Recent revival of the European carbon market has brought some optimism to those, who would like to see lignite disappear from the European energy mix altogether.

Carbon prices could reach EUR 55 per ton by 2030 (Public Domain)

Indeed, the price of CO2 allowances traded under the European Trading Scheme have gone nowhere but upwards since the beginning of 2017. The price of carbon quintupled between January 2016 and October 2018 making the European carbon allowance probably the best performing traded commodity in the world.

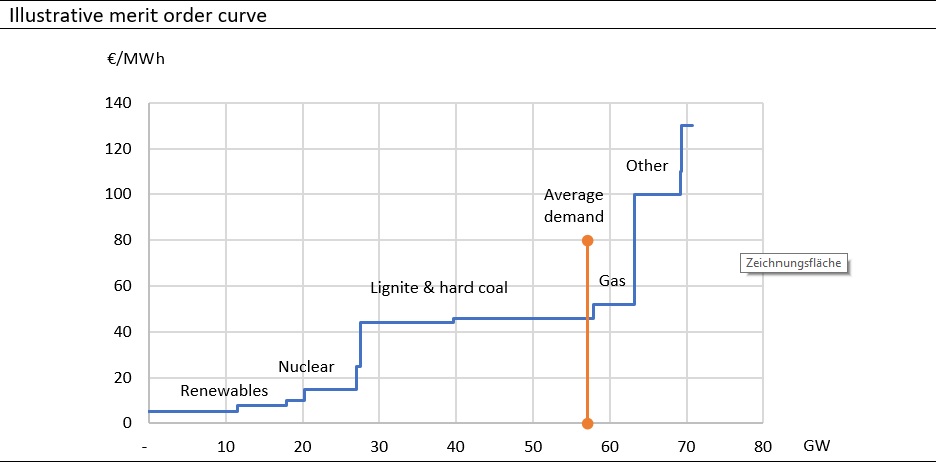

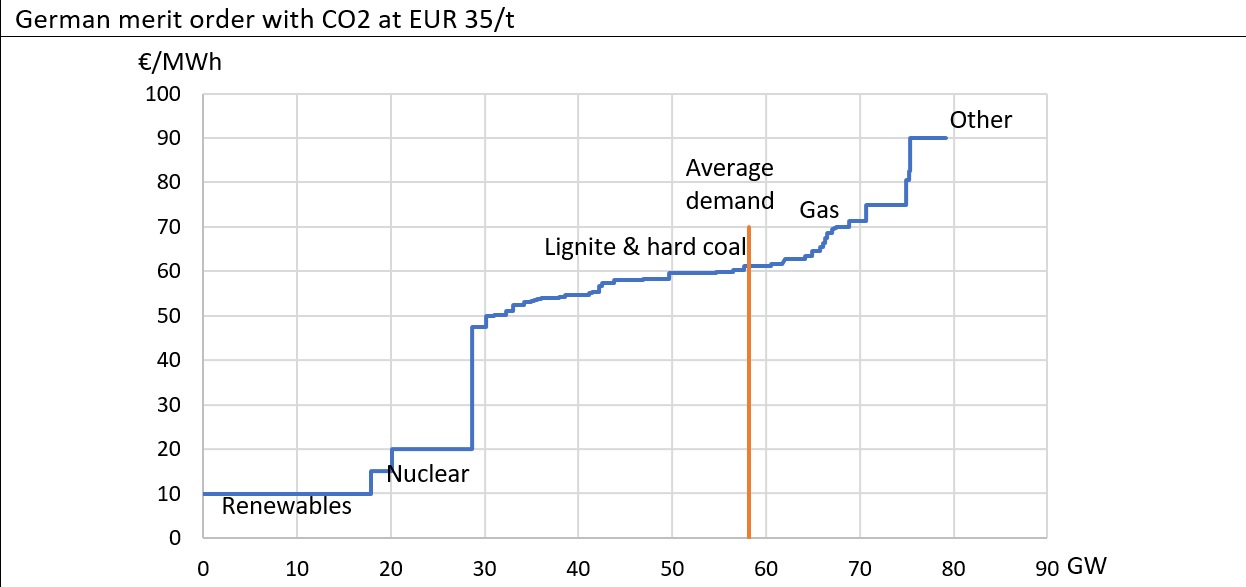

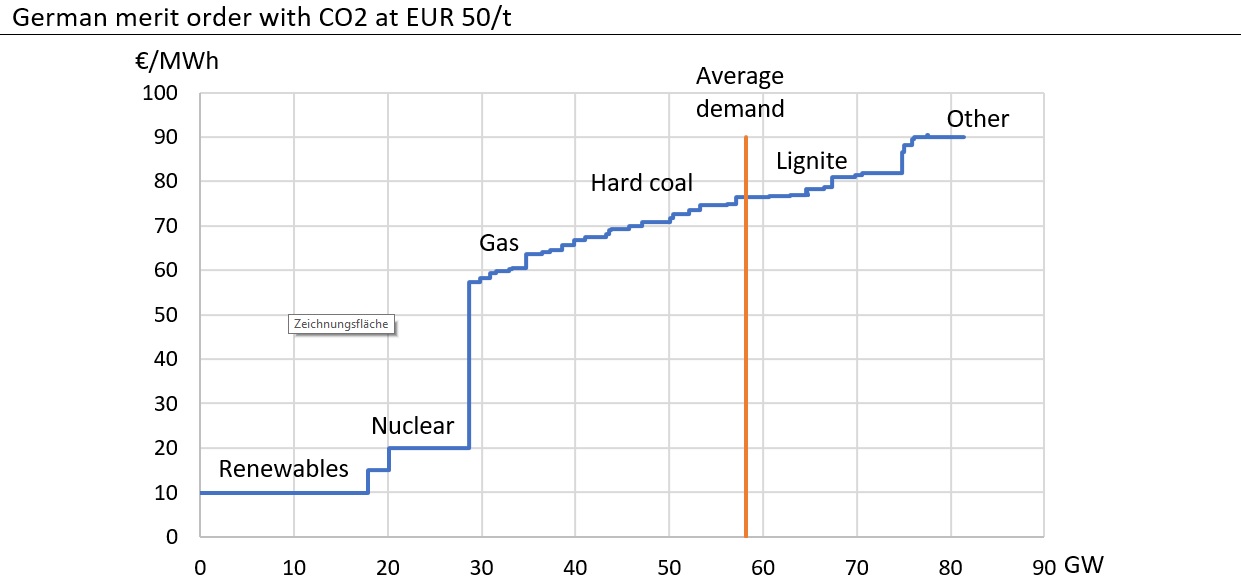

This spectacular increase in the cost of emitting carbon has led to higher production costs of fossil fuel power generators and as a result pushed power prices upwards. This is because power prices in Europe are determined by production cost of the last most expensive power plant, which is needed to supply the last demand of MWh power. This mechanism illustrated by the below chart is known as a merit-order rule.

