The British government seems willing to pay high prices not only for new nuclear, but also for renewables. Given the country’s amazing wind conditions, it does indeed seem that the British are overpaying for wind power in particular. Craig Morris thinks he knows why.

Better conditions – and higher prices: The UK overpays wind power. (Photo by Christian Reimer, CC BY-SA 2.0)

Remember our chart on the proposed strike price for power from a new nuclear reactor at Hinkley?

One main point of criticism was that we compared the price of British nuclear to German solar + wind. “Why didn’t you compare Hinkley to the higher rates paid for solar and wind in the UK?” several readers asked.

The answer was quite simple: German feed-in tariffs actually reflect the cost of solar and onshore wind (but not offshore, which I will come back to). We know roughly what the return is on PV in Germany (it’s very small right now), and we know what the general return has been on wind power as well. In a recent post, I also explained the difference that capacity factors make. The same wind turbine (or solar array) under much more favorable conditions will produce more electricity. The fuel (the wind or the sunlight) is free, so the electricity gets cheaper as the conditions (capacity factors) improve.

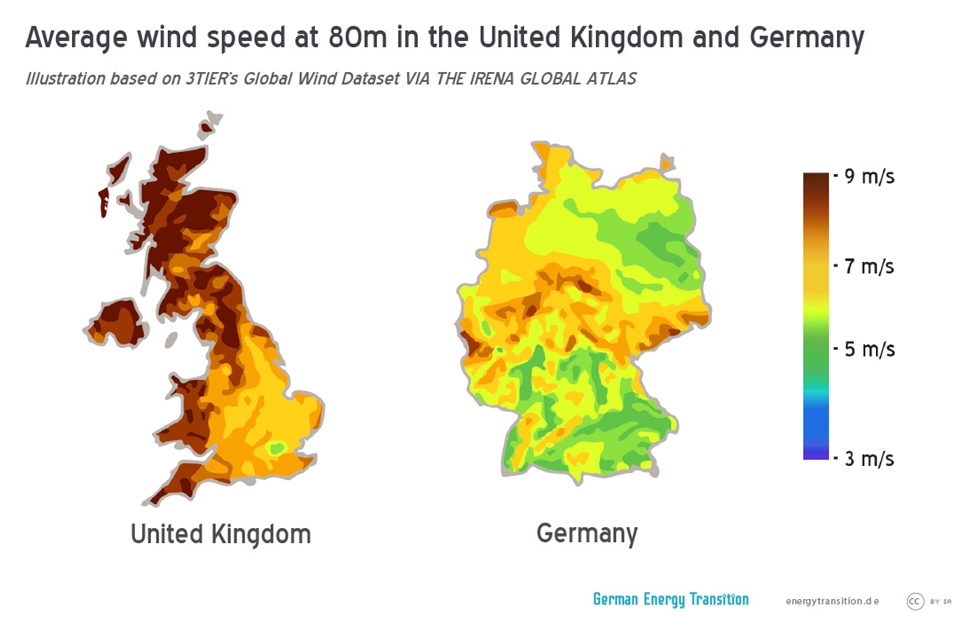

For the sake of brevity, let’s just focus on wind power here. The chart below gives us an idea of how much better wind conditions are in the UK relative to Germany.

Anyone who develops wind farms will point out that the resolution here is inadequate. In particular, it looks like the best German wind conditions are in the middle of the country, whereas they are actually along the northwestern coast – but no matter, we are not trying to site wind farms based on this data, but merely understand the potential for low costs.

Anyone who develops wind farms will point out that the resolution here is inadequate. In particular, it looks like the best German wind conditions are in the middle of the country, whereas they are actually along the northwestern coast – but no matter, we are not trying to site wind farms based on this data, but merely understand the potential for low costs.

The chart suggests that large parts of the UK have wind speeds of 9 m/s on average, whereas large parts of Germany are closer to 5 m/s. A layperson might conclude that there is roughly twice as much wind in the UK as in Germany, but the calculation is more complex. The Iowa Energy Center has a nice presentation explaining how the energy in wind is a function of the cube – or, as wind power guru Paul Gipe puts it, double the wind velocity, and power increases eight times.

