The decision to go ahead with Hinkley shows that any technology with a long timeframe is a juggernaut in an energy world of foreshortening planning horizons. But other questions remain open: can an EPR be built at all? Why is new nuclear cheaper outside the UK? And isn’t Hinkley at least a good low-carbon complement to wind and solar? Craig Morris takes a look.

Wind farm off the UK coast; wind power prices continue to drop, but Hinkley’s price tag keeps rising (Photo by Andy Dingley, edited, CC BY-SA 3.0)

“It looks like a contract that was written five years ago on a business case that was probably pulled together 10 years ago,” British journalist Ambrose Evans-Pritchard cites a spokesperson for ScottishPower. And he gives an explanation for why the UK had to go ahead with it nonetheless: “Cancellation of the project would have led to a diplomatic rift with China and France.”

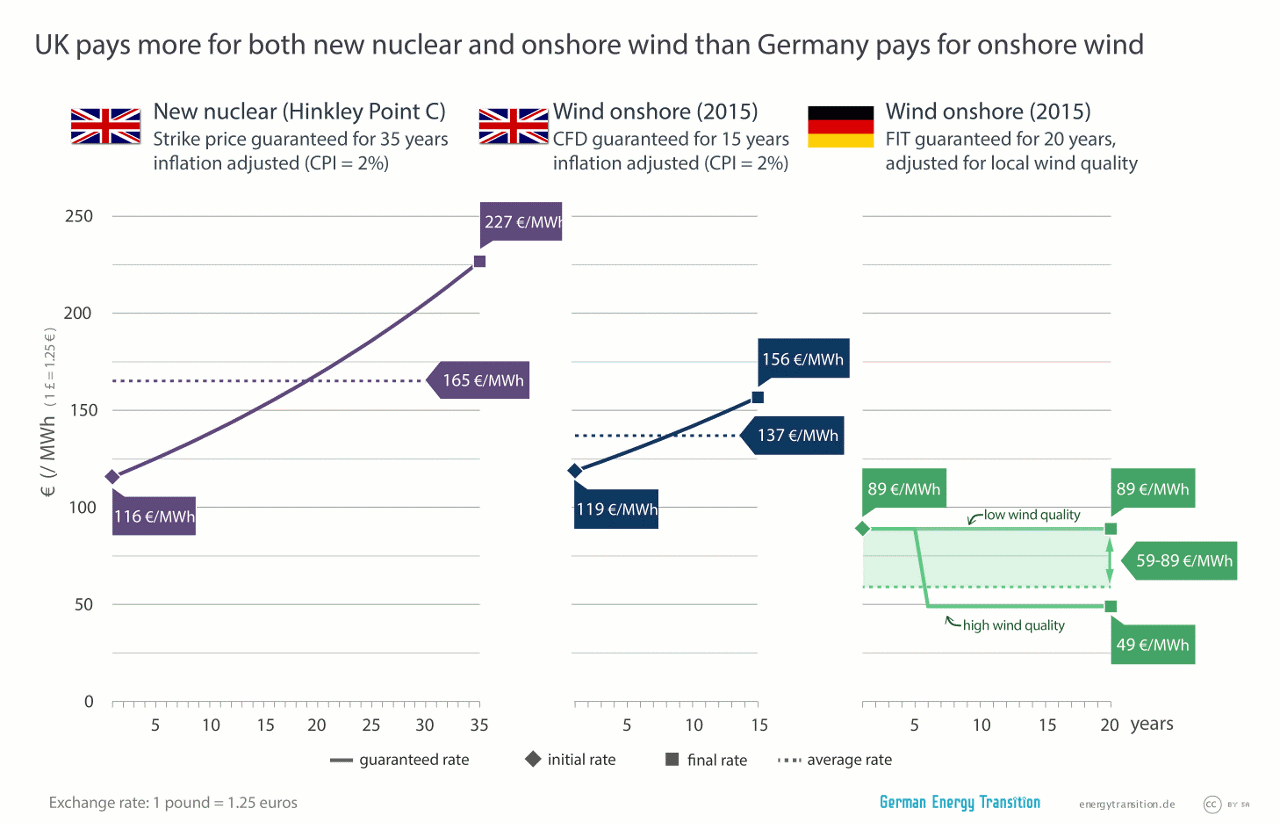

Much of the discussion about Hinkley Point focuses on cost. We made the chart below last year based on a previous one from 2013. Since then, wind and solar have continued to get cheaper. Prices for offshore wind recently plummeted to 7.3 euro cents off the Dutch coast—that’s 6.2 pence at current exchange rates. Hinkley is nearly 50% more expensive. And the British have offshore wind conditions at least equal to the Dutch. Ten years from now, when Hinkley might go online, new wind power will be even cheaper. Hinkley won’t.

What about constructability? Can the 3rd-gen EPR reactor ordered for Hinkley be built at all? “For French state-owned EDF and the entire French nuclear sector, [Hinkley] is a life-saver,” writes Karel Beckman at Energy Post. But if Areva can’t complete what is being touted as the most expensive infrastructure project ever anywhere, Hinkley might turn out to be less a ring buoy and more of an anchor that sinks everyone who holds onto it.

