A new piece by German economics daily Handelsblatt claims to shed light on the “dark side” of “Germany’s massive push into renewable energy.” It comes across as a strained attempt to find a cloud hidden behind a giant silver lining. But despite covering the topic quite broadly (in around 2,000 words), the article is nonetheless unbalanced: the examples given are unconvincing; the gaps, glaring. By Craig Morris.

Many people in Germany regularly demonstrate for the Energiewende and more renewables. A new Handelsblatt-article is now giving the impression, the Energiewende is killing industries. (Photo by Molgreen, modified, CC BY-SA 3.0)

Handelsblatt acts as though Germany’s Big Four utilities were doing fine until German energy policy screwed things up for them. But first (and regardless of Germany’s energy policy), the utilities made some serious strategic mistakes, including on foreign markets:

- E.on bit off more than it could chew throughout the 2000s. It expanded to the UK, the US, Spain, Italy, France, the Czech Republic, Slovakia, Hungary, Bulgaria, and Russia. By the time it stepped away from a major US subsidiary in 2010, E.on’s net debt had grown from 6 billion euros in 2006 to 46 billion.

- Likewise, RWE also invested 9.3 billion in Dutch energy firm Essent, only to write down 3 billion of it by 2014. RWE’s other major international takeovers include American Water Works, the largest water supplier in the US (PDF in German). Purchased for USD 46 per share in 2001, American Water Works was sold in 2009 at a mere USD 21.63 per share.

- Vattenfall took over Nuon Energy of the Netherlands in 2009 for 8.5 billion euros. By 2015, the firm had been forced to write down roughly 7 billion of that investment. Its German coal assets now also seem to be worth little because – surprise, surprise – the Energiewende will mean lower coal consumption.

- Finally, the story of EnBW’s scandal from 2010 is so juicy, it has its own Wikipedia entry (in German): a government takeover without parliamentary oversight at an excessively high price, with the entire procedure ruled unconstitutional by a German court; the matter continues to concern courts today (in German).

Handelsblatt fails to mention that the years of great utility profitability (around 2005-2012) were, perversely, partly the result of windfall profits from emissions trading. These utilities and big industry managed to get governments to design emissions trading so that polluters would profit, not be punished.

“The big utilities, all of us, received a lot of carbon certificates for free at the launch of the EU’s emissions trading scheme. The trading price was included in power prices, which earned us a lot of money. There was nothing wrong about that, but it did not have much to do with our performance.”

– E.on CEO Johannes Teyssen in January (in German)

In addition, profits increased in those years because the Big Four fired people. For instance, in 2012, Germany’s Big Four posted a collective profit of just over 16 billion euros, whereas employing the fourth of the people laid off in the previous decade would have only increased expenses by just under 4.3 billion euros (see p. 69 of this PDF in German). Keep those figures in mind when you hear about these firms firing people because of the Energiewende.

As we explained in German Coal Conundrum in 2014, the Big Four underestimated renewables until recently – but not all utilities did. Last year, I compared the fate of two German municipal utilities; the one that understood long ago what the energy transition meant is doing fine.

The examples Handelsblatt gives from the manufacturing sector are no better

Handelsblatt does not mention low wholesale prices, which particularly benefit the growing number of industrial firms that are 99 percent exempt from the renewable energy surcharge. Businesses are often exempt from other power charges, such as the grid fee, and can pass on some taxes to consumers.

