The new governing coalition taking shape in Germany aims to build a lot more solar and wind “if the grid can absorb the electricity.” Craig Morris spoke with German experts, and no one could tell him what that means.

How do you tell if the grid can take more renewable energy? (Public Domain)

Recently, I wrote about the latest negotiation results for a new German government. On Sunday, the Social Democrats adopted the proposal for a new grand coalition – a repeat with the Christian Democrats – albeit with a lukewarm 56% of voting members. The country is now set to get a continuation of the old coalition that few seem to want, including the coalition partners themselves.

But the new grand coalition will not be the same as the old; the platforms differ. The ambitions for renewables and climate protection are greater than before, though details are still lacking. For instance, an additional 4 GW of solar and 4 GW of wind are to be added by 2020 “if the grid can absorb the electricity.” How do you tell whether the grid can take more?

Negative prices and “EinsMan”

There are two potential starting points: negative power prices and curtailment of renewable electricity. The latter is referred to in German as “EinsMan,” which is short for “feed-in management.” Let’s take each of these in order.

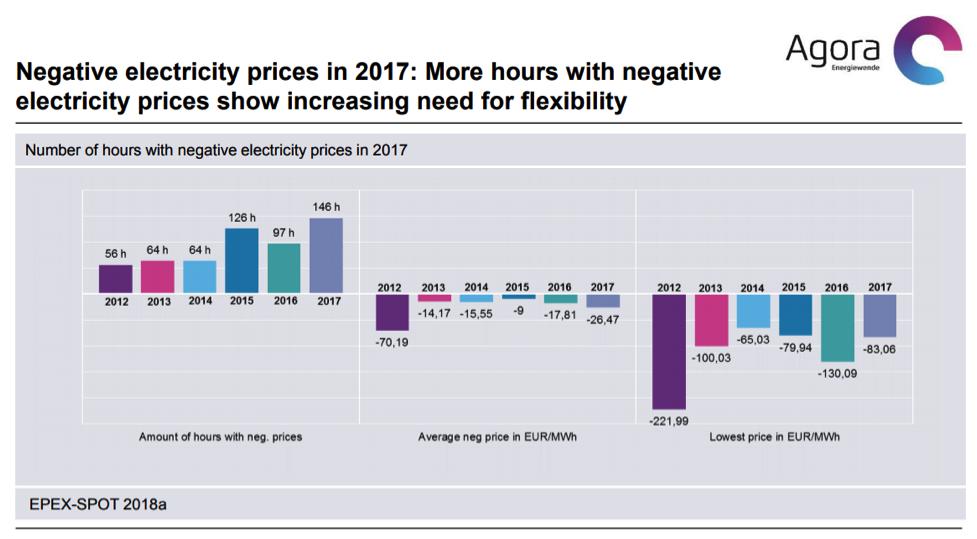

The number of hours with negative power prices has been on the rise over the past few years, as shown below. But this metric only indirectly pertains to grid capacity; it more precisely shows cases when demand for power from conventional plants drops so low that it becomes cheaper (because of technical constraints) for these plants to pay customers to off-take electricity to avoid ramping down further.

Furthermore, negative prices apply in the entire price zone for both the German and Austrian grids. There is only one price signal then for this entire area, but grid congestion occurs locally, not across all of Germany and Austria at once. Here, we need to revert to a more precise metric: “EinsMan”. Grid operators are allowed to curtail electricity from wind, solar, biogas, cogeneration, and mine gas when specific sections of the grid are endangered.