The two EPRs currently being built in France and Finland by France’s Areva are the model for the two to go up at Hinkley. Both are behind schedule and over budget. If they never go online, it will be a disaster for Areva, the French utility EDF, and the French state (which owns most of EDF). But other third-gen reactors in Asia are performing better, specifically the AP1000 in China and the APR 1400 in South Korea.

Has any such reactor ever been finished?

That depends on what you mean by “such reactor”—and “finished.” I have repeatedly pointed out that no EPR anywhere has been built, but this year that may have changed.

Shin Kori 3 went critical (definition) last December and was connected to the grid this year. It is a bit behind schedule, having originally been expected in 2013. World Nuclear News wrote in January that commercial operation was expected in May after tests. However, the reactor shut down for maintenance in August—not untypical for a giant power plant, but an indication that reliable operability had not yet been reached. When an earthquake of magnitude 5.8 struck on September 12th, the reactor was still offline (it would otherwise have needed to undergo an emergency shutdown, as four others nearby did). At most, Shin Kori 3 was online commercially from May to August, though I could find no confirmation online that the unit ever left the test phase (please leave a comment if you know more).

The Chinese were also expected to start up their first AP1000 at Sanmen 1 this month after a few years of delay, but Reuters reported on Friday that the unit is still undergoing hot-testing and is now expected to start full operations next year. So the Korean reactor is the only one that may have gone into operation to date, but it is currently offline. As I write this, no 3rd-gen reactor is running commercially anywhere.

