Energy industry professionals and commentators agree that industrial-scale battery storage will play a pivotal role in future energy systems. But will the battery business take off, just like solar PV, or will batteries remain a great opportunity which will never materialize? Jan Ondřich takes a look.

A Tesla gigafactory manufactures batteries that power electric vehicles (Photo by Planet Labs Inc, CC BY-SA 4.0)

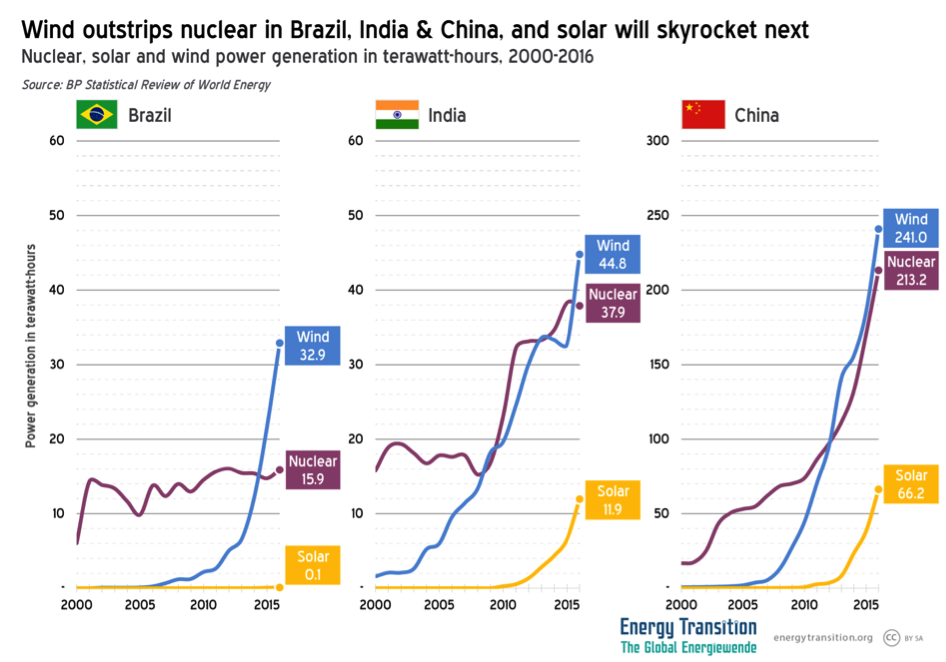

Optimists point out to great success of solar PV in cutting costs down which enabled global growth in PV installations. Over the years, solar energy has gone from being a costly environmental choice to making economic sense.

Indeed, there are many similarities between solar PV and battery storage. Both battery and PV projects are easy, cheap, and quick to develop. Neither battery nor PV projects require complicated lengthy and expensive environment assessments. Entry barriers into both battery and PV project development are thus minimal.

There is however one fundamental difference between the two technologies in terms of their commercial roll-out which makes this simple analogy problematic.