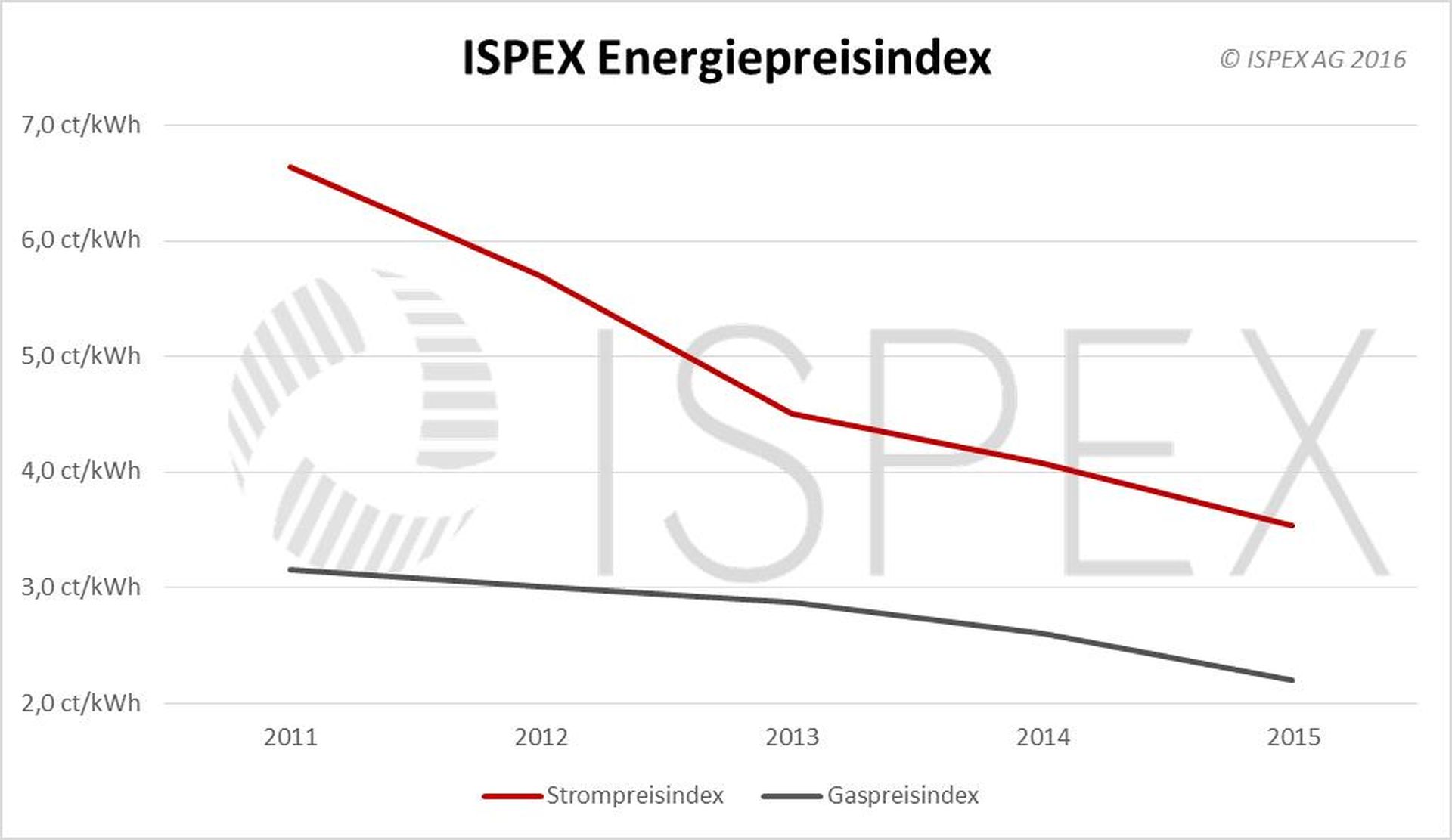

The ISPEX Energy Price Index (here, from February) shows the prices for wholesale electricity (red line) and natural gas (gray line) without any taxes or levies. The latter can add up to nine cents to the price, however. The most important factor is therefore whether a company is exempt from some of these surcharges and can pass on others.

The specific examples of companies that the Energiewende is allegedly killing are unconvincing. Germany’s SGL Carbon, for instance, is reducing its investments not because of German energy policy, but because of “surplus capacity on the market for graphite electrodes, which has been in crisis mode for years,” one investor website put it in November (in German). The firm is a supplier for BMW’s i3 electric car, which is made in Germany at a plant where four wind turbines have been installed. (Apparently, some German companies are using the Energiewende to make their own energy, which Handelsblatt fails to mention.) Granted, SGL built a new carbon fiber production facility in the US because electricity prices were lower, but so were labor costs; as I previously explained, the full story of BMW importing carbon fiber from SGL in the US puts the United States in the somewhat unflattering role of a supplier of raw materials, with the real expertise remaining in Germany. Note as well that both Mercedes and BMW are now investing billions at home, which the journalists do not mention.

