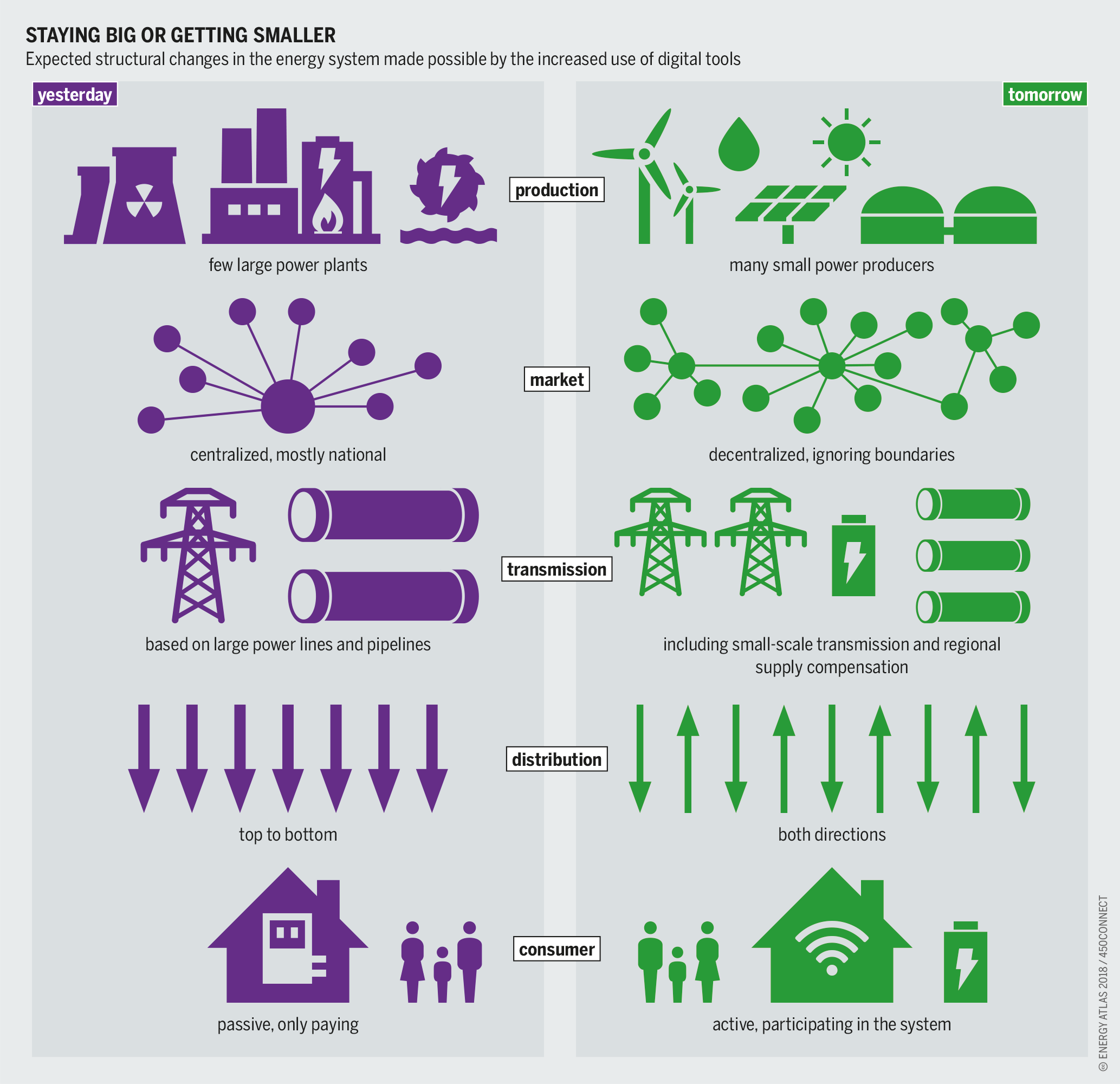

In order to achieve the goals of the Paris Agreement of 2015, the European Commission has set the long-term goal that EU Member States should be climate neutral by 2050. The energy sector must be transformed to keep the temperature rise well below 2°C. Renewable energy supply, combined with energy efficiency and the electrification of heat and transport, is seen as the key to reducing energy-related CO2 emissions by over 90 per cent compared to 1990. Part of the strategy implemented by the German Federal Government for tackling climate change is to further decentralize the electricity distribution system by 2050. This is reshaping the role of Distribution System Operators (DSOs). Philip Emmerich reports how smart grid technologies are disrupting the energy sector and challenging the business of DSOs in Germany.

