In mid-August, Germany had its first normal workday on which peak power prices were below base prices, and futures prices are also down. Craig Morris provides an overview and warns proponents of renewables not to rejoice too soon at the demise of conventional power.

Dirty, inflexible, obsolete: Niederaußem Lignite Power Plant in North Rhine-Westphalia and according to the WWF one of the most inefficient power plants in Europe. (Photo by Stodtmeister, CC BY 3.0)

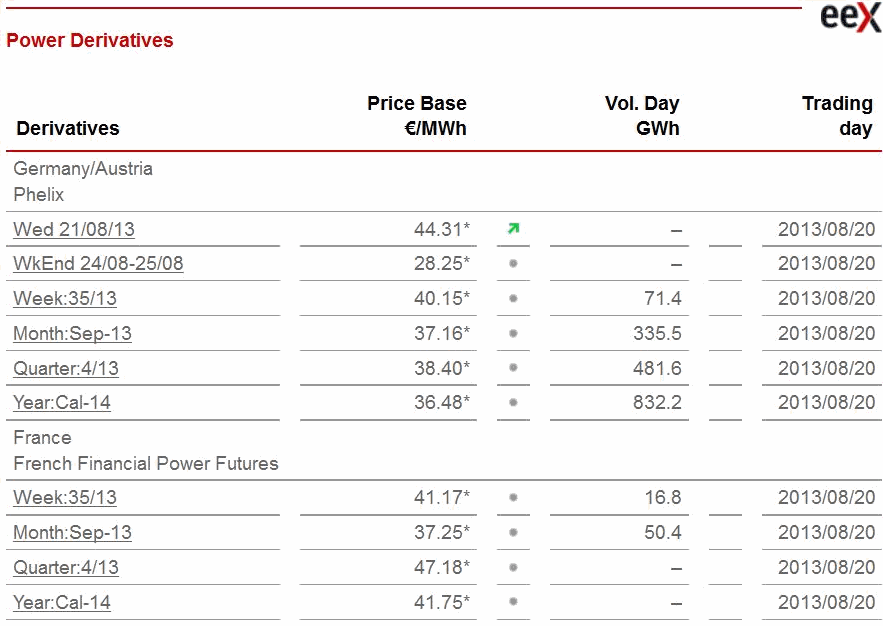

On August 21, the price of power derivatives for Phelix (the power trading zone for Germany and Austria) was below four cents per kilowatt-hour for September 2013, Q4 2013, and 2014; for next year, power is already trading at only 3.648 cents per kilowatt-hour (see chart below). The four-cent threshold has become a buzzword since German energy giant RWE’s CEO famously said no profitability is possible below that price. Going forwards, conventional power producers in Germany therefore face bankruptcy – but we will come back to that topic later. Today, let’s stick to the numbers.

On sunny weekends, it has not been uncommon for power prices at times of peak demand to be lower than baseload power prices (times of low demand). The situation marks a reversal of what’s expected; usually, baseload power is the cheapest, and peak power the most expensive. But on weekends, overall peaks are lower as many businesses are closed, so when a lot of solar power is generated, demand for conventional power is pushed back down to baseload levels even at times of peak demand. Rather than ramp down even further, power firms reduce their prices to encourage demand – and, in Germany, that mainly means power exports.