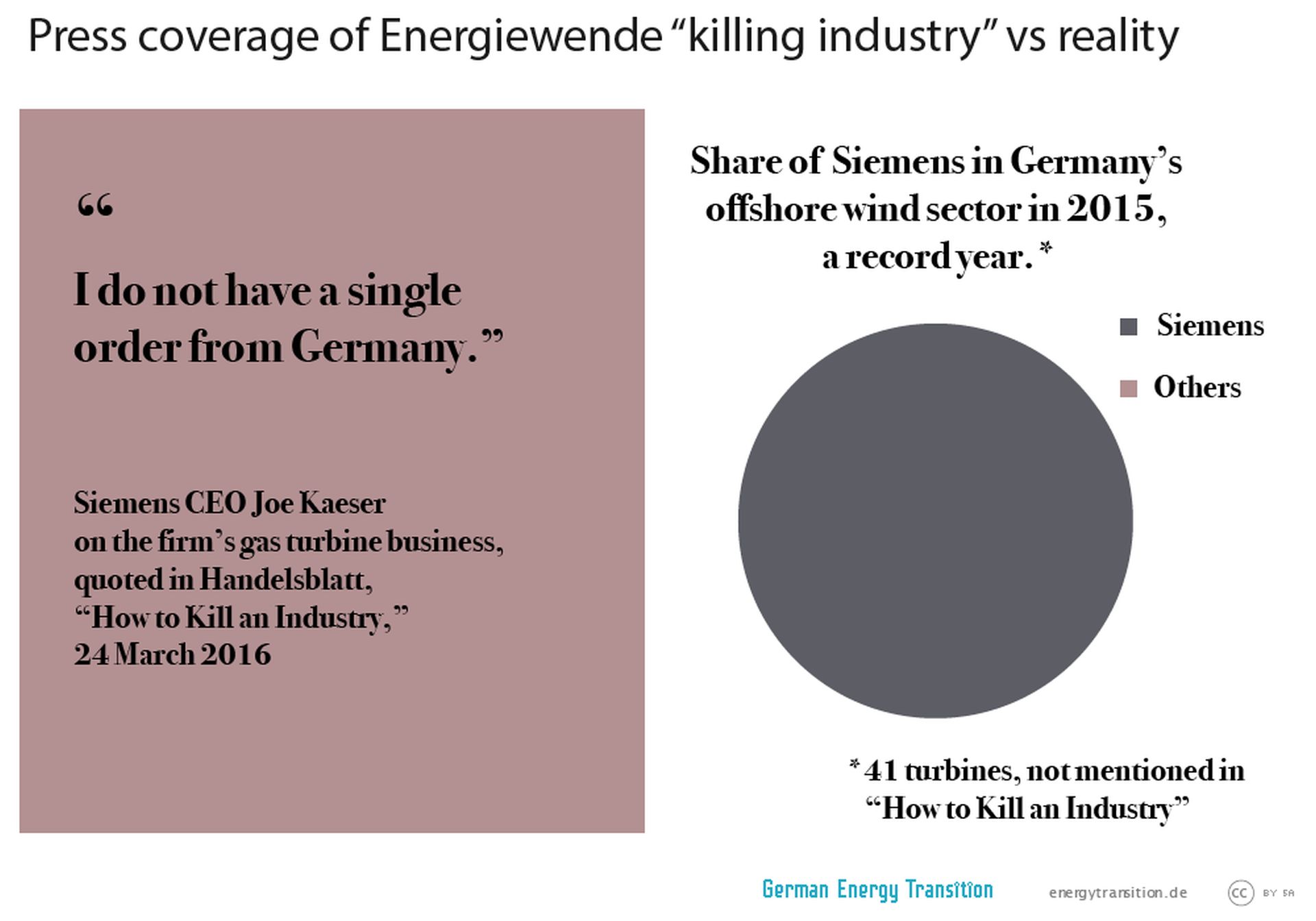

And poor Siemens! The company bet on combined-cycle gas turbines – and lost all across Europe. Strangely, Handelsblatt does not highlight this outcome as a failure of corporate management to see that gas would be the big loser; instead, the journalists seem to think that the Energiewende should promote the least flexible type of natural gas turbine – as though the very purpose of Germany’s energy transition were not to leave fossil fuels in the ground. The firm’s complete domination of the German offshore wind sector in its record year of 2015 oddly does not warrant any mention in the Handelsblatt article.

Apparently, the journalists regret that Siemens can no longer build nuclear plants in Germany (construction of the last one was finished in 1989, none have been ordered since 1982, two decades before the nuclear phaseout first became national policy), adding that the German engineering giant sold its nuclear division to France’s Areva after Chancellor Merkel’s phaseout. There is no mention of Areva’s failure to sell a single nuclear reactor since 2007. In reality, Siemens can consider itself lucky to no longer be in the nuclear reactor business.

