At the end of November, Germany’s Thüga Group exported the first hydrogen made from electricity into the country’s gas network at a point in Frankfurt. Craig Morris says the event could be the beginning of something big.

Powered by wind. (Photo by baracoder, CC BY-SA 2.0)

One of the most popular questions critics of the German energy transition ask is what you do when there is no wind or solar power. It’s not a bad question – on the contrary, it’s the most important one for the power sector.

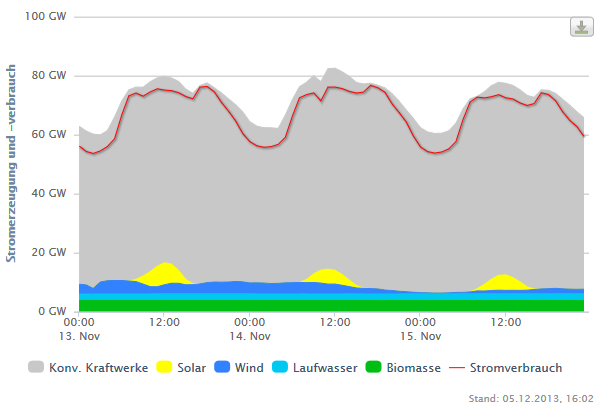

Take a look at the chart below from Agora Energiewende’s website showing the power production from November 13 to November 15. From bottom to top, we have power from biomass (green), hydropower (light blue), wind power (dark blue), solar (yellow), and then the big gray area representing conventional power. The red line across the top represents consumption, so all of the generation above that red line is power for export.

In the winter, Germany has little sun right when power demand peaks for the year – in this case, just below 80 GW. Solar barely appears, and wind power drops to a meager 0.292 GW at 3 AM on November 15 – when there is simultaneously 0 GW of solar.

Clearly, what is needed here is not hourly or even daily power storage, but seasonal – and the best way to do that is chemically.

This is where power-to-gas (P2G) comes in. Excess electricity from the summer could be used to split water into hydrogen and oxygen, and the hydrogen could be stored in existing natural gas networks – no additional storage infrastructure needed. Germany has an estimated four months’ worth of power storage capacity in its gas networks today, and because gas can be used to power vehicles, for cooking, to provide heat, and to generate electricity, it is versatile.

Now, Thüga has exported the first hydrogen from electrolysis to the natural gas network. The firm says it plans to go into official operation at the beginning of 2014 after a test run. The practical test under operating conditions will last for nearly 3 years until the end of 2016. The unit under investigation has a power capacity of 315 kilowatts and can produce 60 cubic meters of hydrogen per hour.

Because hydrogen is not synonymous with natural gas, the firm keeps the share of hydrogen below two percent of the volume within the gas network. A presentation by German energy conglomerate Eon discusses the differences between the properties of hydrogen and natural gas and concludes that 10 percent hydrogen is generally not problematic and even has some positive side effects (PDF). A study by NREL published in March 2013 also found that 5-15 percent hydrogen in natural gas lines was not expected to cause problems.

Of course, new systems could be designed to accommodate a higher share of hydrogen, but at some point the question of cost arises. As I recently explained, competitiveness could still be two decades away. But never mind – Germany’s target for 2050 is only 80 percent renewable power. And by 2035, we might look back at Thüga’s announcement and say, “That was when the seasonal storage of renewable power started – the last piece of the puzzle towards 100 percent renewable electricity.”

Craig Morris (@PPchef) is the lead author of German Energy Transition. He directs Petite Planète and writes every workday for Renewables International.

2% sounds like a little bit but in reality it is HUGE considering that it it is always ready to add energy into Germanys “grid”…

Yet another great idea form Germany and I will predict that P2G will be in use long before 2050…

Craig,

As ever for renewable energy storage, conversion efficiency is critical. Do you know what Thüga expect to achieve in the proposed working system?

[…] P2G gets going – German Energy Transition Las pruebas de generación de hidrógeno como método de almacenamiento energético siguen su curso en Alemania […]

The cost of power-to-gas, like any form of energy storage, is dominated by *capital* costs. Energy input costs are negligible in comparison, so round-trip conversion efficiency is not critical for long-term storage.

The task of power storage is arbitrage among different forms of energy at different prices. We are presently prepared to pay many times more for energy how and when we need it, than in a place or at a time when there is no marginal demand. If the price differential between excess supply at one moment and unmet demand in another is 1000% (or proportionally infinite, in the case of the zero or negative spot prices observed at times of oversupply in today’s market), storage can break even, capital costs excluded, with 90% round-trip energy losses. It could easily prove profitable with losses above 70%.