The calculation is even messier in practice because, for instance, wind turbines may have to turn their blades out of the wind during storms, thereby producing no power, etc. As the Iowa Energy Center puts it, “the actual power increase in a wind turbine is more linear than is predicted by the equation.” But overall, we can assume that the best UK sites onshore produce at least twice as much wind power per turbine as in Germany (again, see my discussion of a global comparison from IRENA). More importantly, on average the UK’s wind turbine fleet has a capacity factor of 28 percent, easily 50% more productive than Germany’s.

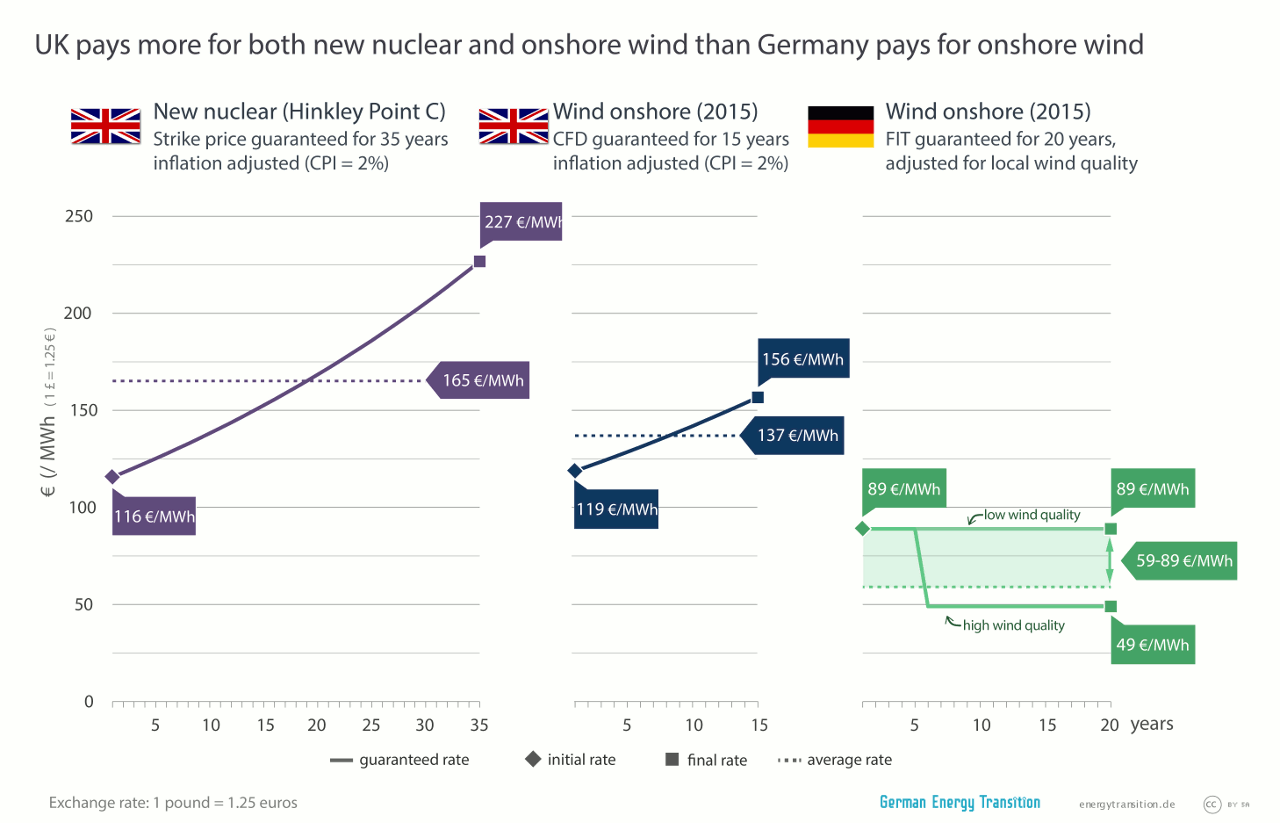

We would therefore expect wind power to be substantially cheaper than in Germany. It isn’t. German onshore wind farms receive 8.9 cents per kilowatt-hour for the first five years, and that number drops to 4.9 cents at some point after that. The purpose is to avoid windfall profits; turbines in less windy areas need the higher rates longer than those in fantastic sites.

