Is Germany building new coal plants to replace nuclear despite the country’s green ambitions? Many observers conclude so. But an in-depth look reveals that the growth of renewables has more than replaced nuclear power over the past decade. Coal is not making a comeback in Germany. However, German policymakers should reduce the country’s coal dependency sooner than scheduled.

Photo by Craig Morris

by Arne Jungjohann and Craig Morris

Germany has drawn international attention for its energy policies in recent years. The term Energiewende – the country’s transition away from nuclear power to renewables with lower energy consumption – is now commonly used in English.

The focus, however, has recently shifted to the role of coal in Germany. Over the last two years, media both in Germany and abroad have spoken of a possible “glowing future” for coal power and a “coal comeback” in Germany. From the decision to phase out nuclear power, observers conclude “that domestically produced lignite… is filling the gap”. Indeed, statements made by German politicians over the past decade also suggest that these coal plants were intentionally built to replace nuclear plants.

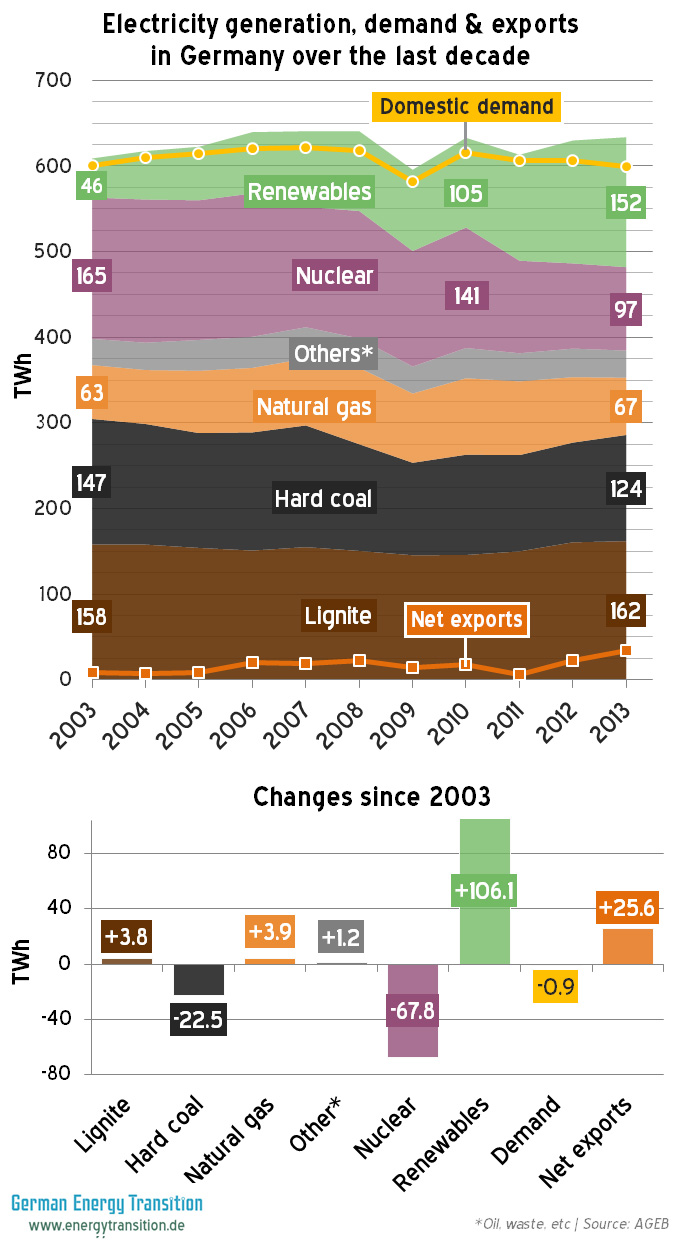

Here, we have the coal conundrum of the Energiewende: is Germany building new coal plants to replace nuclear despite the country’s green ambitions? This concern is based largely on a temporary uptick in coal power in 2012/13 (due to a cold winter and greater power exports) and on a round of new coal plants currently going online.

