countries Czech and Poland being power importers from Germany in parallel most of the time.

The drought and the outage of coal and hydro and atom power plants made both countries net importers for German power in parallel most of the time since then.

The RE generation in Germany has increased since 2014.

Power exports from Germany to Poland and Czech have increased since 2014.

But the looping situations have decreased and now hardly exist anymore.

How many phase changers had been installed in the meantime since 2014?

Maybe more looping will be observed again if more of the Czech atom power plants get repaired?

But this would be hardly happening this Winter and then there are Summer maintenance breaks in 2016 and maybe droughts again …. and this is why phase changers are needed: to allow for an increased import of power. And to pass on power to the Baltic Nations and to Austria and Slovakia and further East.

This looping myth was developed to pull money from Brussel and power consumers to increase the power trade.

In Poland it fell on the well prepared nationalism-manure and in Czech on the fertile field “grab-and-run”.

The “Energy-Union” some call this sort of growth.

Coal market situation in Poland:

http://www.thenews.pl/1/12/Artykul/232908,Polish-coal-mining-industry-makes-rare-profit-in-October

It would take 59 years of continous work per employed person in the Polish coal sector to work-off the debts caused by him.

The debts are € 33,829.-/worker and they have made a profit in Oktober of nearly € 4.- per worker.

Oh Lord, let every month be an Oktober 🙂