The actual cost of wind power in Germany is thus best expressed as a range. Likewise, it is not easy to give an average price for onshore wind in the UK, largely because the prices are adjusted for inflation. Given those caveats, this is what we came up with:

The data on which the chart is based are already a few months old, and the exchange rate between the pound and the euro has worsened from 1.25 to 1.39 euros (in mid-April). This difference would make the prices in the UK seem even higher – but let’s stick with what we have. The chart is already quite busy. (Also, keep in mind that €116 per MWh = 11.6 cents per kWh).

The UK prices were taken from DECC (PDF). For this year, 95 pounds (119 euros in our chart) is paid for wind power onshore. “CPI” indicates the Consumer Price Index, meaning that these rates actually go up over time relative to inflation (which German feed-in tariffs do not). Note as well that the time frames are different: the price guarantees will hold for 35 years for nuclear, compared to only 15 years for onshore wind in the UK. In contrast, German feed-in tariffs apply for 20 years.

Regardless of the details, the main takeaway is hopefully clear. You could slide that green section representing the range of onshore wind power prices in Germany under everything in the UK without any overlapping – and that was even before the weak euro made UK prices even higher.

Which brings us back to the question in the title of this article: how does the UK make renewables so expensive? British energy expert Dave Toke put it well in December: “in Germany the independent renewables sector runs the RE industry. There the political interest group pressure is almost 180 per cent different to the UK. In this country it is the Big Six, give or take a couple of other multinational energy corporations, who will influence contractual terms.” Big firms do not like small returns. Furthermore, by making renewables seem more expensive, they reduce public interest in these technologies, which they do not want to implement that quickly anyway (wind power conflicts with conventional assets).

The situation is even worse when it comes to offshore wind (not shown in any of our charts), where profit margins are quite excessive in Germany as well (the German offshore sector is entirely big business). Over at Energy Post, Mike Parr studied the offshore data from Denmark, where he found returns exceeding 20 percent. Nearly two years after I called for German offshore wind rates to be reduced, Parr now says the same can be done in Denmark and the UK.

In a nutshell, the UK overpays wind power in particular because big utilities with big expectations for returns run the show, whereas new players and communities have largely driven the German wind sector up to now – and they were more interested in getting the transition moving than in increasing their personal profits. As Toke argues, British policy mechanisms for wind power focus on incentivizing investments from corporations, not communities. One conclusion would be that shrinking the role of those with big profit expectations will help keep the energy transition affordable.

Craig Morris (@PPchef) is the lead author of German Energy Transition. He directs Petite Planète and writes every workday for Renewables International. Below, we also provide the new charts comparing German and UK onshore wind prices in a single info graphic. All graphics were created with input from Thomas Gerke (@Zoido4Design).

Great article. Thank you Craig

We also could say that the British system is corrupted by vested interests, that Cameron (and Blair) were poodles of nuclear and fossil industries, but not so the Scottish National Party.

Similar sitation in the US where only big companies get the PTC (production tax credit). To make energy a citizen’s affair would also mean to make clean power cheaper. Why are democratic institutions in the US and UK so weak that a fair market access for independent power producers and community based power seems so weak? A huge treasure to be lifted by open markets and open grid access and better regulations.

Rudolf, Switzerland

Interesting article, but some of the reasoning seems a bit shaky in the light of the CfD auctions in February (which happened after David Toke’s blog was written).

The £95/€119 figure is the maximum CfD. In fact the auction cleared at £79-83. Most of the onshore wind CfDs went to non-Big 6 generators. You can see this in the auction statistics from DECC. https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/407059/Contracts_for_Difference_-_Auction_Results_-_Official_Statistics.pdf

Finally, I may have this wrong, but isn’t the German FiT a flat fee that a generator receives, as well as the revenue they will get for selling the electricity generated? So an onshore wind farm will receive €89/MWh from the FiT plus the wholesale price of electricity.