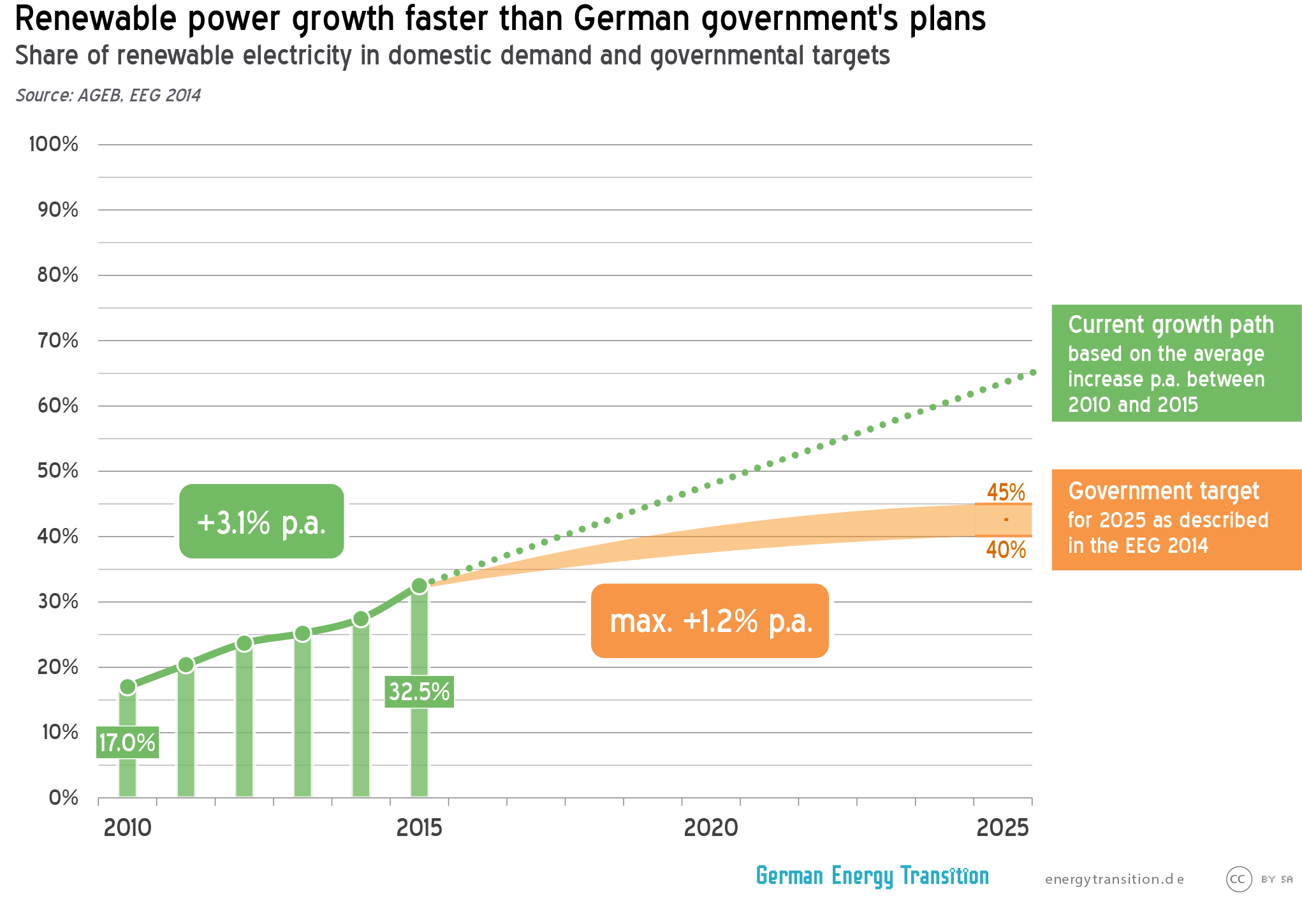

Hinkley is to provide 7% of the British power supply. Over the past five years, renewables have grown in Germany by more than three percentage points annually on average. By the time Hinkley is built, it would no longer be needed if the UK focused sincerely on wind and solar. Even with a nuclear phaseout, renewables in the hands of the people are growing too quickly for the German government.

Are all of these 3rd-gen reactors so expensive?

The strike price at Hinkley (the guaranteed price for the power generated) has drawn a lot of attention, but the Asians ones seem much less expensive. We don’t know the power prices from the Asian projects, but we do have estimates of construction costs. The cost of Hinkley comes in at 10.5 billion euros—or as much as 21 billion pounds according to the latest estimate. That’s two reactors with a cumulative 3.2 GW. For comparison, we’ll switch to USD, putting us at a range of 3,900 to 7,700 USD per kilowatt at Hinkley, depending on which estimate you believe.