High-voltage direct current – License: Public Domain, Photo by Snapwire

Renewable energy sources are unpredictable and volatile. Therefore, DSOs must become more flexible and learn to operate in a dynamic environment, working to ensure security of supply and enable the transformation of infrastructure. By collecting and processing a large amount of data, DSOs want to improve their performance within their core activities and aim to provide new services. Smart grids, smart utilities, the Internet of Things (IoT), artificial intelligence (AI) and blockchain are just some of the recent innovations driving the transformation of the industry. However, many innovative solutions are still at an early stage of development, and DSOs have yet to benefit from their potential.

Source: Energy Atlas 2018

A closer look at visionary smart grid solutions and applications

With real time monitoring, network failure can be identified at an early stage, allowing DSOs to easily react to damages and deploy restoration activities to return power to the grid as fast as possible. By doing so, the System Average Interruption Duration Index (SAIDI), describing the average duration of power supply outage per end consumer, can be kept as low as possible. Furthermore, the conditions of the system equipment in substations along the distribution lines are regularly monitored to improve reliability, reduce maintenance costs and enhance operation. Due to the intermittency of sustainable energy resources, predictions of wind and solar availability are essential. With the data collected among the grid infrastrcture, different simulations can be conducted to better plan and manage the distribution network. Future demand for power can be estimated using AI algorithms, allowing the efficient management of energy flows in the short-, medium- and long-term. Such load predictions would enable optimal distribution network planning, as well as efficient operation.

In Germany, smart meters have now started to provide accurate information in real time, enabling a more efficient demand response. With this hardware it is expected that more detailed end-user data will be generated from smart appliances, thermostats, plug-in electric vehicles (PEVs) and electrical devices. Therefore, the successful roll-out of smart meters is an important step towards an advanced metering infrastructure that allows the assessment of this data and the exchange of information between smart meter gateways and utilities. To support an active response to changes in power demand, a number features can be exploited for cost forecasting: historical load data; customer behavior; billing information; and, of course, economic information from the energy market and stock exchange, such as price indicators and network tariffs. To even better predict the availability of renewable energy sources and their incorporation into the existing grid, weather data such as solar irradiance, wind speed, wind direction, temperature, humidity and pressure are monitored and provide important complementary information. Therefore, additional external data sources such as meteorological data, geographical data from satellites and geographic information systems (GIS), and traffic data from global positioning systems (GPS) are becoming even more essential.

The disruption of the DSO landscape and development in Germany

Overwhelmed by the amount and complexity of the available data and information, DSOs seem to be more inclined to cooperate with third-party companies. Large companies, such as BOSCH and PSI, are offering smart grid solutions to help DSOs overcome new challenges. With the new smart metering infrastructure being rolled out in Germany and The Act on the Digitisation of the Energy Transition in place, a new course has been set. In the coming years, millions of electricity customers will be integrated into the digital energy market via smart meters. This is the first basis for efficient energy consumption and for new business models from smart homes to e-mobility and smart services.

Subseqeuntly, the energy sector is opening up opportunities for new innovative companies to enter the market as the International Renewable Energy Agency has confirmed in an earlier publication. In recent years, there has been a rapid growth in the number of start-ups active in the smart grid environment. Many large DSOs and utility companies are acquiring and founding their own start-ups to expand their operations, cut down on outsourcing costs and tap into new markets. Nonetheless, public authorities are getting involved in the digital revolution of the energy sector as well. Through the Smart Energy Showcases – Digital Agenda for the Energy Transition (SINTEG) programme, the German Federal Ministry for Economic Affairs and Energy (BMWi) is funding several regional projects throughout the country to encourage sustainability and flexibility with regard to the generation and distribution of electricity. These projects are offering smart solutions for utilities and energy providers. In particular, the project “enera” is offering a transparent flexibility market traded on the EPEX exchange to solve network bottlenecks. These are just some examples highlighting the radical transformation that DSOs, a formerly rather monopolised and “business as usual” sub-segment of the energy sector, are facing at the moment. However, many envisioned use-cases have not yet been realized, since the infrastructure is still under construction. Both start-ups entering the industry and established DSOs are still exploring new business models and are in the process of finding their roles in this new market.