By 2030, Germany will gradually no longer have to pay for its most expensive solar arrays installed at the beginning of this decade. But the power will probably still be generated. Craig Morris investigates the probable impact.

What will happen with German rooftop solar installations after they start falling out of the feed-in tariff? (Photo by Túrelio, CC BY-SA 3.0 DE)

In my last article, I focused on think tank Agora Energiewende’s recent study (PDF in German), particularly in terms of wind power. Let’s focus now on what I call “legacy solar power.”

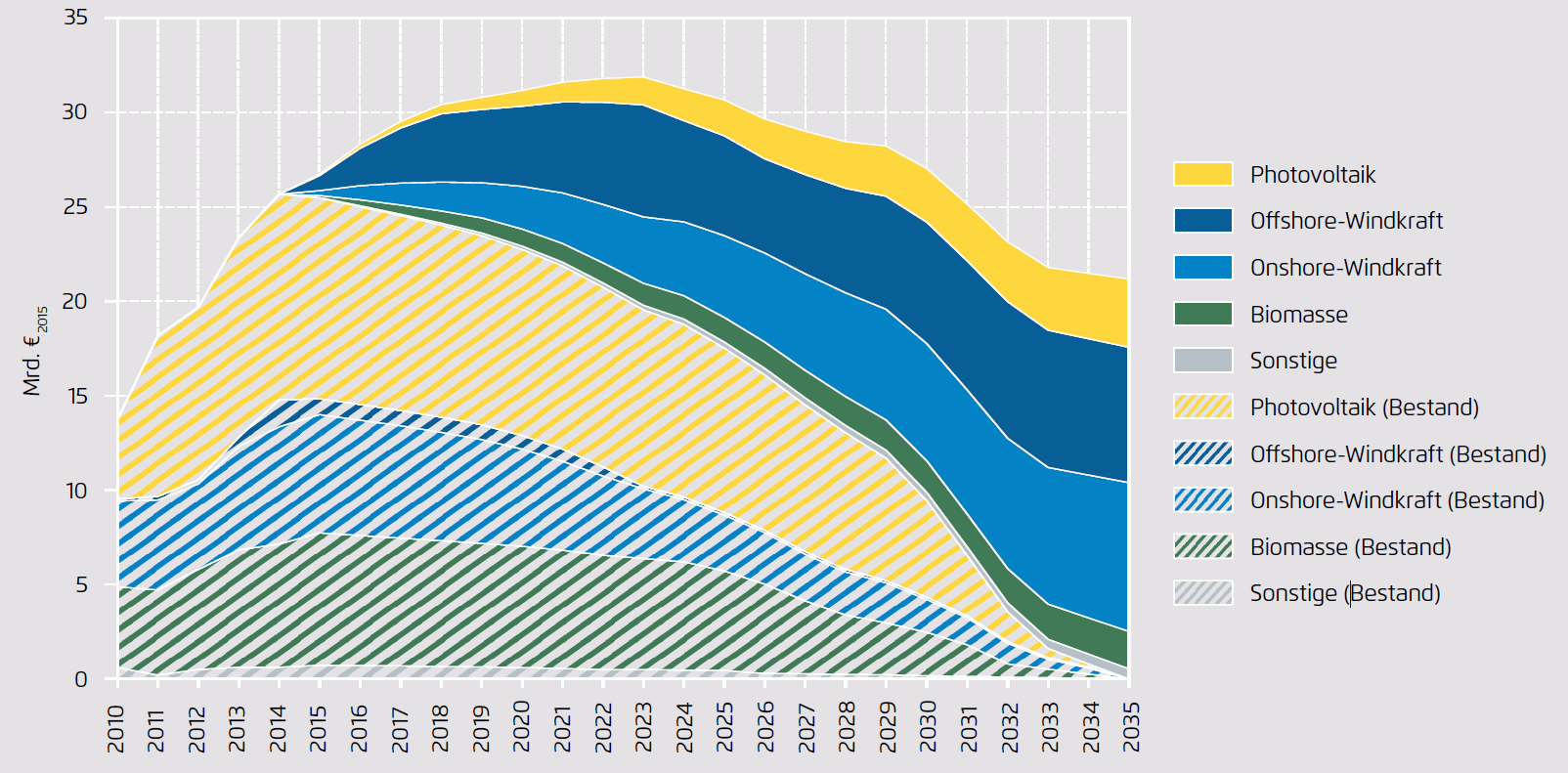

The Agora chart below shows that the study models a scenario in which these old solar power systems actually disappear by 2035. Like all studies, this one works with simplified assumptions – and I’m not criticizing the authors for that. Indeed, a reference scenario like the one below is extremely useful as a starting point for investigations of different possible outcomes. The study mentions a few, but it leaves out the continued existence of all of this PV – around 38 GW that was producing electricity at the end of 2014. I’d like to investigate that variant now.