Sanmen 1 was apparently built for 3,500 USD/kW. Oddly, the same reactor type—the AP1000—is being built in the US for far more money. At Vogtle in Georgia, two AP1000s are to be built by 2019, just ahead of two others in South Carolina. The price tag at Vogtle may rise from 14 to 21 billion USD. Even the lower estimate is around 6,300 USD/kW—nowhere near the Chinese price, but closer to Hinkley. Likewise, the Korean APR1400 came in at an impressively low 2,400 USD/kW back in 2007. Judging from plans to build two new APR1000s, the price hardly seems to have changed at only 2,500 USD/kW.

Plants built in the EU and US thus seem to cost around twice as much as in Asia. Why the difference? Proponents of nuclear generally argue that excessive fear of nuclear accidents makes nuclear plants unduly expensive—but then, 3rd-gen reactors are supposed to be more intrinsically safe by design. The safety costs are planned in already. One expert has said 3rd-gen nuclear is like building a “cathedral within a cathedral.” Another expert says South Korea’s “nuclear cost data are not independently audited and are therefore of unknown quality.”

Baseload: a bug, not a feature

In the end, we have a dilemma: transparency and nuclear safety make new nuclear plants more expensive, even when system integration costs (storage, intermittency, etc.) are accounted for.

Word is getting out outside of Germany, which has understood the issue for years, that nuclear is the worst possible complement for wind and solar. Ambrose Evans-Pritchard says “big nuclear reactors are a poor way” to back up wind and solar because the reactors “cannot easily be switched on and off.” But even he understates the argument against baseload by saying, “Britain will always need reliable ‘base-load’ power to supplement renewables.”

In fact, “baseload” describes the inflexibility of a power plant. It’s a bug, not a feature. There is no “baseload demand” without baseload plants. Get rid of the latter, and you no longer need to light up your highways at night, as Belgium does, to create artificial demand for nuclear power. You can then tailor demand to renewables just as we tailored it to inflexible nuclear and coal over the past several decades.

So I’m very sorry to all the pro-nuclear climate campaigners: you simply will have to decide. It’s either nuclear or solar and wind—not both.

Just a decade ago, 15 years of planning (like at Hinkley) would have seemed unspectacular in the energy sector, where plants often run for half a century. But solar and wind can be built quickly, which means foreshortened planning timeframes. Germany took only three years to replace its 8 nuclear reactors shut down in 2011.

In the end, the energy sector must be seen within society. What future do the British want: one with experts promising them that financially risky megaprojects will work out? Or one in which people have the right to make their own energy so fast that megaprojects are not needed? British MP Caroline Lucas perhaps put it best: “Do we keep ploughing billions into mammoth infrastructure projects such as Hinkley, or do we refocus resources and build up an energy democracy from the bottom up?”

Craig Morris (@PPchef) is the lead author of German Energy Transition. He is co-author of Energy Democracy, the first history of Germany’s Energiewende, and is currently Senior Fellow at the IASS.

A good article & much to recommend it. My discussions with National Grid the UK TSO suggest that they find large reactors like Hinkley a pain in the arse because they need to hold in reserve 800MW of generation for when (it is always “when” not “if”) one of the Hinkley turbines decides to drop off the system.

One area not covered by the article or only briefly is politics. The pre-2010 Labour gov’ was hesitant wrt Hinkley – the economics did not add up. Post 2010 and with the Tories running the show, things changed. It is a simple matter of record, that the Tory party gets funding from 3 sources: finance/bankster sector, oil ‘n gas and construction. The Hinkley trough is a windfall for the UK construction industry. This windfall will lead to grateful donations to the Tory party. Trust me on this: nobody does corruption quite like the UK in general (it is institutionalised) and the Tory party in particular. Hinkley is one example of the corruption endemic in the UK body politic. Perhaps one reason why the Euros will be glad to get shot of the English.

Oh & one last comment: Tories reading this & not liking it – sue me – I’d be happy to meet in your high court & we could then see using endless examples how true my statements are.