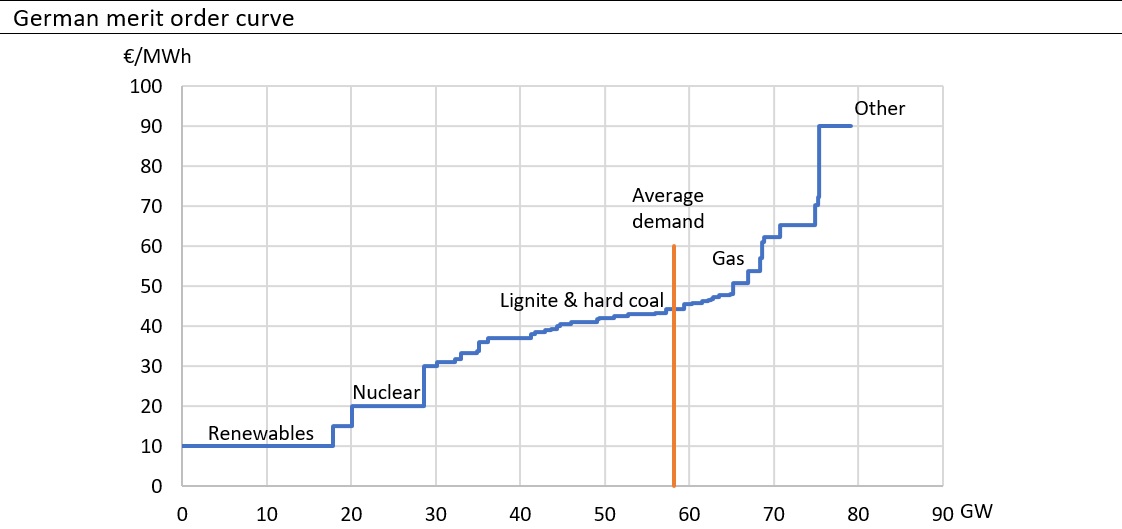

In Germany, the most expensive power plant to close the market tends to be either a hard coal or gas plant, depending on the relative price of coal, gas and carbon. The merit-order chart below shows the ranking of the German plants from lowest to highest generation cost.

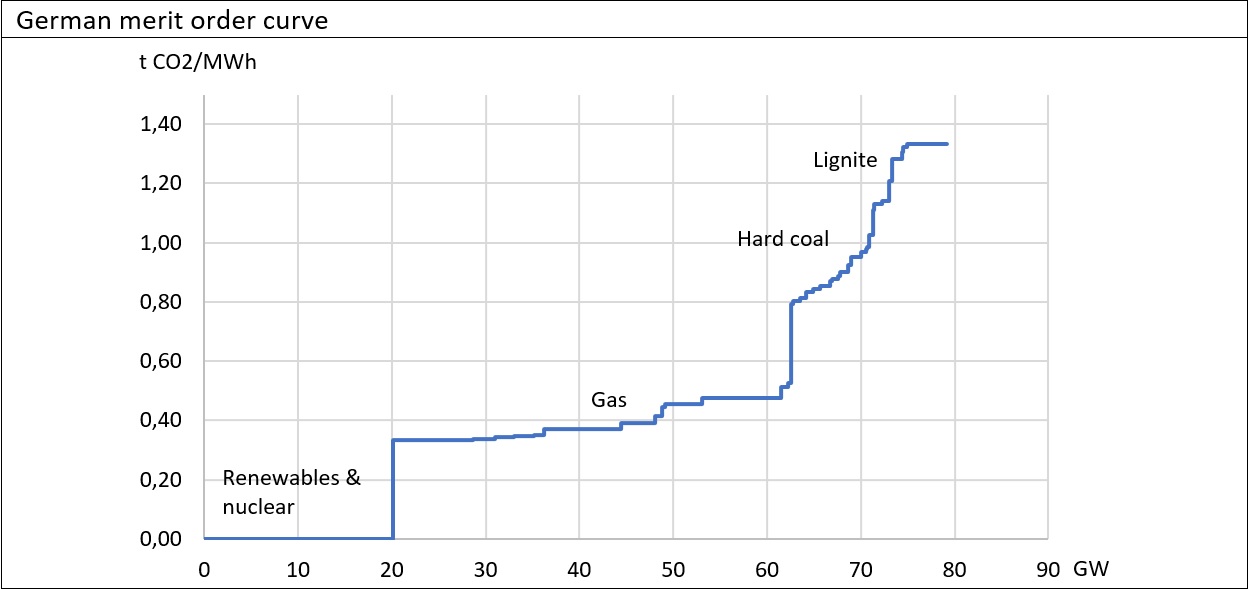

The chart below shows ranking of power plants from the point of carbon intensity, that is how much carbon is released to the atmosphere to produce 1 MWh of electricity.

Because the power price is set by generation costs of a fossil-fuel plant, any increase in the price of carbon translates into an increase in the power price as well. And it is precisely this feedback loop between the price of carbon and the power price that seems to cause persistency of lignite in the fuel mix.

Generation cost of lignite-fired plants increase with every increase in the price of carbon allowance, but so do the costs of hard-coal and gas plants. The competitive advantage of lignite versus hard-coal and gas is its low cost of mining, transport (lignite plants tend to be built next to lignite mine pits) and low-price volatility (typically, one utility would run both the lignite mine as well as the power plant).

