A recent paper by Berlin-based think tank Agora Energiewende finds that Germany is paying now for cost reductions in the future. While other countries can expect rising power costs, German costs will stabilize and then begin to drop in the 2030s. Craig Morris explains.

Offshore wind will cause higher costs than PV in the future. (Photo by Martina Nolte, CC BY-SA 3.0)

Entitled “The development of EEG costs up to 2035,” the study (PDF in German) is only available in English as a summary. The main findings are that the primary cost driver for electricity over the next few years will be offshore wind, and the total cost of renewable electricity will decrease a decade from now even though Germany will continue to expand the share of green power.

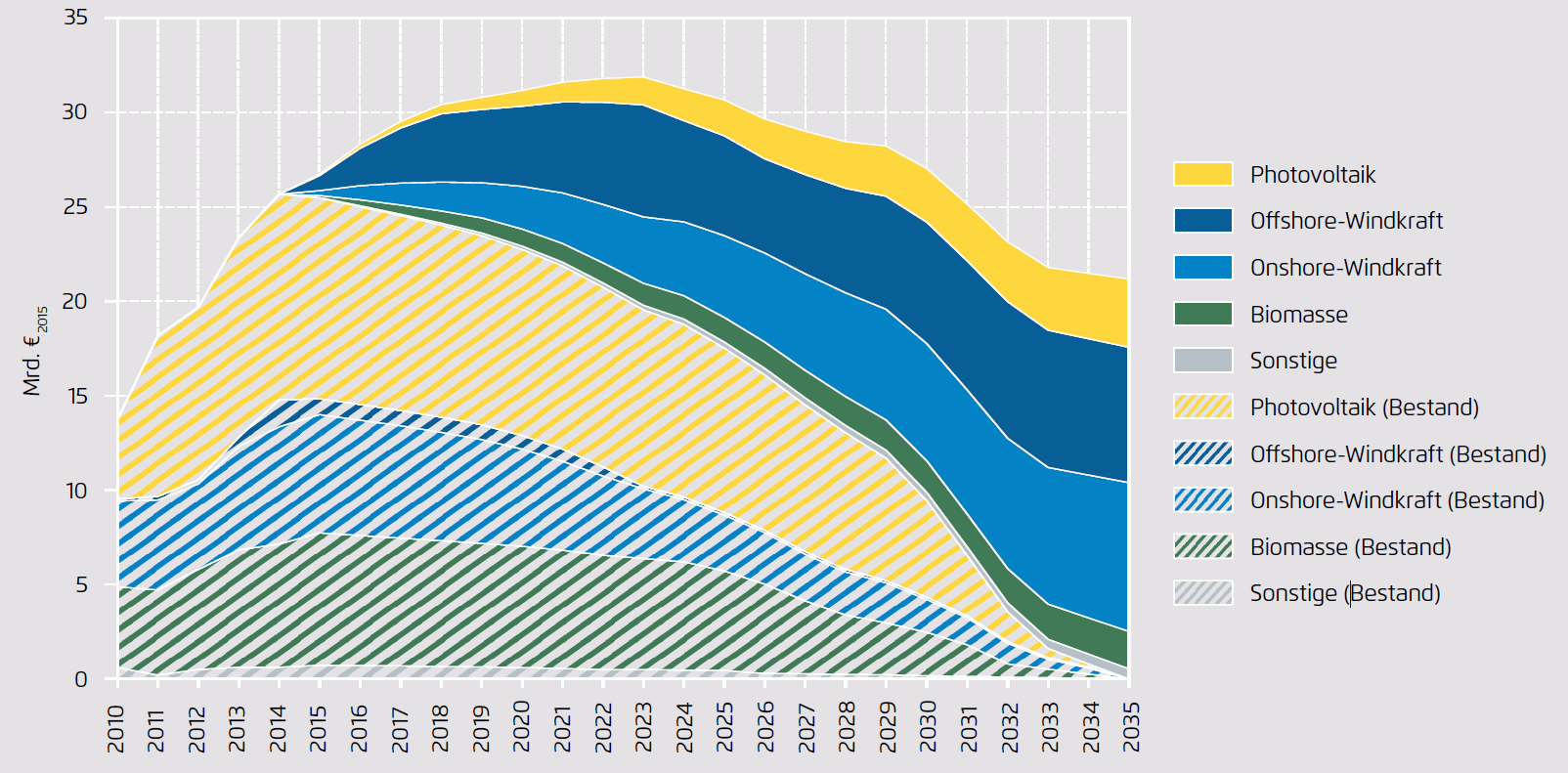

The chart below shows the cost distribution. The German should be self-explanatory except that “Bestand” refers to existing systems (as opposed to future systems) and “Sonstige” means “other.” Photovoltaics, offshore/onshore wind, biomass, and other are broken up into systems installed before (striped area) and after (solid area) 2015.