But an in-depth look reveals that coal is not making a comeback in Germany. The current addition of new coal projects in Germany is a one-off phenomenon. Recent projects started in 2005-2007 as part of an overall trend in Europe caused by low carbon prices and upcoming stricter pollution standards for coal plants. New coal plants in Germany are unrelated to the nuclear phaseout of 2011 after the Fukushima accident.

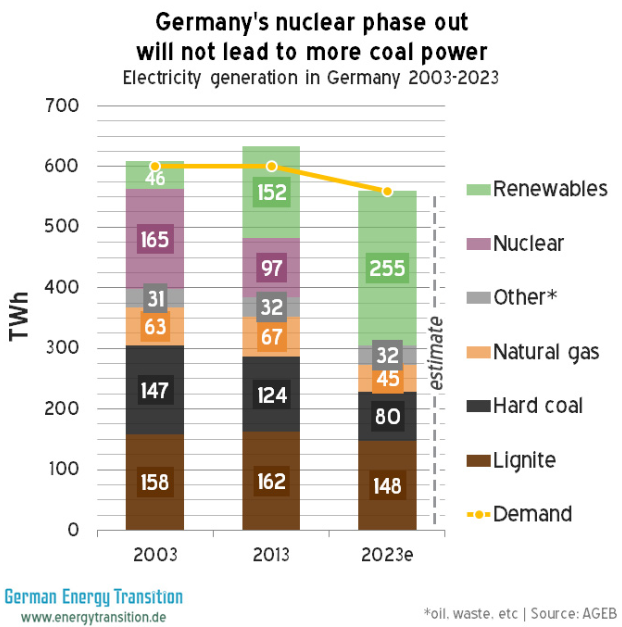

Instead, renewables have more than offset the shutdown of nuclear plants. Since 2003 (the start of the initial nuclear phaseout), electricity from nuclear dropped by 68 TWh. Over the same time, renewable electricity increased by 106 TWh. During the nuclear phaseout (completed by 2023), this trend can be expected to continue, though the specific outcome depends on the actual growth of renewables and demand for power in Germany and neighboring countries.

The crunch is on hard coal. Conventional power plants serve a shrinking “residual load” – a crucial term in understanding the German power sector – after the power demand covered by renewables. Less power will thus come from coal plants regardless of how many are built. Newly added capacity faces fewer operating hours. Given the surplus in power generation capacity, utilities are stopping new coal projects whenever they can.

Nonetheless, lignite is in a safe position during the nuclear phaseout unless policies are changed. Renewables have only slightly cut into demand for electricity from fossil fuel. Mainly, power from natural gas has been offset, with hard coal going next based on fuel price in the merit order. During the nuclear phaseout (until 2022), this situation can be expected to continue, though the specific outcome depends on the actual growth of renewables and demand for power in Germany and neighboring countries. Germany lacks specific policies to reduce lignite and increase natural gas use. Unless that changes, the market is unlikely to bring about a reduction in power production from lignite until the mid-2020s.

Germany can reduce its coal dependency sooner: Policymakers can – and should – implement policies to reduce Germany’s coal dependency before the mid-2020s: first and foremost by initiating a reform of the emissions trading system (EU-ETS). German policymakers should also consider taxing carbon and implementing a Climate Protection Act, focus more on efficiency, and strengthen natural gas as a bridge fuel. The EU is unlikely to find a consensus for ambitious policies anytime soon, so Germany should join forces with the large number of Member States willing to forge ahead. Here, the example set by the United States is illustrative; there, numerous communities, cities, and states have adopted their own climate and renewable energy targets rather than wait for policies from the federal level.

A coal phaseout could focus on removing the most polluting lignite plants in Germany. The United States has stricter emissions standards; if similar requirements were applied, Germany could begin switching off its biggest emitters of carbon as well.