Handelsblatt points out that Siemens now focuses on the oil and gas sector largely in the US. In 2014, the engineering firm sold its holdings in a long-standing joint venture for household appliances – where it could have contributed to efficiency improvements – and used the liquidity to invest in burning more fossil fuels (report in German). Handelsblatt does not say how these investments are faring with oil prices now so low that a slew of shale companies are either in or nearing bankruptcy. But rest assured that, however these firms fare, it’s the Energiewende’s fault.

BASF is another (unconvincing) case in point. Handelsblatt points out that the firm invested 1 billion USD – “its largest single investment ever” – in a US facility recently without mentioning the recent nearly 10 billion euros in investments at headquarters in Germany (report in German). Nor does Handelsblatt comment on the German chemical giant’s current dilemma: low oil prices, one reason why the firm’s share price has fallen by around two thirds over the past 12 months. Instead, the journalists speak of industrial power prices, which are allegedly twice as high in Germany (note: the comparison is far more complicated). In reality, “BASF” followed by “German electricity” is a non sequitur; the company does not purchase any electricity from the German grid; it has its own gas turbine fired with natural gas from a 100% subsidiary. German power prices are irrelevant for BASF.

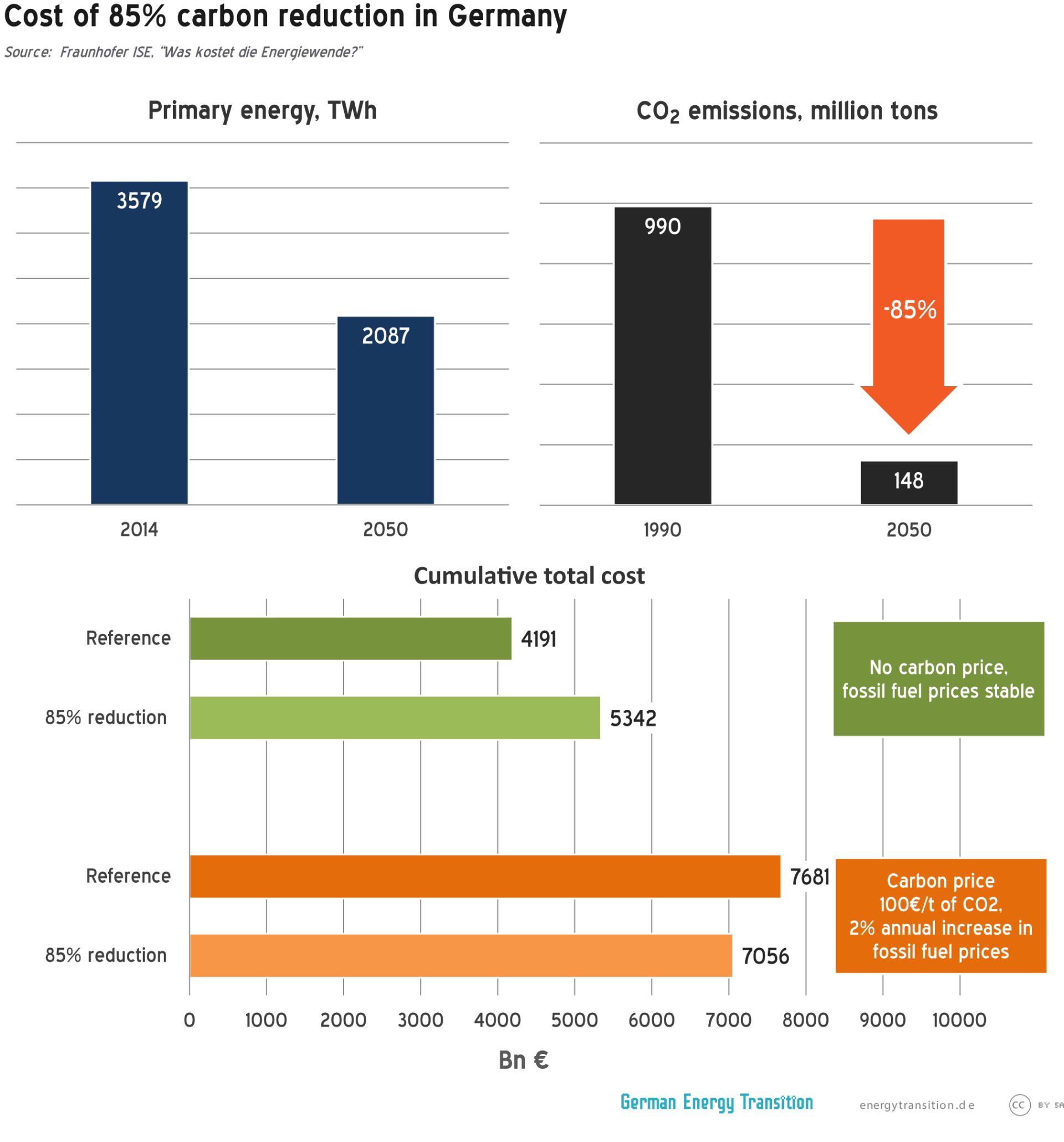

The main thing to like about the Handelsblatt article is its tenacious fidelity to its angle. It speaks of 350,000 German households having their power cut off because they cannot afford their bills… without mentioning that the situation is generally worse in other countries, that most of these households in Germany have power restored in a few days (report in German), and that German power bills are not higher than those in the US. The journalists even mention Fraunhofer ISE’s estimate of 1.15 trillion euros for the Energiewende by 2050… without pointing out the study’s main finding: the price will probably be higher without an energy transition.

Finally, the journalists want to have their cake and eat it, too. They complain that Germany is not bringing down carbon emissions fast enough, but then add (quoting a labor union spokesperson) that “Germany is responsible for 2.7 percent of global carbon emissions, so we’re fighting over nanograms here while in China, they’re building coal power stations every other week.” The journalists should make up their mind: either German carbon emissions are a problem or not. (Note: China is currently shutting down coal mines and producing less coal power.)

Handelsblatt frames the Energiewende as “killing industry,” and that framing rules out mentioning numerous facts. Future Energiewende-bashing articles from the economics daily will hardly be able to afford to highlight the record-low unemployment rate in Germany along with the government’s repeated success in producing a balanced budget (a Three-Peat!) Indeed, the German economy is doing so well that the country posted a budget surplus of 12.1 billion euros in 2015, easily enough to cover the unexpected 6 billion needed for the record influx of around 1 million refugees that year.