Clearly, photovoltaics surged from 2010 to 2014 (striped yellow area). But starting now, PV will only add a small amount to the expenses (the solid yellow area at the top). At the same time, the “legacy costs” – as I refer to current expenses for previous systems – clearly taper off starting in 2029 for old PV. Renewable power generators are eligible for feed-in tariffs for 20 years, and the first boom year for PV was 2009. These old PV systems will increasingly no longer receive feed-in tariffs starting at the end of the 2020s.

Clearly, photovoltaics surged from 2010 to 2014 (striped yellow area). But starting now, PV will only add a small amount to the expenses (the solid yellow area at the top). At the same time, the “legacy costs” – as I refer to current expenses for previous systems – clearly taper off starting in 2029 for old PV. Renewable power generators are eligible for feed-in tariffs for 20 years, and the first boom year for PV was 2009. These old PV systems will increasingly no longer receive feed-in tariffs starting at the end of the 2020s.

By the end of this decade, the greatest additional costs will come from offshore wind power (solid dark blue area at the top). The overall impact is expected to peak at around 32 billion euros in the early 2020s. By 2035, the cost impact will be lower than it is today – and note that these figures are absolute, not adjusted for inflation.

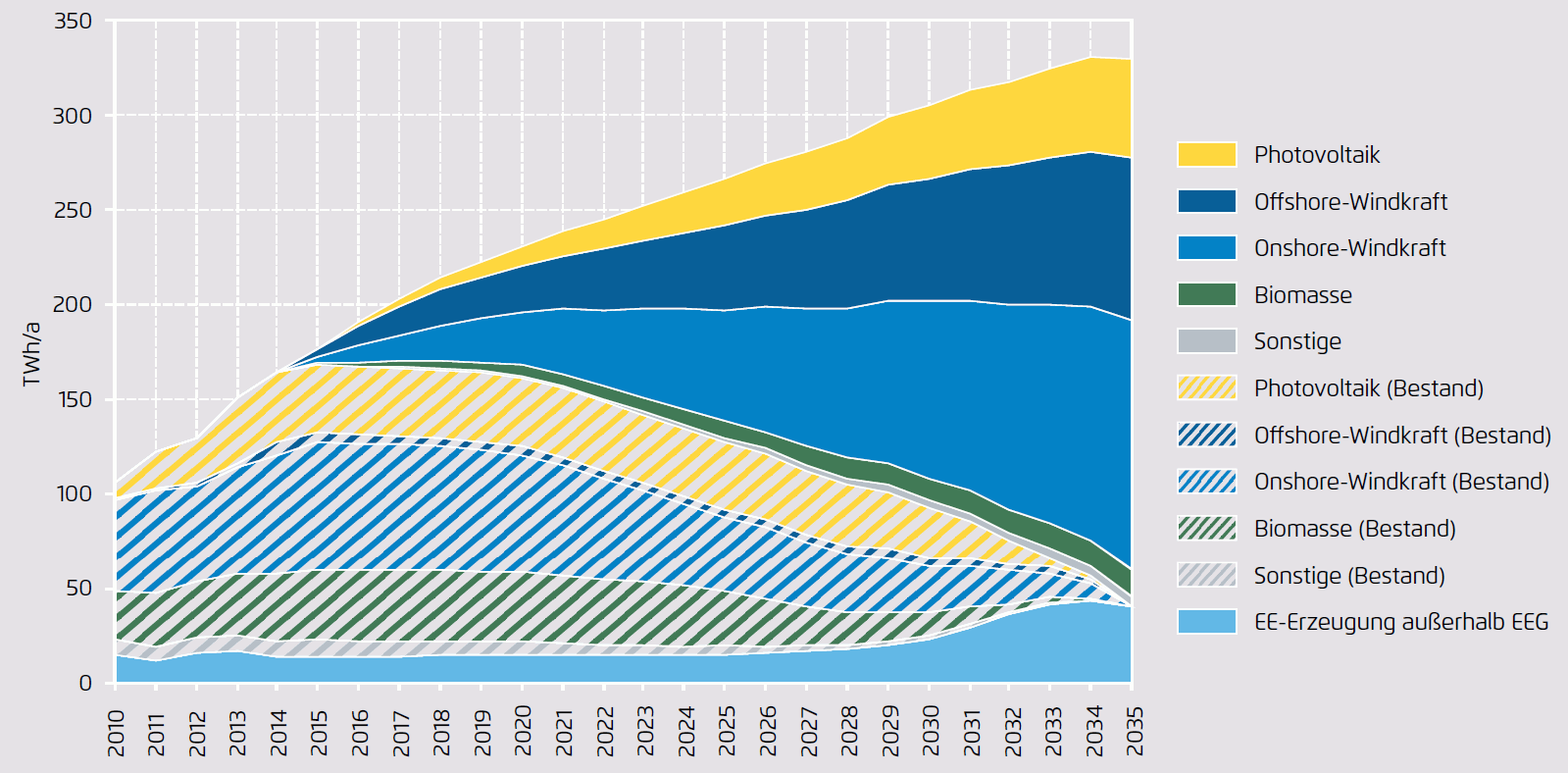

In the years of the solar boom (especially 2010-2012), great concern was expressed about the cost impact of PV even as the prices for new systems plummeted. It was pointed out, for instance, that solar made up roughly 50 percent of total cost although it only provided around one fifth of the electricity. As we see above, the situation is similar for the rest of this decade from offshore wind, which will also make up around half of the cost impact in 2018 but only provide a much smaller amount of electricity, as the chart below shows.

Over the next few years, we will thus have a boom in the cost impact of offshore wind that outstrips the growth in actual offshore wind power – a repetition of the situation with PV at the beginning of the decade. Yet, there is no uproar about offshore wind. One explanation might be that the overall cost impact is not as great. PV added around 10 billion euros per year to the costs, whereas offshore wind will add on closer to 4 billion in the near future. Another reading is impolitic: citizens and community projects owned a lot of the PV, but they will own none of the offshore wind since these installations are too expensive for citizens to invest in. Large companies and utilities are behind the offshore wind sector, and decision-makers seem satisfied that they are at least now getting on board the Energiewende.

Over the next few years, we will thus have a boom in the cost impact of offshore wind that outstrips the growth in actual offshore wind power – a repetition of the situation with PV at the beginning of the decade. Yet, there is no uproar about offshore wind. One explanation might be that the overall cost impact is not as great. PV added around 10 billion euros per year to the costs, whereas offshore wind will add on closer to 4 billion in the near future. Another reading is impolitic: citizens and community projects owned a lot of the PV, but they will own none of the offshore wind since these installations are too expensive for citizens to invest in. Large companies and utilities are behind the offshore wind sector, and decision-makers seem satisfied that they are at least now getting on board the Energiewende.

