Although some have argued that new nuclear is necessary for the power mix, Jan Ondřich disagrees. He takes a look at the numbers and finds that in the next 30 years, there’s no way that nuclear can compete with a mix of solar, wind, and gas.

View of the gas peaking plant in New Jersey (Photo by Jim.henderson, edited, CC0 1.0)

When I speak on the topic of commercial viability of new nuclear projects, I am often asked why I thought power prices would stay so low that nuclear projects would not be feasible. Everybody in the in the industry knows, the argument goes, that current power prices are low because of high output of zero-marginal cost wind and solar generation which are subsidized directly by customers. And everybody knows that the current price level makes it impossible to build any generation source. Therefore, they maintain, power prices must increase significantly so that new capacity can be built in the long run.

Below I explain why I think power prices will not increase to levels necessary to allow commercial construction and operation of new nuclear plants in the next 30 years.

My estimate that prices will not increase over EUR 65/MWh in 2015 prices is based on the following assumptions:

- Germany will reach its energy policy targets and will be producing 60% of its energy mix from renewable sources, mostly wind and solar by 2050. Demand is expected to decrease by 25% by 2050 compared to 2008 levels

- Pay-as-you-clear based spot markets will continue to dominate energy trading in Germany and CEE, although other market models such as capacity payments, bonuses and feed-in tariffs will continue to co-exist.

- Power grids of Central and eastern European (CEE) markets remain connected with Germany with at least current interconnector capacity.

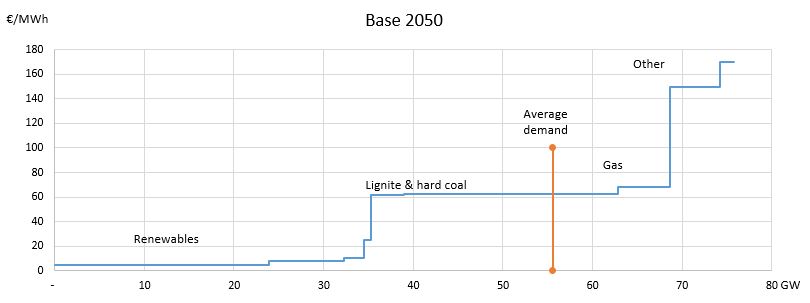

The chart below shows a German merit-order curve in 2050 assuming Germany meets its policy targets and 3 different load scenarios – low, median and high and 3 wind and solar generation scenarios – low, median and high. By 2050 all nuclear plants will have been decommissioned and significant coal capacity also will have left the grid. The fuel mix will be dominated by wind and solar with gas balancing the market.

Around 120GW of wind and solar will be producing for free because its 20 year support schemes would have finished, but they will still have another 5 years of technical lifetime ahead of them.

New wind and solar will still be bidding at their marginal cost EUR 0/MWh. Those projects will continue to be supported by fixed-price contracts tendered in auctions. Recent auctions cleared at EUR 69/MWh for solar in Germany and EUR 64/MWh in Denmark for offshore wind.

Wind and solar will be generating 282 TWh at zero marginal cost. This is around 58% of German energy annual consumption. Another way of expressing this is that there will be 5,080 hours in which German demand will be fully met by wind and solar resources selling electricity at EUR 0/MWh.

Another generation class contributing to lowered power prices would be gas cogeneration, or CHP. Gas CHP can be cheaper than condensing plants because approximately 50% of its fuel cost is covered by the heat sales. Large share of capital cost amortization comes from CHP bonus, that is, another support scheme outside of the power market. Gas CHPs will therefore come second on the merit order after renewables.

The remainder of the merit-order curve will be made up of legacy coal and gas peaking plants. Coal will likely supply 17% (83 TWh) of German mix with around 3400 full-load equivalent hours. Typical coal bid would be EUR 68/MWh in 2015 prices, meaning it will deliver mostly peak load demand. The remainder of what is needed will be provided by gas peaking plants. Currently 11GW of modern gas-fired power plants are mothballed in Germany, able to provide 90 TWh of power if needed. This is certainly sufficient capacity for peaking, therefore no new peaking capacity needs to be built in the next 20 years.

In summary, 58% of demand will be covered by wind and solar generation at EUR 0/MWh. It is important to note that price of this generation is not linked either to inflation or to commodity prices. Therefore, it is even likely that power prices may increase at below-inflation rates.

The model shows that the system will be more sensitive to weather conditions than it is today, which is an intuitive conclusion. Power prices will be often close to zero, but price volatility will increase as expensive gas peaking plants will provide the missing power in case of high demand and low RES output. In our model, power prices may increase to as much as EUR 180/MWh in scarcity hours when wind and solar capacity is idle. Power prices will continue falling into negative territory when wind and solar output is significant but demand is low.

This will not however result in a high average power price – the price at which difficult to regulate nuclear plants sell electricity. The system average price (volume weighted price) will stay at around EUR 63/MWh due to high production of cheap wind and solar compared to small production of expensive gas peaking plants.

New nuclear projects need power price of around EUR 127/MWh in 2015 prices, as the Hinkley Point C project in the UK shows. And this price needs to be indexed to inflation. It is highly unlikely that nuclear projects would ever be in the money as our above presented model shows. Power prices would have to double in 2015 levels from the price gas-fired peaker plants need to operate and quadruple from today’s levels.