Overall, some things in the Energiewende are going well; others, less so. But we have only just begun: the Energiewende is a generational project, with 35 years left until 2050. A lot of things can still go wrong. Handelsblatt marvels at the German public’s support for the energy transition but closes the piece on the Energiewende’s dark side with an ominous foreboding: “As the costs and stresses on the German economy mount, however, things may not always stay so quiet.” Handelsblatt, is that a promise or a threat?

Craig Morris (@PPchef) is the lead author of German Energy Transition. He directs Petite Planète and writes every workday for Renewables International.

Perhaps the Handlesbladder article was satirical?

Was it written on April 1st – maybe it was a joke?

It would be good if the jounralists who wrote the article responded to you points – maybe they are too shy?

Not a joke. Many of these people are convinced that we are strangling the geese that lay the golden eggs. Unfortunately, their solution seems often to be a return to business as usual 10 or 20 years ago. I would like to see from them some positive suggestions for an improved Energiewende. For example, the merit order squeeze on wholesale electric rates has been immensely and successfully disruptive (leading to much of the unhappiness evidenced in the article) but does not of itself guide the design and financing of the new systems that we will need. Suggestions?

What a tremendous research job, Craig. Fantastic work. It would indeed be interesting to see a serious response in this column from the Handelsblatt journalists. If you have made just one of them question their beliefs, your hard work was woth it

Yeah, a fools-day article as Mike Parr already pointed out.

Here a fresh one from today showing how atom power plants save the general industry:

First the big subsidies for Hinkley Point and the cuts in the RE sector and then the soother for the home industry in January

http://www.gmb.org.uk/newsroom/steel-at-hinkley-point

followed today by the revelations that the steel is of dubious quality:

http://www.telegraph.co.uk/news/2016/04/07/serious-fraud-office-launches-criminal-inquiry-into-tata-steel/

Sure it is the Energiewende killing the dead men walking, it must be so.

The best response to the article was the Siemens infographic. Brilliant 🙂

Just a small comment. RWE, Vattenfall, Eon, and EnBW are no longer utilities in the traditional sense, i.e. vertically companies owning power plants, transmission and distribution grids and having a monopoly on power production and retail. Nowadays they are mainly power producing companies, although they still own some local distribution grids, and they have to compete with other companies both on the wholesale power market as well as in retail. So “utility” is a bit of a outdated concept in the European context.

In my opinion, the journalists did their job (honestly or not) which consists of pointing out problems. But your article Craig is really interesting and should be written. It will certainly contribute to shaking politicians and decision makers convictions about energiwende. Thank you.