In my next post, I returned to an interesting finding in the Excel table Agora provides for its study: the organization models a collapse in the onshore wind market.

Craig Morris (@PPchef) is the lead author of German Energy Transition. He directs Petite Planète and writes every workday for Renewables International.

I would like to comment on the last paragraph: In our reference scenario, we calculate with very stable installation rates of wind onshore: 2.5 GW per year from 2016 until 2020 and 3 GW after 2020. That’s not a collapse. However, in some years after 2020 it might occure that more old wind turbines (20 years old or older) will go offline than new ones will go online. This can result in slightly less GW of totally installed wind power.

Everybody who thinks that this assumption is unrealistic is invited to model his own scenario in our EEG-Calculator and see what those will result in.

Christoph Podewils

Agora Energiewende

German off-shore wind power parks overrun the planned costs by about 20%.

And German atomic power by around 200%

http://www.hertie-school.org/mediaandevents/press/press-releases/press-releases-detail/article/large-infrastructure-projects-offshore-wind-parks-perform-relatively-well-with-20-per-cent-cost-ove-1/

French PV already cheaper than UK atomic and French off-shore power:

http://www.la-croix.com/Actualite/Economie-Entreprises/Economie/A-Bordeaux-le-plus-grand-parc-solaire-d-Europe-voit-le-jour-2015-05-21-1314537

http://lenergiedavancer.com/bientot-le-plus-important-parc-solaire-deurope-sera-girondin/2015/05/25/

In 2 years time PV will beat on-shore wind power prices, becoming the cheapest power source in France.

This is not the cost of renewables, but the cost of how Germany chooses to pay for it.

The real cost of renewable power is its cost price. Germany chooses to pay the EEG price.

The cost price of power from on land wind turbines is about 3 cents, when turbines are owned by power users. Because turbines work automatically, they can be owned by power users, that generate for themselves.

If germans were allowed to own part of a weindfarm, and use the power from their piece, at home, they would have lower stimulation cost.

And social acceptance of on land turbines would grow, because there is a direct relation between new turbines and their nearby owners/users.

The same is true for offshore, Denmark recently closed a deal for 10.2 cents per kWh, for a offshore windfarm in operation in 2020.

It depends on the price structure of what consumers and SME’s pay for their power, how expensive it really is.

Belgium has an other stimulation system, but lowered the stimulation by 30 % in 2 years, because the costprice of power from wind decreases.

By paying in advance for future cost reduction, may be not the most cost effective way, when the real costs falls earlier than the EEG predicts.