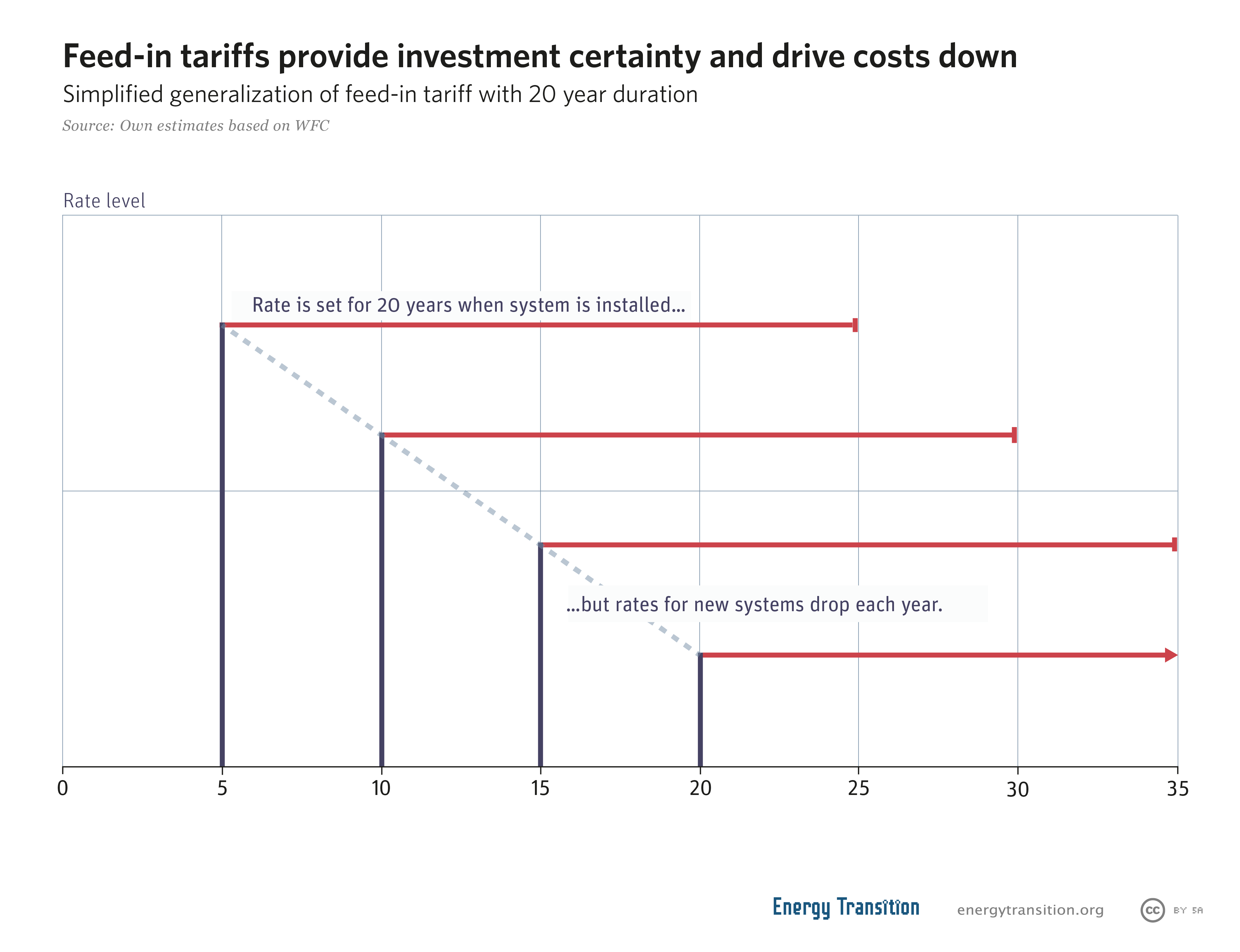

The key issue inhibiting faster roll-out out of battery storage is lack of a market design that would reduce reliance of returns on volatility of electricity prices. Solar PV industry could benefit from feed-in tariff schemes which provided motivation to developers to build early to lock in higher tariffs as most of the schemes included decreasing tariffs over time for new installations.

The fact that regulated tariffs were dropping at a slower pace than solar PV prices led to developers piling into the business. This rush into the solar business then created further efficiencies in both production, installation and financing of plants which led to further price decreases. As a result, PV solar prices are on par with wholesale power prices in many countries with good solar irradiation.

On the contrary, batteries do not benefit from any scheme which would allow developers to lock in returns over a certain payback period. Inevitably the battery business turns into a race to zero as costs of batteries are coming down.

Unlike in the PV solar business, in which developers were motivated to build early as tariffs were decreasing, in the battery business it pays off to be the last one to be connected to the grid. The later a developer orders a battery the more they benefit from lower investment costs. They can then bid for better prices than those who had installed more expensive systems earlier.

The fact that industrial-scale battery projects are fully exposed to changing market prices acts as another barrier to further development of battery projects. Investors who are able to accept full merchant risk exposure require corresponding returns on their investment in exchange for shouldering such risk, which makes capital-intensive battery projects uneconomical. Banks and infrastructure funds which can provide reasonably priced capital to make battery projects viable cannot invest or lend to projects with high degree of merchant risk. As a result, many technologically sound projects are left unfunded. The European Battery Alliance, funded by the European Commission, is one effort to increase investment.

One possible way of unlocking investment into battery storage would be to introduce long-term capacity contracts. This would eliminate merchant risk exposure and attract project finance and reasonable-priced long-term equity into the projects.

Another possible solution would be to treat batteries as grid-related infrastructure rather than a kind of power generation. Under this scenario, transmission system operators (TSOs) and

distribution system operators (DSOs) could tender battery storage capacity they need to balance their grids. The cost of such balancing would then be passed on to consumers via regulated grid tariffs.

In any case, battery storage will need the right market design to replicate the success of the solar industry.

This is special pleading. The need for battery storage is systemically hyped by battery promoters, brushing under he carpet the many and usually cheaper alternatives: overbuild, demand response, trade, and pumped storage. What is the case for subsidising battery deployment as a critical technology? Utilities have an obligation of supply to consumers. If they need batteries to meet this, they will buy them. If they can find a cheaper way without batteries, that’s fine too.

Besides, battery technology is being driven forward rapidly by the market in which they are essential and subsidies absolutely correct: electric vehicles. Car battery companies thrive, grid battery companies go bust. Battery technology for the grid will solve itself.

James is right, the volume boost that allowed lower prices for PV came from direct subsidies. The volume boost for batteries is coming from

1, transport demand

2. Low FITs in some markets and or high peak demand charges already making battery storage economical, eg in South Australia

3. Avoiding curtailment and market opportunities in FCAS from wind and solar farms.

4. Grid reinforcement to cut down on spinning reserves and oversized transmission assetts

At this time demand is running ahead of supply so there is no real need for subsidies to get things moving and at this time it is far cheaper to subsidise thermal storage, demand response and in some cases pumped hydro

[…] Les mer om batterilagring i denne artikkelen på nettstedet Energy Transition. […]