The difference between the price of electricity at times of low demand (baseload) and high demand (peak load) has shrunk dramatically in Germany over just the past few years. As Craig Morris points out, one result is that pumped storage no longer pays for itself.

Pumped-storage power station Rönkhausen in North Rhine-Westphalia as seen from above. (Photo by Dr.G.Schmitz, CC BY-SA 3.0)

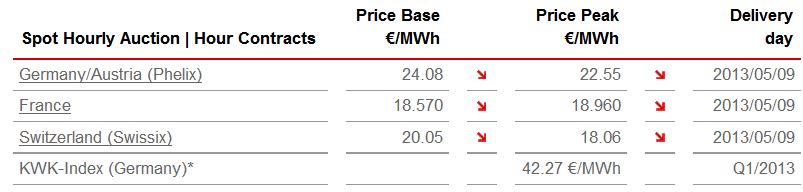

On May 8, the prices for hour contracts on the Phelix exchange – the German and Austrian grid – for May 9 were roughly 1.5 cents lower per kilowatt-hour for peak power than for baseload power. The difference was even greater in Switzerland, with peak power costing two cents less than baseload power. This situation marks a complete reversal; until recently, power cost a lot more at times of peak demand – after all, rising demand usually brings up prices.

That same day, the old market situation was only still seen in France, where the price of peak power was still slightly above the price of baseload, but only by around 0.3 cents. But although a Thursday, May 9 was a holiday. On May 10, a normal workday, the price of peak power was roughly 3.3 cents higher than for baseload in the Phelix zone – but only 2.4 cents higher in Switzerland. Yet, only a few years ago, prices easily fluctuated on a daily basis by six cents or more.

At six cents per kilowatt-hour, pumped-storage facilities were quite profitable. Basically, they would pump water uphill when electricity was cheap (at night) and run it back down the hill through turbines to generate power when the prices were higher (during the day).

Under the new market conditions, however, there’s no money to be made on sunny days in May. German power consumption generally stretches from 40 gigawatts at night to as much as 70 gigawatts on summer workdays – a difference of roughly 30 gigawatts. But Germany now regularly gets more than 20 gigawatts of solar power on sunny summer afternoons, with more than 22 gigawatts having been added from 2010-2012.

As a result, pump-storage plants now only run on certain days of the year at much tighter margins. And the future is already clear as Germany continues to add solar in excess of the target corridor of 2.5-3.5 gigawatts per year; by the end of this decade, pumped-storage plants in Germany will have reversed operation in the summer to store power from the day for the night.

But first, we have to get through this interim period. Existing facilities are increasingly unprofitable. German weekly Die Zeit recently reported that Vattenfall may shut down the country’s oldest pumped-storage facility, with a capacity of 120 megawatts, and the firms behind a new proposal in the Black Forest currently see no profitability. In addition to the fast growth of solar, the article points out that forecasting has improved greatly, allowing coal plants to react more flexibly – thereby reducing the need for pumped storage.

What is the solution? One idea tossed about is a capacity market – payment by the kilowatt, not the kilowatt-hour. Some EU member states have already implemented such policies, but not everyone was happy. EU Energy Commissioner Oettinger also wants member states to start harmonizing their energy policies and does not like the idea of national capacity payments skewing the market.

Over the next few weeks, we will take a look at some of the ideas and concerns being discussed. There’s no rush – nothing is expected to be implemented in Germany before the elections in September.

Craig Morris (@PPchef) is the lead author of German Energy Transition. He directs Petite Planète and writes every workday for Renewables International.

The units for storage capacity have to be energy. So, Vattenfall’s facility can’t have a capacity of 120 MW (this is power, the derivative of energy) but it could have a capacity of 120 MWh (energy). This isn’t a nit-picky distinction because energy storage largely determines the usefulness; many systems can deliver power at 120 MW but far fewer can store 120 MWh of energy.

It needs to be understood that the true source of the problem comes more from adding a lot of production capacity without any rise in consumption. Therefore the fossil plants are fighting against each other for a market that is shrinking and the prices are going down, below profitability at times.

The trouble is that this favors the cheapest production, coal, which is at the moment going against the purpose of reducing CO2 emissions.

Amongst the country that have started capacity payment is Germany with the Irsching units. But if many units needs to be paid like that, that’s a new source of costs.

I don’t believe the future looks rosy with easy solution.

[…] The Flattening Of Peak & Base Prices […]

[…] The Flattening Of Peak & Base Prices […]