While media coverage has mainly focused on China and India’s record-level imports, other countries in Asia – particularly East Asia – have also been among the top global importers of Russian energy – and are therefore also implicit contributors to the war effort. A new data visualization website shows that countries in the region are likely to become top importers of Russian fossil fuels once Europe finalizes its plans to phase them out, and that moving towards renewables makes more sense considering the global security risks of fossil fuels, the climate crisis and the falling costs of renewables.

Taiwan’s Kaohsiung port, the fourth largest russian-coal importing port. (Photo by Nicolas Vigier, CC0 1.0)

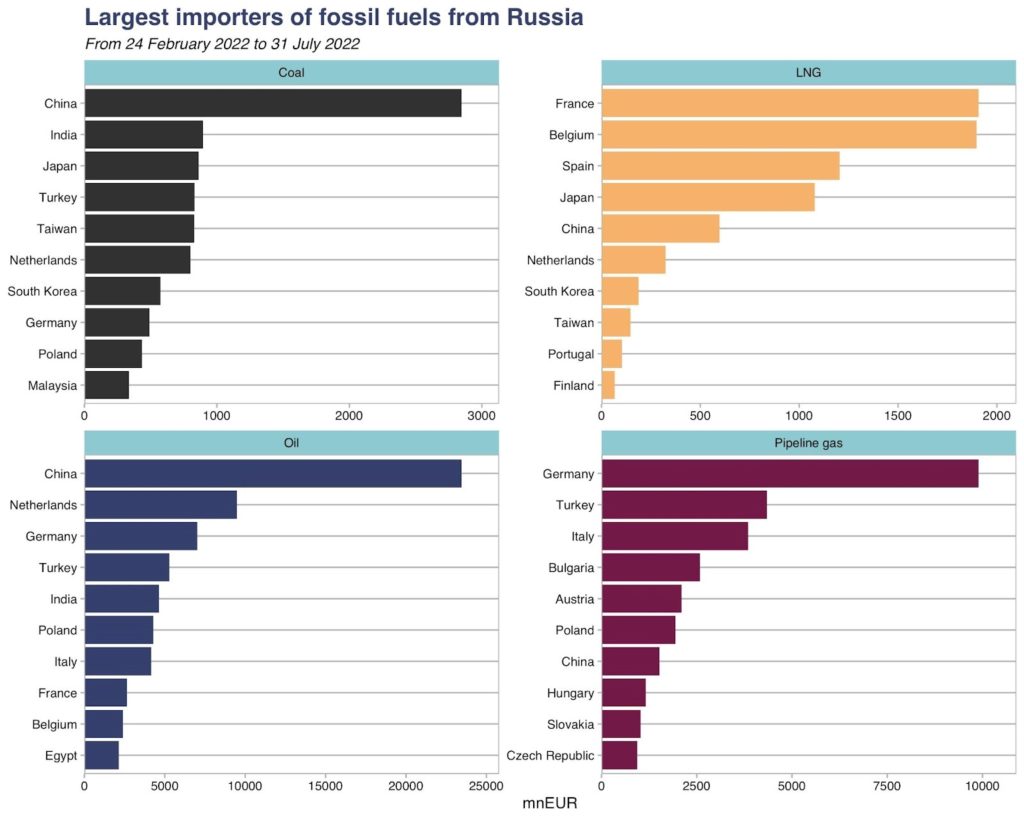

According to new data revealed by research think tank Centre for Research on Energy and Clean Air (CREA), Asia’s top economies – China, Taiwan, Japan, and South Korea – bought over 33 billion euros worth of fossil fuels from Russia since the beginning of its invasion of Ukraine up to July 31.

As the Ukraine war nears its six-month mark, EU countries have finalized plans to ban Russian coal and crude oil by the end of the year. Experts say that will leave countries in East Asia – which have not committed to phase-out plans as robust as Europe’s – to rise as the top importers from Russia.

Russia’s war effort has been enabled and sustained by fossil fuel revenues. In 2021, approximately 45 percent of Russia’s federal budget came from oil and gas revenues, according to the International Energy Agency.

Between February 24 and July 31, approximately 28.4 billion euros worth of Russian coal, gas, and oil were bought by China. An additional estimated 5.1 billion euros worth of Russian coal, gas, and oil were bought by Japan, South Korea, and Taiwan: an estimated 2.4 billion euros by Japan, 1.6 billion euros by South Korea, and 1.1 billion euros by Taiwan.

During that period, an estimated 1 billion euros worth of the latter three countries’ revenues went toward Russia’s federal budget, according to CREA’s estimate.