These arrays will not all suddenly stop producing power after 20 years, when the 20-year period for feed-in tariffs expires. They will disappear from the cost impact, but not from power supply. What exactly happens to that power is hard to forecast, however.

These arrays will not all suddenly stop producing power after 20 years, when the 20-year period for feed-in tariffs expires. They will disappear from the cost impact, but not from power supply. What exactly happens to that power is hard to forecast, however.

They could be torn down and replaced with new systems. In the wind sector, this process is called repowering. But there is a difference: as Germany fills up with wind farms, planners will find it easier to tear down the old turbines at the end of their service lives and put up new ones on the sites of existing wind farms, where building permits will not be a major obstacle.

The same could happen for large ground-mounted solar power plants, but rooftop systems are less likely to be replaced. A homeowner is more likely to install batteries (which will be much cheaper by then) and simply offset power consumption from the grid. If retail rates are still around 30 cents per kilowatt-hour, the incentive to do so will be tremendous – after all, you only need the battery pack if you already have the solar panels. These systems will therefore disappear from the grid – as though the households had become extremely frugal with their power consumption.

Other legacy arrays might look for a power buyer, but this option will not be attractive. Because wind and solar have no fuel cost, they price themselves out of the market; the more wind and solar is generated, the lower power prices are. The German power market price scheme is based on the merit order, which is a misnomer. The only merit here is the marginal cost, which is largely the fuel price. I have yet to see a convincing explanation of how renewable energy with no fuel price (wind and solar) are supposed to survive in a price scheme based on fuel prices. This legacy solar power from large arrays is likely to look for a buyer at extremely low prices if it is not “repowered.”

How much legacy solar power are we talking about?

Solar panels now have a performance warranties for 25 years, meaning that they will still produce around 85 percent of their rated capacity by that point. German solar power now peaks at around 25 GW (a third of peak demand), with solar making up roughly seven percent of annual electricity demand. 85 percent of that level is still significant, especially since the cost no longer shows up at all on power markets.

Although Germany currently has around 1.5 million power generators spread across the country, most of them are small PV arrays (there are some 24,000 wind turbines and 14,000 biomass units [PDF in German] along with hundreds of conventional plants). As my colleague Bernard Chabot has pointed out (PDF), the largest 10 percent of PV systems in Germany make up around three quarters of PV power production. These large arrays are the ones most likely to look for a buyer or be “repowered.” An argument can therefore be made that only a small share of this legacy solar will still be generating power without a cost impact on the power exchange. But really, this scenario has not yet been properly investigated, so it’s hard to say what will happen.

Yet, the Agora study does not even mention the issue. Instead, the section on sensitivities is exclusively about effects that could increase power costs, not decrease them. Overall, the study stresses that higher wholesale rates reduce the renewable energy surcharge in a similar amount because of the way the surcharge is calculated. The surcharge covers the additional cost of feed-in tariffs after the electricity has been sold at the wholesale rate; logically, a higher wholesale rate means a lower additional cost.