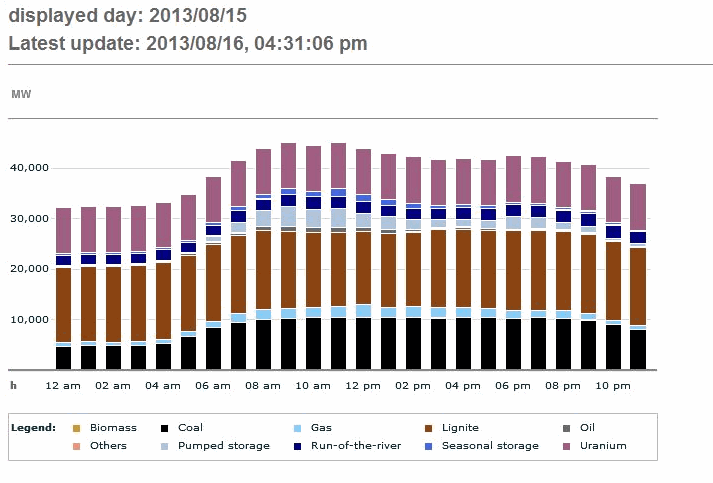

On Thursday, August 15, conventional power (fossil, nuclear, and hydro) was kept down in the lower 40s (gigawatts – see chart) as wind and solar peaked at around 20 GW – not an especially high level. Indeed, as our friends over at Clean Technica recently reported, the record for solar power alone in Germany is higher. So on a normal workday, with peak demand approaching 70 GW, peak power cost less than baseload power on the exchange.

It may be the first time this has happened, but it probably won’t be the last. This month, researchers at Fraunhofer ISE published a study (PDF in German) with the following key findings:

- The number of hours in which power prices were below one cent per kilowatt-hour increased nearly fourfold in the first half of 2003 year over year

- The number of hours with negative prices increased by around 50 percent

- Brown coal and nuclear plants run at even higher capacities during these times of low prices; 83 percent for coal plants when prices are low and up to 96 percent for nuclear plants when prices are negative

- In contrast, hard coal power plants run at only 10 percent capacity when prices are negative, and the figure is similar for natural gas (despite cogeneration for the latter)

The result is considerably greater power exports, much of it obviously electricity from brown coal and nuclear plants – but we will have to come back to that as well.

And then there is the question of how conventional power providers will survive. Proponents of renewables might not like to admit it, but we will need these plants during the transition; the companies cannot go bankrupt, and the plants cannot all be mothballed. Some interesting proposals are on the table for a market redesign, and we have discussed capacity payments here several times already. Perhaps the most important takeaway now for international readers is that Germany’s energy transition is a major threat to the profitability of conventional power, which is staying afloat at present primarily by exporting power on the cheap.

Craig Morris (@PPchef) is the lead author of German Energy Transition. He directs Petite Planète and writes every workday for Renewables International.

Great article, but I would disagree with the notion that it would be a bad thing if those companies go bankrupt. (Though there is no real danger for them to go bankrupt, only their power generation business is in big trouble)

However I agree that we still(!) need some of these power plants, but the devestation of the enrgy only market is still a good developement for several reasons.

1. There is no longer a market incentive to build a new generation of capital intensive coal / nuclear power stations in Germany or Europe.

2. The screams for help & attention by the big energy corporations showcase that future energy prices need to be much higher for them to provide conventional power.

3. There is a good chance, that a capacity market will favour those capacities that we actually need. Flexible, economical with low capacity factors and clean(er). Though this new market will be shaped by the next government and if the current coalition continues, it might get less effective than possible. (Though I have a certain trust that the parliament won’t pass the worst ideas from the Conventional Energy Coalition)

Anyways, there have been many critical voices who warned about the lacking economic viability of new coal power investments 10 years ago. Now that the big energy corporations have wasted several billion euro on stranded investments they should pay for their failure… just like it is common in the market economy. Let them fail… the viable pieces can be sold to the highest bidders and the gaps should be filled by new investments.

We know that there are more than enough investors that are ready to commit ranging from the business community, large & small municipal utilities all the way down to households & communtiy projects.

Unlike the “Big Four” they have capital & excellent credit ratings, which means they require less financing costs.

[…] German Electricity Getting Cheaper on Exchange […]

I agree with Thomas.

As Hermann Scheer long foresaw, Big Energy will be, must be, the Big Loser if we are to transition to 100% renewables.

We have little time to act to avoid climate tipping points, so the news that conflicted, politically-connected, feet-dragging big energy corporations may well soon go bust in Germany is cause for minor celebration. Once out of the way, the German energy transition can only gain pace and go from strength to strength. Thus bringing the day closer when the rest of the world wakes up to the very real example of a major industrialised nation able to run on energy that is not only clean, but secure and cheap to boot.

[…] German electricity getting cheaper on exchange La politica energetica alemana hace bajar los precios de la electricidad a niveles que hacen peligrar la rentabilidad de las generadoras tradicionales. […]