If that is the case then the comparison falls down, as the GB system is a contract for difference. The subsidy to the wind farm is the difference between the auction price (£79-83/MWh) and the wholesale price (typically £40-50/MWh in GB).

To Adam:

Feed-in tariffs in Germany were the only payments that generators received as compensation for their electricity (before the shift to obligatory market premiums, which are essentially similar). In the case of wind, they amount to 4.95 Eurocent/kWh. But during the first five years – and longer if an installation produces less electricity than the law’s reference installation – the compensation amounts to 8.9 Eurocent. So it is appropriate to speak of a range of returns, resulting from the varying mix of the two compensation figures. See § 49 of EEG 2014. For new installations from 2016 onwards, compensation will be lowered in steps for each quarter’s new turbines, The reduction depends on how far the volume of new build exceeds the target of 2.4 to 2.6 GW per year and can reach the figure of 1.2% every three months. See §29 EEG 2014.

@Adam “seems a bit shaky … In fact the auction cleared at £79-83”

Which at today’s exchange rate is a CfD of EUR 110-115. Given the better wind resource, I would expect the UK’s CfDs to be closer to the German high wind FIT of EUR49.

Why are the UK’s CfDs double this number?

Thanks for the article.

It is much longer and better explaining than the one published at

http://www.renewablesinternational.net/new-community-wind-farm-in-uk-is-largest-ever/150/435/87583/

A different head line of course.

It was the exclusion of atomic power which made German RE-costs cheaper, investors see better chances in marketing their power even with low guaranteed returns when they do not have to compete against an all-mighty industry.

An interesting phenomena is to be watched in Scandinavia now:

Since Sweden has decided to give-up on new builds of atomic power plants and tightening safety regulations on the existing ones (at least two will be pushed out pre-maturely from the playing field) Norway fears for lower results selling hydro power via the Nordpool power exchange:

http://www.tu.no/kraft/2015/05/11/svenskenes-vindkraft-smutthull-kan-bli-staende

(use the translation engine)

The lower volume sales expected for the Norwegian utility Statkraft (because more RE will be deployed by Sweden to make up for the national power market) will increase the consumer power prices in Norway:

profits made by Statkraft with exporting power are used to pay for to import power when needed.

But international help is at hand, they will build a cable between the UK and Norway and another one to Germany:

http://www2.nationalgrid.com/About-us/European-business-development/Interconnectors/norway/

http://www.tennet.eu/nl/grid-projects/international-projects/nordlink.html

This could (!) push down the power prices in the UK and will help to stabilize them in Norway:

http://utilityweek.co.uk/news/more-power-links-could-cut-energy-bills-by-1bn-says-national-grid/1028642#.VVtQPFKJjct

The UK has already the highest power prices on Europe’s exchange markets, pure luxury compared to Nordpool prices and twice as expensive now as in Germany:

http://www.apxgroup.com/market-results/apx-power-nl/dashboard/

(scroll down to ” CWE and UK Power Day Ahead Prices “)

Imagine the atomic waste costs of the UK now being added to the power prices (the old saving account has been emptied already!) and a few more Hinkley Points – all the cables in the world would not make the UK power prices competitive. Despite having splendid wind and tidal resources.

The average power price in the UK would always be to expensive to export power to earn money for importing power when needed, see the sample from Norway linked above.

The UK power market will be a financial burden to society as long as it is designed as it is.There will never be a clean import-export balance sheet.

By this market mechanism which the mafia has introduced the UK consumer pays for other people lecky bill – using tabloid language.

Atomic power has no place in a competitive environment.

As long as atomic power is a pace maker for national power prices the national power has no chance on the international exchange.

Hello Craig,

I know your article is intended as a thoughtful addition to the economics of renewables but by using Levelized Cost of Energy your results are deceptive and incorrect. As proposed by the US DOE-EIA, a Levelized Avoided Cost of Energy must be computed to include all the additional costs associated with renewables, including more connections, intermittency, reduced efficiency for dispatchable generation, etc. In sum, you should revisit your methods.

Best regards,

Lawrence

DR L HAAR

… [Trackback]

[…] Read More Infos here: energytransition.de/2015/04/why-is-uk-wind-power-so-expensive/ […]