Over at Renew Economy, our colleague Giles Parkinson reviews a study by HSBC showing that “generators are to be the biggest losers” in the energy transition currently taking place worldwide. Today, Craig Morris talks about what that looks like in Germany.

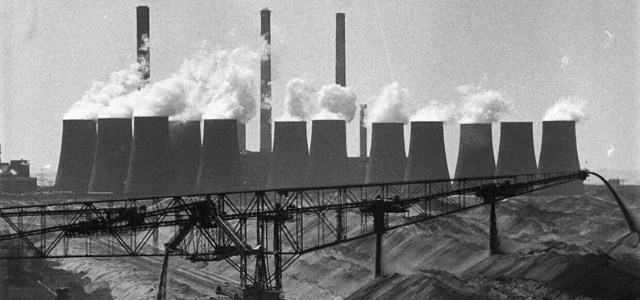

Photo of better days in the early 90s – conventional German power plants have increasing difficulties to stay profitable. (Photo by Rainer Weisflog, Bundesarchiv, Bild 183-1990-0629-013, CC-BY-SA)

Although he unfortunately does not provide a link back to the study (which may not be online), Parkinson points out that power storage represents a great challenge to power generators. And the study also apparently believes Germany is a good example: “The German energy transition encourages the retail consumer to become a pro-sumer,” essentially not only a consumer, but also a producer.

This is certainly true, which is why we use the term ourselves. And yet, we read in a recent study that the Energiewende that will not even need storage for the foreseeable future. And those findings were not new; Germany’s Fraunhofer ISE came to a similar conclusion last winter.

To solve this apparent contradiction, we need to talk about what is being stored and at what price. In Germany, the market for storage is currently largely dominated by homeowner PV + battery systems. This market segment is wrong-headed, however; it attempts to optimize the smallest unit in the power supply system – individual households. Storage is expensive and should be avoided if possible. It should also be based on what the grid needs, not what a particular homeowner needs.

Nonetheless, this market is not very big. Go to the Intersolar tradeshow, and you will see that the focus in the PV sector is now on storage systems. There is a lot of hope – and a lot of hype. Less is being built then you might expect. The German PV market continues to shrink even with the cost of new solar power at less than half the retail rate. Apparently, storage (and, admittedly, the new surcharge on direct consumption) still makes PV quite expensive relative to the retail rate. That may change in a few years – the new buzzword is “storage parity” – but we are not there yet.

Nonetheless, conventional generators are in trouble already, as HSBC describes. Wholesale prices on the exchange were down from around 4.5 cents in August 2013 to 3.5 cents in August 2014. There is no money to be made generating power anymore.

Or is there? As fluctuating wind and solar power grow, there will be more need for backup power, and battery storage joined the market for operating reserves last month. But storage for power provision pays for itself less and less, with pumped storage facilities in Germany not making any money now because solar in particular shrinks the difference between peak and base prices. The money is thus no longer in power purchase agreements made in advance, but in quick reactions; hence the growth in intraday trading.

Grid expert Thorsten Zoerner also points out the strange uptick in unplanned outages of conventional plants (blog post in German). Rather than being ready to produce 200 GWh of electricity per day, German hard coal plants were only prepared to generate 115.4 GWh at the beginning of October because so much capacity had malfunctioned in some way.

What’s happening? Coal plant operators may be getting lazy and trying to save money on maintenance due to price pressure. Another possible explanation is unlikely: operators might be intentionally taking down a plant so they can ramp up another one down the road. The same amount of electricity is provided, but it might now be paid for at a higher price because the provision of this power is on a different market now – the one for unplanned electricity.

The second scenario is unlikely for two reasons. First, it constitutes market manipulation, and firms could get caught. Second, shutting down a plant and cold-starting it again later is not free either. Coal plants, for instance, consume quite a lot of oil when heating up to operating temperature. Gaming the system in this way would not be easily profitable, but there is potential. Whatever the case, profitability is moving away from the normal power generation and into ancillary services. This winter, we may also finally get the details about the proposal to have a capacity market in Germany – yet another new market segment to ensure profitability.

One thing is already clear, however, and here I quote Zoerner: “Wind and solar can be predicted a day ahead with 98 percent accuracy. The unscheduled downtime of the coal and natural gas plants described here, however, can usually only be detected a minute before they happen.”

Craig Morris (@PPchef) is the lead author of German Energy Transition. He directs Petite Planète and writes every workday for Renewables International.