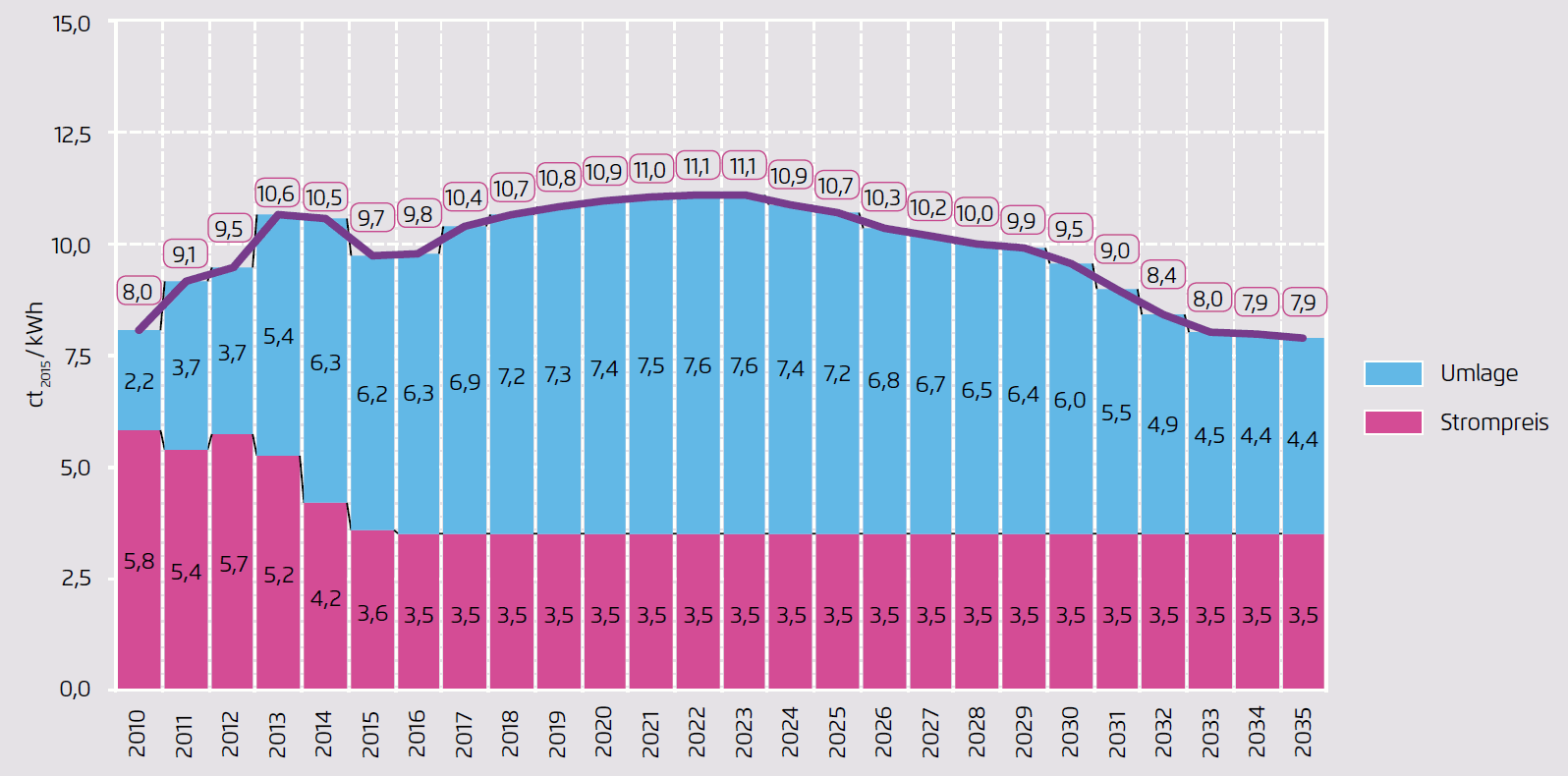

Here is the reference projection that assumes a stable wholesale price of 3.5 cents per kilowatt-hour going forwards (Umlage = the renewable energy surcharge, whereas Strompreis = the wholesale power price):