The energy conversion efficiency of electrolysis to hydrogen is, with modern catalysts and careful voltage and current control, in excess of 80%. Conversion of electricity via hydrogen to methane by combining H₂ and CO₂ in the Sabatier reaction is currently achieved (as early as 2010 at ZSW Stuttgart, at pilot industrial scale) with between 49% and 65% energy efficiency.

http://en.wikipedia.org/wiki/Power_to_gas#Efficiency

http://www.fraunhofer.de/en/press/research-news/2010/04/green-electricity-storage-gas.html

Further conversion of hydrogen or methane gas to methanol or other useful energy-bearing chemicals like ammonia, urea, alkanes (zero-sulfur petroleum-equivalent fuel, very clean-burning) and the like does incur further energy losses, but not more than those already familiar from today’s large-scale fertiliser or coal-to-liquids industries.

At the moment, energy is stored in the form of fossil fuels underground at no cost whatsoever to the money economy, but drilled or dug up and converted with sub-50% efficiencies to motive power or electricity, on demand, and at a profit.

Electricity from the socket in the home is several times more expensive than at the power station busbar, but the cost of the coal which is burned to produce that electricity is itself only a fraction of the running cost of the power station. Spot markets in electric power vary from around 10 times the retail price at peak demand times, down to NEGATIVE prices when supply is in excess. Liquid fuel for vehicles which can be burned at will is substantially more expensive, per joule, than domestic electric power.

If electric demand is ultimately to be supplied year-round mainly by intermittent renewables, of course the total capacity must expand many times over. When total non-fossil generation matches total consumption exactly over the course of a year, 100%-efficient seasonal storage would at that point be sufficient to meet all demand at all times and retire fossil-fuelled generation. At that point excess generation in summertime would be enormous but instantaneous generation even in winter would meet demand for only a fraction of the time.

Yet it can be more-or-less assumed that by that time, the capital equipment for intermittent generation will be significantly cheaper than now, and that shorter-term storage such as pumped hydro storage, batteries, compressed air, cryogenic storage, vehicle-to-grid, etc. will be a vibrant and maturing market. The capital equipment for short-term storage will be inexpensive and generators for intermittent energy sources will be very cheap. Probably power-to-gas itself will already be a significant niche industry despite losses, as even short-term storage and clean green vehicle fuel command a premium price over excess electric power. There will be no residual demand for most of the summer months — fossil fuels will be used almost exclusively in wintertime.

Yet wind power is already cheap now, peaks in winter, and will be even cheaper by the time annual intermittent generation matches annual intermittent demand. Meeting most winter demand with additional wind generation and short-term storage would quite likely be a cheaper option than storing energy seasonally for later use. Yet by now (thanks to all the wind turbines which simply aren’t required for summertime needs), the summer excess is ridiculously large. By this point fossil fuel would supply only a few percent of annual electric demand.

Replacing that small quantity of fossil fuel with synthetic fuel manufactured in summertime even from large amounts of excess power generation, even at very high energy losses, would “feel good” and cost relatively little in energy terms.

Chances are in fact that the power-to-gas (and perhaps more importantly power-to-liquids) industry will develop as much for the purposes of relatively short-term power storage (in competition with technologies with higher round-trip efficiency but higher capital costs), and for powering heavy vehicles, ships, aircraft and the occasional legacy domestic heating or cooking appliance with fossil-equivalent fuel, as for the seasonal electricity storage it is being promoted for.

Jonathan,

Unfortunately, the renewables surcharge would still apply for stored power. It is currently at 6.24 cents per kWh. If the wholesale rate is zero and power is purchased at that rate, the purchase price is still 6.24 cents.

http://www.renewablesinternational.net/power-storage-not-hampered-by-feed-in-tariffs/150/537/71374/

Given the 50% losses for electrolysis, twice as much power would be consumed, so the kWh of stored power s 12.48 cents — completely uncompetitive.

You could exempt power purchased for storage from the surcharge, but then who would pay the cost of FITs, which the surcharge covers?

Ciao

Hi Craig, I’m sorry I didn’t realise for a few months that you had replied to my comment!

Existing (pumped) storage facilities are already exempt from most taxes including the renewables surcharge and grid fees when buying power. So, of course, are foreign grids, which provide at least some of the existing management of variation in residual demand.

http://www.germanenergyblog.de/?p=16634

There’s no way under an ongoing Energiewende that any new bulk storage facility would be paying such fees and taxes. It would buy electricity at the same wholesale price paid by pumped hydro and by buyers across the border.

5 years after:

Hesse runs the first hydrogen train, 4 more are ordered:

https://www.vbox7.com/play:78cb15599e

http://www.alstom.com/press-centre/2018/04/alstom-to-supply-5-coradia-continental-regional-trains-for-hessische-landesbahn-in-germany/