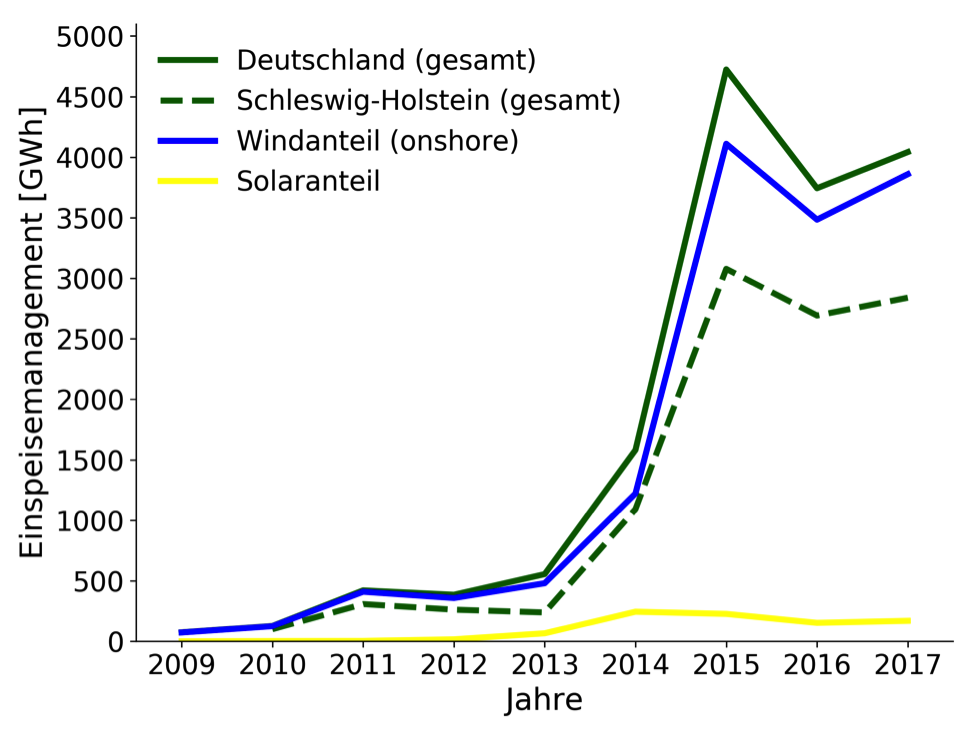

The amount of renewable electricity curtailed skyrocketed from 2013 to 2015. After falling in 2016, it rose again slightly in 2017 according to preliminary figures.

The green line represents the total amount of renewable electricity curtailed; it never reached 1% of total German power generation (around 6,000 GWh). Most of the curtailed electricity is on shore wind power (blue line); little solar is curtailed (yellow line) probably because much of it is connected at the low-voltage distribution level, whereas curtailment occurs at the high and medium-voltage levels. Schleswig-Holstein is the state where most curtailment occurs (dotted line). Source: Ubimet.

Ubimet, a service provider, already visualizes the EinsMan data, which are available by postal code, and combines them with weather data, renewable power forecasts, standard load profiles, grid topology, and load flow calculations to produce a forecast. Policymakers don’t even need the forecast, which wouldn’t be available for a whole year anyway; the data for the previous year could be used to show where grid congestion occurs, and wind farms could be excluded from auctions within that postal code unless the grid had been expanded in that area.

But no one I spoke with expects this to happen. Angela Pietroni of think tank Energy Brainpool says the requirement for grid capacity could just be “a loophole to limit the auction volumes.” To make matters worse, Andreas Jahn of the Regulatory Assistance Project (RAP) says that there is a lack of transparency in grid data in general, including with re-dispatches – when the grid operator requests that a conventional plant change its output immediately to stabilize the grid. (See our previous report entitled Blacked out German grid.) But he also points out that most wind and solar are connected at lower voltage levels on the grid; re-dispatches take place at higher levels.

The question of transparent grid data is entering the foreground in Germany. Over at Energy Post, Jahn sums up the main issues, including a ruling by the German Constitutional Court last year that revenue from the grid must be more open. The case was brought by green power provider Lichtblick, which points out that grid fees are now the biggest single part of retail power prices – and it’s hard to verify these fees independently. Grid operators are considered natural monopolies; as such, they propose prices to regulators, who need transparent data to confirm proposed fees. “Withholding relevant data is a violation of EU law,” he adds.

In other words, Germany could make the construction of new renewable energy projects more advanced by discouraging, if not ruling out, new builds in areas with a defined level of grid congestion – we have the data. Alternatively, policymakers could use grid congestion to incentivize local electricity-to-heat; the excess green power would then not be curtailed, but used as a heat source. Section 13, para 6a of the 2017 Energy Management Act (in German) is a starting point but doesn’t yet apply to wind and solar.

Whether the current debate over the transparency of grid data will help or hamper such advances is anyone’s guess at present.