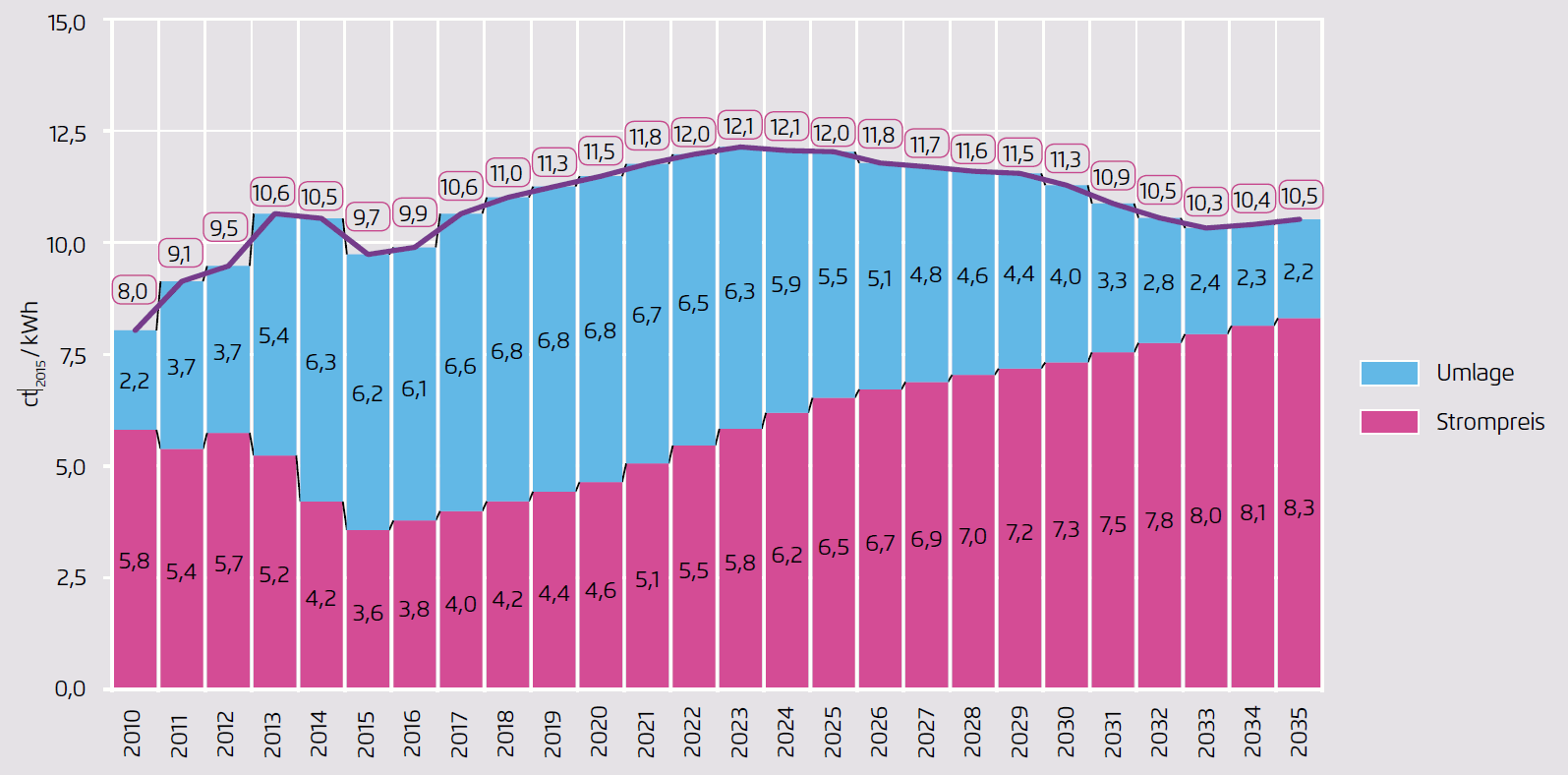

And here is the chart representing a scenario with rising wholesale prices:

And here is the chart representing a scenario with rising wholesale prices:

In the second chart, wholesale prices are 2.5 times higher than in the first one, but the surcharge is cut in half, so the total price is only a quarter higher.

In the second chart, wholesale prices are 2.5 times higher than in the first one, but the surcharge is cut in half, so the total price is only a quarter higher.

Legacy solar has the potential to push wholesale prices down tremendously even as it lowers the renewable energy surcharge, and it could happen quite suddenly. It all depends on what specifically happens with all that legacy solar power starting in around 2029. One thing is certain: this power will not simply disappear as modeled in the reference scenario.

To be fair, the study has a clear subject matter: cost trends in the power sector. The greatest impact of legacy solar may therefore lie outside of the study’s scope. If wholesale rates fall, say, to two cents, it is doubtful that any dispatchable generators will make money; we already have enough complaints of unprofitability at around four cents. Legacy solar might therefore lead to additional payments to maintain the profitability of dispatchable power generators. In turn, those costs might show up as Germany’s Next Surcharge.

Craig Morris (@PPchef) is the lead author of German Energy Transition. He directs Petite Planète and writes every workday for Renewables International.

Interesting problem, what to do with almost free electricity. Some alternatives:

1. Repower = replace degraded <15% efficiency panels with new 24% panels (or more, in 2030?), sell or donate old panels to off-grid or abroad. Better use of space.

2. Re-register old panels for 10 years additional use, with rate either at wholesale or a low fixed feed-in, which will be profitable at much less than the rate for new panels. To the extent that this reduces the new panel installation, it creates no additional pressure on the wholesale price. It lowers the surcharge, rather than raising it. Maybe necessary to stagger timings to prevent collapse of the new panel market in 2030.

3. Re-register old panels, with mini-rate, as above, and use the extra electricity as low cost feed-in for electrolysis facilities, thus removing it from the wholesale market.

I wonder how the repowering vs adding storage looks from an environmental perspective.

The additional energy needed to create a battery may speak in favour of repowering. On the other hand the energy pay-back time for PV systems is considerably longer as for wind turbines and the extra yield from a new system might not be that amazing. Additionally, self consumption reduces production peaks and consumption peaks reducing the need for balancing power stations and negative balancing power.hand,

Interesting issues. Wind is different, with moving parts and resulting maintenance. Especially if the concrete base and power lines can be reused, the replacement decision seems fairly straightforward.

One thought on utility scale ground mount solar. The mount becomes more valuable that the panels, if the hardware is still usable for second generation solar. Roofs may need maintenance, so pulling off old panels and starting new may be common. Even clay and concrete tile roofs need flashing and valley repairs.

If electric vehicles become common, I expect many some home solar today will be replaced. The Agora chart does seem to include an electrified transportation sector.

If half of German personal transportation becomes battery electric, hundreds of gigawatt hours of storage will be “on wheels”. How those are charged will have a large effect on power planning. Altering the Agora chart significantly.