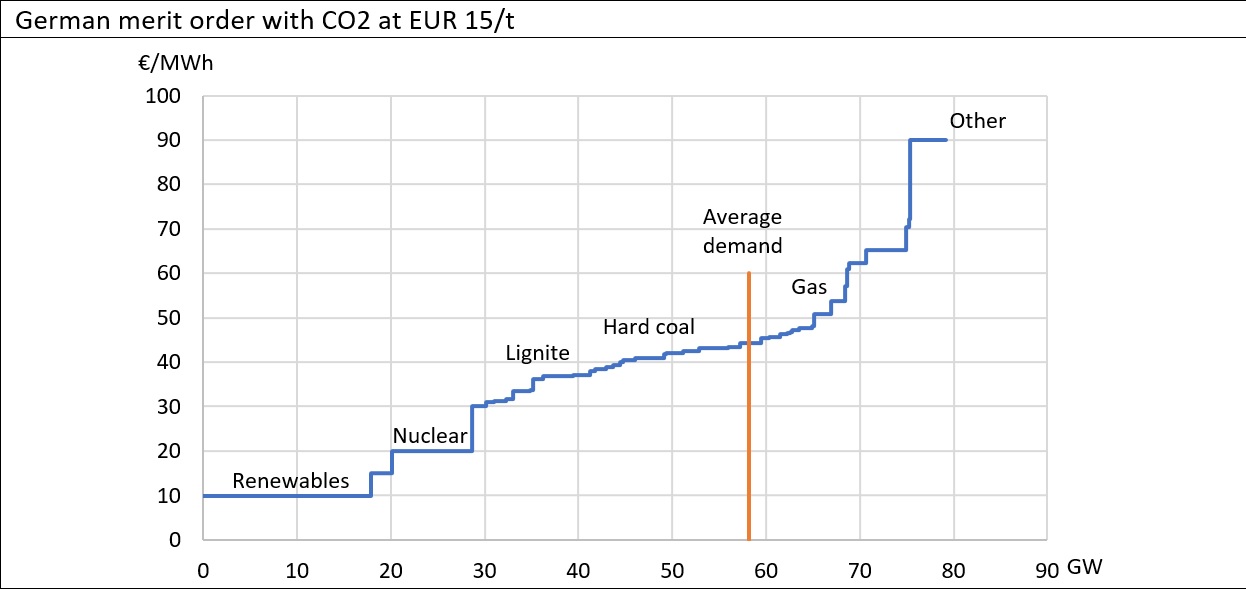

So what price of carbon allowance is needed to push lignite-fired power plants out of the market? The charts below show the ranking of German power plants assuming the price of carbon is EUR 15, 35 and 50 per ton as well as the current market price for hard coal and gas.

The charts above show that the generation cost of lignite increases more than the cost of hard-coal and gas plants, but not enough to fully erase the fuel cost competitive advantage until the price of carbon allowance reaches EUR 50 per ton.

How probable is it that the price of carbon will increase to EUR 50 per ton by 2030? Under current conditions, this seems unlikely. Carbon Tracker’s report “Carbon Clampdown: Closing the Gap to a Paris-compliant EU-ETS” estimates that carbon prices could reach EUR 55 per ton by 2030 only if the EU adopts more stringent legislative measures. Currently, the EU aims to cut emissions by 40% against 1990 levels, but Carbon Tracker calculates emissions need to be cut by 55% to comply with the Paris Agreement. This could be achieved if additional 1.6 gigatons of allowances on top of the current Market Stability Reserve mechanism are taken out of the market by decreasing the annual EU ETS cap on emissions.

If policy makers agree on the merits of a gradual exit from lignite they need to adopt additional policy measures to achieve that objective. Those could be either pan-European such as a further tightening of the carbon market, or national such as higher royalties for lignite-mining companies. Without those measures it is likely that lignite will remain an integral part of European fuel mix at least for another decade.

Your analysis is good but considers only variable cost. I do not know about German lignite plants so much but many coal plants have debt and fixed cost burdens. A reduction in contribution margin (revenue less varible cost) makes it tougher to cover fixed cost, fund capes etc. So the pressure on lignite suppliers increases.