1% curtailment is invisible in the accounts of wind and utility solar generators. When should we start to worry about it?

Do a thought experiment. Wind and utility solar are about 5c/kwh LCOE in Europe now. That’s twice the lowest world prices, from auctions in a range of countries. With foreseeable technical progress – just the regular incremental stuff, not counting possible breakthroughs – Europe should be below 2.5c/kwh sometime in the early 2020s. That allows an adequate return to investors, the one they are getting today, with 50% curtailment. Yes, shut down half their potentially productive time. That’s a huge margin, beyond anything in standard modelling. But it’s perfectly liveable.

The gap problem will be solved by a mixture of storage, demand management and massive overbuild (with curtailment). Demand management is cheapest, but has technical and economic limits. Overbuild is likely to be cheaper than bulk storage.

Massive overbuild might not actually be a bad thing, in terms of timely social adaptation to the new normal of a mostly-renewable energy system. I mean, if for example investors in power-to-X technologies (gas, hydrogen, fertilizers, carbon nanofibers, whatever) see that Germany is “throwing away” lots of electricity at peak solar/wind times, then it becomes a natural decision to build those power-to-X pilot factories where that practically free resource of surplus electricity is – even if it’s not available 24/7/365 and so there may be production stops sometimes. [I also remember reading about an aluminium smelter / recycler already prefering Germany, though that was because of low wholesale prices, not to soak up otherwise curtailed renewable power, as there isn’t much of that yet.] An existing power system overbuild (that’s not costing the power companies a lot of money to keep idle until demand catches up, like a mothballed nuclear plant does) in at least one sizeable country might in this way be a better incentive for bringing power-to-X technologies to a large-scale industrial level. It could make for faster implementation than if the power-to-X companies and investors had to squeeze into a power grids that are already fairly well-balanced with regards to demand/supply of electricity.

” In other words, Germany could make the construction of new renewable energy projects more advanced by discouraging, if not ruling out, new builds in areas with a defined level of grid congestion ..”

This is already done by adjusting the FITs according to what RE’s are there already. More FIT for PV in the North where traditionally more wind power was installed and more FIT for wind power in the South where more PV was installed historically.

B.t.w.: Ireland copes very well with over 3% wind power curtailment

http://www.eirgridgroup.com/site-files/library/EirGrid/2017-Qtr3-Wind-Dispatch-Down-Report.pdf

They plan to sell it to France and them take anything :):

http://www.eirgridgroup.com/the-grid/projects/celtic-interconnector/the-project/

The Celtic interconnector would be 500km subsea. The first UK-Norway link (NSL), already under construction, will be 730 km. The Irish cable is quite feasible technically. Go for it!

Re. going for it:

I see it from my window.

Well, the diggers who put it under ground once being financed.

———-

Spain is connecting as well with over 2 GW I’ve read, to France … 🙂

Now press for Portugal to join central western Europe/CWE directly.

The EU clowns/commissioners don’t seem to like the idea, Portugal pays no bribes ….

Hi Craig, it may worth mentioning that §118 para 22 of the EnWG has already closed this scheme down by the end of 2023. As far as I know, only a few (if any) contracts have been signed by TSOs and CHP owners so far.

The grid is full, grid defection is now a hard issue pressing the utilities from below.

The latest one to be f… is Vattenfall who is selling what they have (German lignite) and is stucked to the trash like atom and hard coal.

Vattenfall wants to copy Eon selling ” PV+battery” to the end-consumers, oh dear 🙂

https://www.bloomberg.com/news/articles/2018-02-06/blockchain-a-savior-for-stretched-computers-at-energy-trader

Eon ceased to exist after 3 years they started this.

But now to the fun quotes from Bloomberg:

“We will be able to deal with more trades with smaller volumes of each trade,” he said. “And with smaller transactions sizes you are able to target volumes that otherwise would have been neglected. ……

(and)

…

Department Stores

Examples of smaller trades that Vattenfall will go after include power from solar or batteries at department stores or homes across Europe. …. ”

No job to small, grid defection is here.

Hi capacity conductors such as ACCC are beginning to play an important role in reducing grid congestion worldwide as they are capable of carrying twice the current without the need to modify or replace existing structures.