Jan Ondřich is a partner in market analysis and advisory firm Candole Partners. He is a regular contributor to this blog.

They never have. Why would they now?

… what is more nuclear is (almost) completely inflexible. Thus nuclear cannot supplement the volatility of Renewables in a future electricity mix. Like coal, nuclear is an energy dino from the dark ages … too big, too inflexible, too expensive, too dangerous … with massive long term waste effects.

Is there anybody out there who can tell me why anyone wants new nuclear power plants to be constructed?

“… Completely inflexible.”

Only because it is currently designed to be that way. Until the amount of nuclear exceeds the baseload, there is no real need for “flexibility” unless irrationally forced to coexist with an unREliable source.

Since the unREliables add NOTHING to the grid that nuclear can’t and at much lower prices, requiring nuclear to “supplement the volitility of REnewable” is an assinine goal. Remove the redundant, unRElible sources and be happy with the affordable, clean, safe*, very low carbon energy from nuclear power.

“Is there anybody out there who can tell me why anyone wants new nuclear power plants to be constructed?”

If you got military uses for nuclear (ships, u-boats, nuclear warheads, etc..) you need a civil backdrop to pull resources from (engineers, research, etc.).

That’s also why Hinkley C is pushed.

If we hadn’t had egomaniacs at the helms everywhere we wouldn’t need that stuff and no sane public would be willing to pay for it.

@ Dr. Josef Pesch re. “Is there anybody out there who can tell me why anyone wants new nuclear power plants to be constructed?”

Areva can:

http://www.usinenouvelle.com/article/areva-dans-l-eolien-c-est-fini.N484209

” Dans le même temps, Areva s’est également séparé d’Areva TA, spécialisé dans la conception des chaudières nucléaires pour les sous-marins et les porte-avions, que l’Etat a souhaité nationaliser pour la sanctuariser.”

Everything is closed, sold and outsourced except for atomic arms,the only profitable part of the company.

This model for the future energy mix in Germany is really out of date because it doesn’t incorporate any form of energy storage such as battery, power-to-gas, or power-to-heat. These are already entering the energy market rapidly and will be big players in the future. Talking about what will happen at times of low wind or sunshine without taking energy storage into account is a waste of time and column inches.

“Is there anybody out there who can tell me why anyone wants new nuclear power plants to be constructed?” I asked some time ago.

Thanks for you comments.

In other words, the answer is: No, there is no-one!

New nuclear plants are not about electricity, but about a completely different kind of power.

Why should the power demand decrease? That’s totally unrealistic. Greenpeace expects an increase by a factor of two, others talk about a factor of 5. Where should all the electricity for the electric cars and the heat pumps come from. It seems that the writer has no idea of the German Energiewende.

@ henningflessner:

The power demand of Germany is decreasing since 2011

http://www.ag-energiebilanzen.de/4-1-Home.html

(see “Strommix”)

Slight increases are followed by decreases, the trend is clear.

As far as I know the situation is the same most over Europe.

You have asked ‘why’: well, there is no eternal growth.

The kicker, which Jan has missed, is that the technical lifetime of solar photovoltaic panels appears to typically be over 40 years, maybe 50 years. If all you have to do is replace the inverters and wiring… well, it become very cheap to life-extend a solar system from 25 years to 50 years.

Underlying power demand is flat. Electronics are getting more efficient, homes are getting insulated, etc.

Power demand decrease from LEDs is roughly equal to power demand increase from electric cars (if all cars and trucks become electric).

Power demand increase from switching heating to electric is much harder to calculate, but it’s not that large — *maximum* 30% increase, I think.

Seconded. 25 years is the lifetime conventionally used by investors with a fairly high cost of capital. If you discount at over 5%, it makes little difference to the NPV if you use 35 or 25 years. The former is a far more credible horizon for solar – the output keeps declining slowly, but until the encapsulation fails, you have free electricity from a fully paid-off system. Where space is constrained (rooftops), some users may replace earlier to get higher efficiency at output, but they they are unlikely to be many. The true lifetime of wind turbines is harder to judge. Many early turbines were replaced early, because they were unreliable or built on low towers. These problems are much less likely to affect recent installations. There is likely be a business in conservative refits, upgrading the generator train and electronics, on existing towers. Blades will be replaced when they fail.

I miss a discussion of PPAs. One thing fossil fuels cannot offer, and renewables can, is 25-year fixed-price power supply contracts. These prices are just as real as spot ones. In a deregulated electricity market, a fair number of large consumers will like the certainty.

The main point is that renewables are contributing almost nothing to curb CO2 emissions; on the contrary, biomass and hydro dams emit huge quantities of greenhouse gases, and solar and wind have strong dependence on fossil fuels to keep production of electricity when sun is not shinning or wind is not blowing or during prolonged droughts because cost-effective batteries/energy storage does not exist and is ever from reality. Aside that renewables ruin natural landscapes, disturb wildlife’s habitats, and slaughter millions of birds, bats and other endangered species.

Renewables have not proven yet(maybe never) be able to reduce meaningfully carbon emissions, e.g. Germany, while carbon-free nuclear power has proven to be the fastest way to deeply decarbonize modern grids, e.g. France and Sweden.

If Global Warming is really a serious concern, then carbon-free nuclear is necessary for the power mix because it is “worth the price” as the only viable path to curb emission of greenhouse gases.