EDF management have been deeply split on the advisability of the Hinkley C contract, with several board-level resignations. The worker directors are opposed, thinking that the project is a financial risk to EDF and therefore to its generous pension scheme. It’s unclear why Hollande came down on the go side.

If Hinkley turns out like the Finnish and French plants under construction, it may never be switched on. Around 2020 the UK will have to build plan B anyway (interconnectors to Norway, massive pumped storage in Scotland) as the current nuclear stations reach the end of their lives. It will look cheaper to break the contract and indemnify EDF than to keep feeding the white elephant.

As far as I understand the contract still hasn’t been signed.

French atom output is now the lowest since 10 years:

http://www.icis.com/resources/news/2016/09/22/10036415/french-curve-jumps-as-edf-revises-nuclear-targets/

The power prices are rising, the cross-border knock-on effect is already effecting the UK:

http://www.platts.com/latest-news/electric-power/london/french-power-prices-spike-as-edf-extends-nuclear-26552026

Maybe that is the Mafia’s plan: bonding several stupid dogs together. And have the sheep paying for the rope 🙂

OT

The Dutch atom power plant Borssele and it’s owner Delta will cease to exist in June 2017.

Well , the owner Delta (30% owned by German RWE and 70 owned by local energy utilities) bankrupt and the atom power plant being closed.

http://www.fluxenergie.nl/krant-volgend-jaar-einde-energiebedrijf-delta/

http://www.pzc.nl/regio/zeeuws-nieuws/kerncentrale-levert-delta-over-2015-een-verlies-op-van-65-miljoen-euro-1.6404297

An ‘anonymous’ organization asks if the state should take over the losses and keep Borssele running, they have now enough people signed to organize a plebiscite:

http://www.omroepzeeland.nl/nieuws/2016-09-21/1043275/genoeg-handtekeningen-voor-volksraadpleging

Here the organization’s home page:

http://zeeuwsevolksraadpleging.nl/meer-info/

Wind having lower energy cost than nuclear is probably true today. But how do you keep the lights on when the wind power falls off for days on end? And what do you do with wind energy when there is far too much of it, just throw it away? These are problems that have yet to have affordable engineering solutions. So at this point we know how to design a system based on nuclear power but we do not know how to design a fully workable system that works all the time based on wind and solar. That’s the problem. Here in the US we lean on fossil fuels to make wind and solar workable but that’s only good up to a point and even with maximum penetration of wind and solar with fossil fuel backup we still wind up getting half our energy from fossil fuels. What kind of plan it that? It’s not green enough.

With respect to the questions by Mr Preston.

“Wind having lower energy cost than nuclear is probably true today”

There is no “probable” it is true – read the article.

“But how do you keep the lights on when the wind power falls off for days on end?”

Interconnectors to Norway, more PHS, reduce electricity demand

“And what do you do with wind energy when there is far too much of it”

Power to gas: scalable to GW/TWh

“These are problems that have yet to have affordable engineering solutions”

Nope: they are all affordable right now.

The contract may be signed on the 29th this month:

http://uk.reuters.com/article/uk-edf-britain-idUKKCN11T26F

ASN-news:

http://france3-regions.francetvinfo.fr/basse-normandie/manche/nord-cotentin/flamanville/epr-de-flamanville-20-anomalies-constatees-par-l-asn-1093175.html

Moneyquote:

” Concernant les anomalies relatives à l’EPR de Flamanville, ces anomalies sont « toujours en cours d’instruction », a expliqué à l’AFP à Julien Collet, directeur général adjoint de l’ASN, ajoutant que ” l’EPR n’est pas en service donc ne présente pas de risque. » ”

As long as the EPR isn’t operating there shouldn’t be a problem. Yes.

The written statement by the ASN here:

http://www.french-nuclear-safety.fr/Information/News-releases/Areva-NP-s-Creusot-Forge-Plant-ASN-publishes-the-list-of-irregularities-detected-so-far

The link to the list leads nowhere …..