Fig. 1

During that same period, China was the largest importer of Russian fossil fuels out of all countries, and the top importer of Russian coal and oil. Japan and Taiwan were the third and fifth largest importer of Russian coal. All three countries were among the top eight importers of LNG, with Japan importing considerably more than South Korea and Taiwan.

Ports in East Asia also ranked among the top importing ports globally. Taiwan’s Kaohsiung port was the fourth largest coal importing port, behind only China and the Netherlands. South Korea’s Yeosu port – also a popular holiday destination – was the fifth largest oil importing port, behind only China, the Netherlands and Belgium.

“Japan, South Korea and Taiwan are all among the ten largest importers of both LNG and coal from Russia, collectively importing nearly 5 billion euros worth of fossil fuels since the start of the invasion,” said Lauri Myllyvirta, lead researcher at CREA. “When EU countries’ bans on Russian coal and oil take effect by the end of the year, countries in East Asia will essentially be left as the top buyers of Russian fossil fuels.”

Japan announced a gradual ban on Russian coal in April, as well as on Russian crude oil as part of its membership of the G7 in May. However, while oil shipments stopped mid-April, coal shipments still made its way into the country as recently as July. While South Korea and Taiwan have mostly aligned with EU and U.S. sanctions on Russia, they have yet to enforce a ban on Russian fossil fuels specifically. According to CREA’s data, shipments for Russian fossil fuels have been received by both countries in July.

“Moving to a full ban on imports would show both important moral leadership and improve the countries’ energy security by insulating them from energy blackmail,” Myllyvirta added.

CREA’s policy recommendations for countries importing Russian fossil fuels are as follows: end all purchases of Russian fossil fuels to strengthen the impact of sanctions, institute tariffs on imports from Russia to lower the price paid to Russian suppliers on spot markets, and create a plan to replace Russian fossil fuels with renewable energy.

“Continued investment in fossil fuels will accelerate climate change and continue countries’ dependence and vulnerability to often autocratic regimes,” said Florian Krampe, Director and Senior Researcher at SIPRI’s Climate Change and Risk Programme. “If countries embrace the necessary energy transition towards a fossil-free economy and invest in renewables, they might do more with less and ensure more resilient peace when the time comes.”

The top importing companies in East Asia

The top companies receiving fossil fuel imports in Japan, South Korea and Taiwan were JERA, Japan’s largest power company; Kogas, South Korea’s state-owned public gas company, which has a long-term LNG offtake contract with Gazprom until 2045; and Taipower, Taiwan’s state-owned power company.

Between February 24 and July 31, JERA – including both joint ventures and subsidiaries – imported an estimated 825.4 million euros worth of LNG, coal, and oil; Kogas an estimated 187.4 million euros worth of LNG; and Taipower an estimated 309.8 million euros worth of coal.

Some companies have taken steps to ending Russian energy imports. In February, at least one unit of Korea’s state utility KEPCO started “diversifying” its coal import sources away from Russia, according to an unnamed source at the unit. In March and April, Japan-based Kyushu Electric Power and ENEOS said they would no longer buy Russian crude oil and coal.

According to a July 22 SP Global Commodity report, Taiyo Oil has suspended signing new contracts for new Russian crude oil, following the Japanese government’s decision to ban Russian oil imports.

Taiwan’s state-owned gas company CPC Corporation said it would not renew its 5-year LNG contract with Russia in March, when the contract was slated to end. However, CREA tracked an import from a Russian port – most likely a spot purchase – in May, despite Taiwan’s announcement that it would not extend purchases beyond the end of its contract in March.

No other company in the region besides those above have publicly committed to stopping purchases of Russian fossil fuels.

Ukrainian activists pressure Japanese corporations

In June, a group of Ukrainian activists sent letters to six Japanese companies that received imports, including JERA, Hokkaido Gas, JFE Steel, Nippon Steel, Tokyo Electric Power and Chubu Electric Power. They said with the exception of Hokkaido Gas, they received responses from five companies, most of whom stated that they would take measures in “accordance with Japanese government policy.”

In JERA’s response, it said the company “would consider necessary measures in accordance with economic sanctions and trade restrictions imposed on Russia by the Government of Japan and other governments,” while Nippon Steel’s response said it would “quickly implement alternative procurement and other measures in line with the Japanese government’s policy.”

“While Japan still buys Russian fossil fuels and is still one of the largest importers of Russian coal, Ukrainian people still lose their homes, their future, and their lives,” said Nataliya Lushnikova, project and program management specialist of Ecoclub, a Ukrainian environmental NGO.