The Czech government follows the example of the German RWE-Innogy to legitimize the split of CEZ into nuclear and non-nuclear parts. Jan Ondrich takes a look.

The government prepares the division of the company in order to realize the project (Photo by Daggerstab, CC-BY-3.0)

In my previous blog I wrote about possible funding for a new nuclear plant in the Czech Republic. One of the possibilities presented by the Czech government draws inspiration from division of German utilities into parts exposed to the carbon risk and carbon-free units.

It seems the government is more inclined to follow the example of RWE-Innogy. The government wishes to offer minority participation of 49% in the new daughter company to investors, and increase its shareholding in the parent company to 100%. The government is considering the following options for the split of the company.

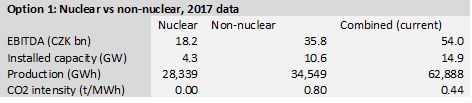

Option One: Nuclear vs other

In the first option the government would control 100% of nuclear assets, including the new nuclear project. The remaining assets, such as thermal generation, hydro, grid, renewables and sales would be put into a special purpose vehicle in which the state would own 51%. Table 1 below summarizes assets owned by the two companies and their respective earnings in comparison with the current status.

If the government chose to split CEZ into nuclear and non-nuclear parts, the minority shareholders may not necessarily be worse off when considering their share of the company’s earnings. Currently the minority shareholders have a claim on 30% of the company’s earnings, that is CZK 16.2 billion (around $7.12 million). After the split their share of the company’s earnings would slightly increase to CZK 17.5 billion ($7.7 million USD).

However, the risk profile of cash-flows would change fundamentally. The non-nuclear company would be more exposed to commodity risk, in particular to carbon prices (which are currently rising atmospherically). The carbon intensity of the non-nuclear part of the company would almost double from its current 0.44 tones per MWh to 0.8 tons per MWh. This would make the non-nuclear company one of the largest emitters of carbon per MWh in Europe, exceeding both RWE and Uniper.

Option Two: Conventional power vs other

The second option presented by the government is for a company (100 percent owned by the state) which would encompass nuclear, conventional and hydro generation. The grid, sales, energy efficiency service company (ESCO) and renewables would be owned by a daughter company in which minority investors would own a 49% share. Table 2 below summarizes key statistics for this option.

In this option minority shareholders would be worse off with respect to their share of earnings, which would decrease to CZK 14.5 billion ($6.4 million USD). However, the overall risk of the company would decline. The company would be exposed to few commodity risks as the vast majority of generation assets would be carbon-free renewables, and more than half of the company’s earnings would come from regulated power distribution business.

This would probably lead to changes in the shareholding structure of minority investors. Those investors seeking higher returns through exposure to commodity prices may sell out, but on the other hand the company could become attractive to pension fund types of investors seeking stable returns with little exposure to commodity risks.

It appears that the second option would be a better way of dividing CEZ if the government ever decided to push the button and start the process. The new daughter company would own stable, regulated power distribution and mostly renewable and co-generation energy sources with almost no exposure to carbon risks. As a result, the company could attract different class of investors who would not have invested into CEZ previously because of its nuclear and coal assets. Those investors, such as pension funds, have lower risk requirements than investors seeking exposure to power generation assets, which may decrease the overall cost of capital for the company.

To split the company into carbon-intensive and carbon-free parts appears to make sense especially as the cost of carbon has been increasing. In Germany, for example shares of Innogy overperformed those of RWE over the past year (Innogy up by 5.86%, RWE down by 15.03%). Likewise, shares of EON have overperformed those of Uniper, albeit both are down this year (EON down by 8.56%, Uniper down by 10.16%).