20 ‘abnormalities’ in the one RPV in Flamanville. Twenty.

All other EPR-RPVs had been made in China and Japan according to the very same methods but the French ASN has nothing to do with these, nothing at all.

https://www.hongkongfp.com/2016/05/27/made-china-critical-component-taishan-nuclear-plant-manufactured-guangzhou/

ASN-list of faulty parts:

http://www.french-nuclear-safety.fr/Inspections/Supervision-of-the-epr-reactor/Anomaly-affecting-the-Flamanville-EPR-reactor-vessel/Areva-NP-s-Creusot-Forge-Plant-ASN-publishes-the-list-of-irregularities-detected-so-far

click on

” Consult the list of irregularities detected at Creusot Forge (in french) ”

under “Learn more” at the bottom on the page.

Olkiluoto 3 might never start production

The owner of the EPR Olkiluoto is lobbying in Brussels to get the Areva atom company saved, it is feared in Finland that the EU competition authority/EU commission will not allow the saving of Areva (who is building the EPR in Finland) under current proposals.

http://www.verkkouutiset.fi/kotimaa/Olkiluoto-55633

http://www.talouselama.fi/uutiset/huoli-herasi-suomessa-hs-9-vuotta-myohastynyt-olkiluoto-3-uhkaa-viivastya-entisestaan-6585463

The issue is tricky and will lead to an even later start (if ever) of the reactor:

If the EU commission decides that the French state is not allowed to sell a state owned company (Areva) to the state and simply forget about the debts (the state would not pay the debts to itself) then Areva can’t finish the reactor.

If the EU commission decides to allow the French state to buy a French state company

then the French state’s plan splitting Areva in 3 parts (as it is now being considered and placed upon the table of the EU competition authority) then the 3rd part of Areva will not include the EPR in Olkiluoto.

Because EdF – the proposed buyer of Areva – won’t take any risk with it.

So no matter how the EU commission decides Olkiluoto3 would be left in a limbo.

The only alternative seen at the moment would be a new deal but this again would have to be worked out by France and then again to be placed upon the table of the EU commission.

This would then take (if being tabled at all) another year or two.

In the meantime a defacto bankrupt Areva would not be capable to work on the site unless the French state/exchequer would pay directly for the construction works on a day-to-day base and that is illegal under competition laws.

So what is clear at the moment from Finnish TVO’s point of view is that Olkiluoto3 won’t be delivered in 2018 – if at all.

Finnish TVO fears that Areva might be giving up on Olkiluoto and the French state (via EdF) will put every effort and all resources left into the Flamanville EPR reactor.

Because the working(!) Flamanville reactor is part of the Taishan and Hinkley Point deal, if this EPR reactor project in France fails a chain reaction of litigation will start.

How progress at the Olkiluoto site could go on is nowhere clear to anyone now ….

France in it’s effort to fiddle elections (by joining Creusot and Areva and EdF) has simply worked out the wrong plan and brought this bad plan for decision making to Brussels.

Here the link to Helsingin Sanomat who published the story today and to who the other two magazines linked above are referring:

http://www.hs.fi/talous/a1474771202053

————————

The ‘most expensive building project in history’ Hinkley Point is called.Well, the entire atom industry seems to cling now on Flamanville which is a Ponzi scheme.

If Flamanville doesn’t get finished the rest will be officially declared bankrupt.

A market failure …. what allows for state subsidies ….. tzzzzz!

Finish TVO takes Areva to the court about the EPR failure:

http://www.lesechos.fr/industrie-services/energie-environnement/0211333019837-epr-finlandais-tvo-assigne-areva-en-refere-2030606.php

Next month there should be first hearing in Nanterre. TVO fears that the proposed splitting of Areva without the Olkiluoto EPR would leave the site abandoned, even if the project was finished in 2018 no one could be made responsible for warantees and guarantees.

——————–

Another Scandinavian atom power company, Swedish Vattenfall, has decided to put Europe’s most efficient coal power plant Moorburg/Germany up for sale.