Finally, Germany’s Energiewende proponents are not eager to correct the alleged but incorrect coal renaissance. Though talks of a “coal comeback” are overstated, Germans are not rushing to correct such misreports. This perception helps to keep pressure on policymakers to clamp down on coal consumption.

The report The German Coal Conundrum: The status of coal power in Germany’s energy transition was written by Arne Jungjohann and Craig Morris. All graphics can be downloaded here. Graphics by Thomas Gerke.

Indeed “new coal plants in Germany are unrelated to the nuclear phaseout of 2011 after the Fukushima accident”, but if there had not been this nuclear phaseout then “a reduction in power production from lignite” could hardly have been avoided”.

The interconnection capacity to export power in not unlimited.

Just wondering: if emission standards for lignite power stations in the US are more stringent then in the EU, couldn’t those US standards.be considered Best Available Technology within the EU Industrial Emission Directive framework?

Looking at your other graphs, it seems that since 2000 lignite and coal use has not been reduced by much. However, one change is that the fraction of imported coal has increased by a lot. I wonder: has this weakened the coal lobby, that has always been very strong in Germany?

I am on the green anti-nuclear side, but I don’t think that manipulation is the best way to defend the cause, specially if that manipulation is so obvious. You are analizing if coal is replacing closed nuclear plants (closed in 2011). You say … no “the growth of renewables has more than replaced nuclear power over the past decade”. That figure is true, but it is also true that coal consumption grew in 2012 and 2013. And in any case you can’t use data from 2004-2011 to make any conclusions about what happened after 2011. Is then going coal to replace closed nukes? We must admit that in the short term (may be the next 4-5 years) some of the lost power will be replaced by coal (mainly because coal plants are the only way to fill the gap while new infraestructures are built). Failing to admit that is to help those who oppose EnergieWende

Hi Rober2D2,

The coal article does not aim at manipulating the debate around the role of coal in Germany. Quite the contrary: we felt that we needed to put the coal issue into a greater historic political perspective which is why we make a reference to 2005-2008. That was a period when utilities were investing in coal-fired power plants across Europe, a crucial period when looking at the new coal plants going online today. These coal plants were all planned during that period. The truth is that many of the utilities in Germany today wish they had never invested heavily in new coal plants as their revenues continue to decline due to an increasing level of renewable energy in the system (please note that renewables have priority access to the grid). All this is explained in detail in the paper – did you just read the blog?

Rober2D2,

If you have a look at the paper, you will see that we do indeed talk about what has happened since 2011. The chart showing changes since 2003 has labels put in for 2010, the last year with the nuclear plant shut down in 2011, so that you can see for yourself that nuclear has dropped by around 44 TWh, whereas renewables have increased by 47 TWh. Therefore, renewables have already replaced the eight nuclear plants switched off in 2011.

Over the next decade, we have a couple of plants going off every couple of years starting in 2015, so renewables will easily continue to outstrip.

In 2021 and 2022, roughly the same nuclear capacity will be shut down as in 2011. Whether renewables can offset that amount of power by 2023 simply depends on how much renewable capacity is built until then. But if we replaced eight plants in 2011 within 2-3 years, why wouldn’t we be able to do so over the next eight years?

Nichol, the reason for increasing hard coal imports is the cut back in subsidies in domestic mining. By 2018, these subsidies will have dropped to 0. Then Germany will have switched completely to imports in hard coal. Lignite remains domestic, is hardly traded internationally. (See chapter 1 of our paper)

Just a question. Is renewable power in Germany subsidized by the power consumers plus government subsidies and does it compete with coal and gas generated power on an even playing field?

If Germany is phasing out nuclear they will need reliable, cost effective base load production which coal provides at far less risk to people and the environment in event of future disasters which will inevitably happen.

Just a question. Is renewable power in Germany subsidized by the power consumers as well as government subsidies or does it compete with coal and gas generation on an even playing field?

If Germany is phasing out nuclear they obviously need reliable, cost effective base load production which coal provides at far less risk to people and the environment in event of an inevitable future nuclear disaster(s).