They need the money whilst Moorburg burns it.

“We are still trimming the plant in ….”

http://www.reuters.com/article/vattenfall-coal-idUSL8N1BV32C

Moorburg runs in a stop-and-go modus since it was officially grid connected about a year ago:

http://grid.stromhaltig.de/management/engpass/redispatch/Moorburg

With the new cable between Norway and Northern Germany (Moorburg) the brand new coal power plant becomes obsolete:

http://www.power-technology.com/projects/nordlink-interconnector/

Hydropower from Norway can react faster and cheaper serving (redispatching) power demand.

The final bill:

http://mainichi.jp/english/articles/20160928/p2a/00m/0na/015000c

Keep your lecky bills, they might save you from poverty.

You bought green electricity, knowing what is waiting ahead ….

Here one from the atom state Belgium:

The atom minister has forgotten to draw the atom tax

http://newsmonkey.be/article/71666

as agreed in 2015:

http://af.reuters.com/article/energyOilNews/idAFL5N1093EE20150729

The time has passed now where this tax can be claimed for last year, about € 3 million have been waived.

Thank you Miss Atomanny, bedankt,merci …..

EdF could be saved says Moodys.

For example if the atom power plants would be put into a payed cold reserve (capacity payments):

https://www.moodys.com/research/Moodys-downgrades-EDFs-ratings-to-A3P-2-stable-outlook–PR_355702

Moodys knows that RTE – the grid utility – is owned by EdF. So Peter would rob Paul again.

Not the power price would increase then but the grid charge ……

Otherwise their Mafia connections are the last straw.

” WHAT COULD CHANGE THE RATING UP/DOWN

Upward rating pressure is unlikely in the medium term given the limited headroom expected against the ratio guidance for the A3 rating. The ratings could nevertheless be upgraded provided that EDF demonstrates credit metrics in excess of the guidance above on a permanent basis; most likely as a result of the introduction of regulatory measures such as carbon price floor or capacity payments that would support the group’s business model.

The ratings could be downgraded if (1) credit metrics fall below Moody’s guidance for the A3 rating; or (2) EDF were to be significantly exposed to AREVA NP’s liabilities. In addition, downward rating pressure could arise if a change in the group’s relationship with the government were to cause Moody’s to remove the uplift for government support, or if there were to be a significant downgrade of France’s government rating. ”

12 reactor pressure vessels are cracked:

http://www.reuters.com/article/france-edf-nuclearpower-idUSL8N1C45IY

Interesting the “made in Japan” factor: last year the EdF chieftain distributed public soothers, saying the RPVs of Olkiluoto and Taishan are not made by Creusot … haha:)

Yesterday we watched a record price jump on the power exchange EEX for 2017 futures in France and Germany.

As the Times and BBC report the Mafia has got the £1.2 million job to “advise” the British government on the price of atom power:

http://www.thetimes.co.uk/edition/business/hinkley-firm-in-conflict-row-over-links-to-french-m8mzv0cxt

http://www.bbc.com/news/uk-england-somerset-38031448

As I understand the law firms mentioned by the BBC employ politicians.

[…] at Flamanville goes into operation. It is unclear what happen if the EPR reactor turns out to be impossible to finish. France aims to reduce its reliance on nuclear power from 75% of demand to 50% by […]

[…] Flamanville goes into operation. It is unclear what will happen if the EPR reactor turns out to be impossible to finish. France aims to reduce its reliance on nuclear power from 75% of demand to 50% by […]

[…] Flamanville goes into operation. It is unclear what will happen if the EPR reactor turns out to be impossible to finish. France aims to reduce its reliance on nuclear power from 75% of demand to 50% by […]

[…] is, thus, not surprising that the subsidies granted for the controversial Hinkley Point C project in England have found a base for legitimacy in Euratom. The much contested state aid worth several […]